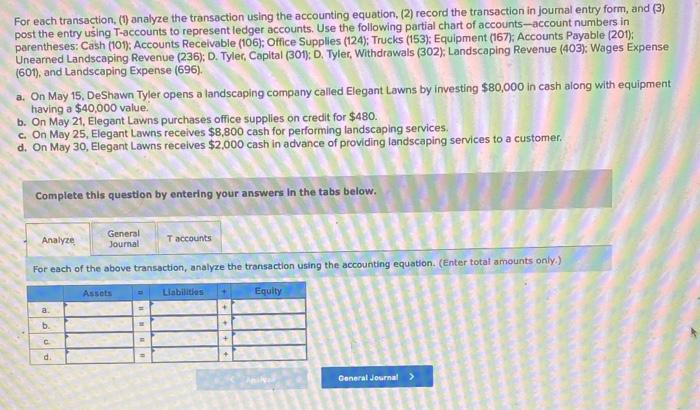

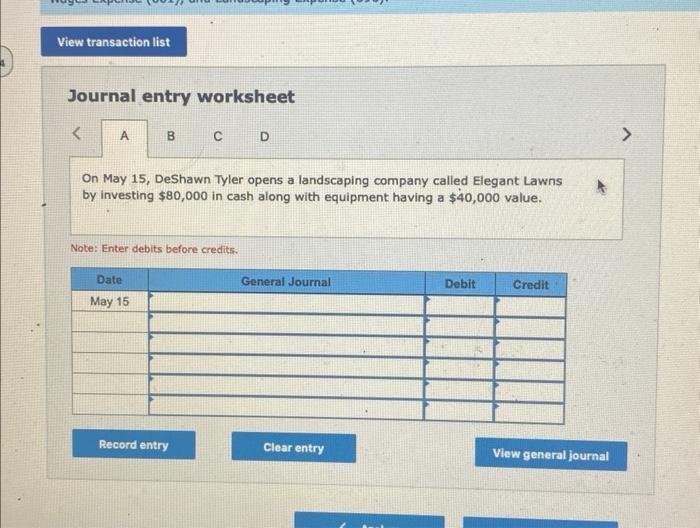

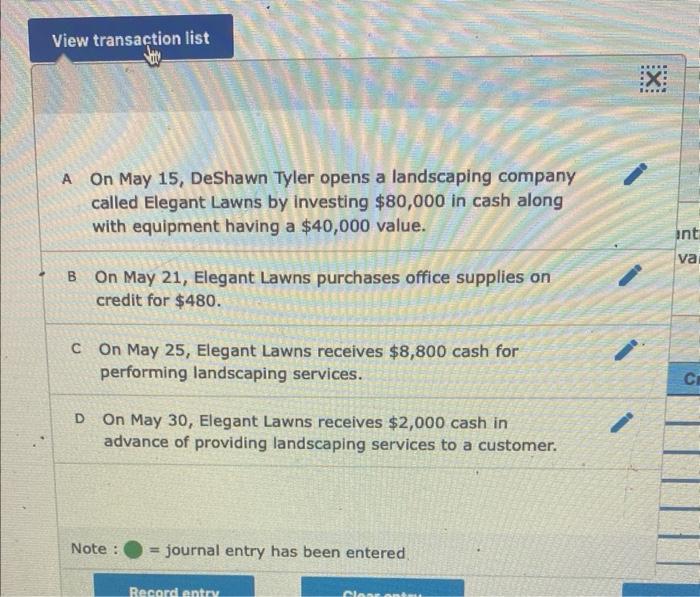

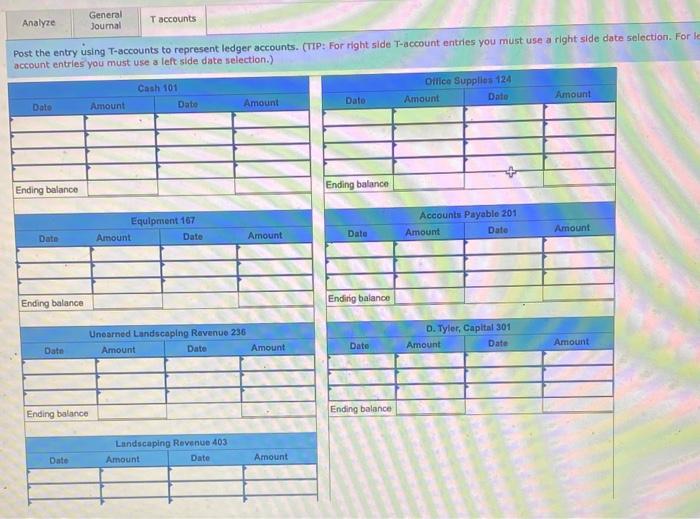

For each transaction, (1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry using T-accounts to represent ledger accounts. Use the following partial chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); D. Tyler, Capltal (301); D. Tyler, Withdrawals (302); Landscaping Revenue (403); Wages Expense (601), and Landscaping Expense (696). a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $80,000 in cash along with equipment having a $40,000 value. b. On May 21, Elegant Lawns purchases office supplies on credit for $480. c. On May 25 , Elegant Lawns receives $8,800 cash for performing landscaping services. d. On May 30 , Elegant Lawns receives $2,000 cash in advance of providing landscaping services to a customer. Complete this question by entering your answers in the tabs below. For each of the above transaction, analyze the transaction using the accounting equation. (Enter total amounts onily.) Journal entry worksheet On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $80,000 in cash along with equipment having a $40,000 value. Note: Enter debits before credits. A On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $80,000 in cash along with equipment having a $40,000 value. B On May 21, Elegant Lawns purchases office supplies on credit for $480. C On May 25, Elegant Lawns receives $8,800 cash for performing landscaping services. D On May 30, Elegant Lawns receives $2,000 cash in advance of providing landscaping services to a customer. Note : = journal entry has been entered. Post the entry using T-accounts to represent ledger accounts. (TIP: For right side. T-account entries you must use a right side date selection. For account entries you must use a left side date selection.)