Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each transaction, tell me what basic account will be debited, and which will be credited. I have done #1 for you-- 1. Bailey

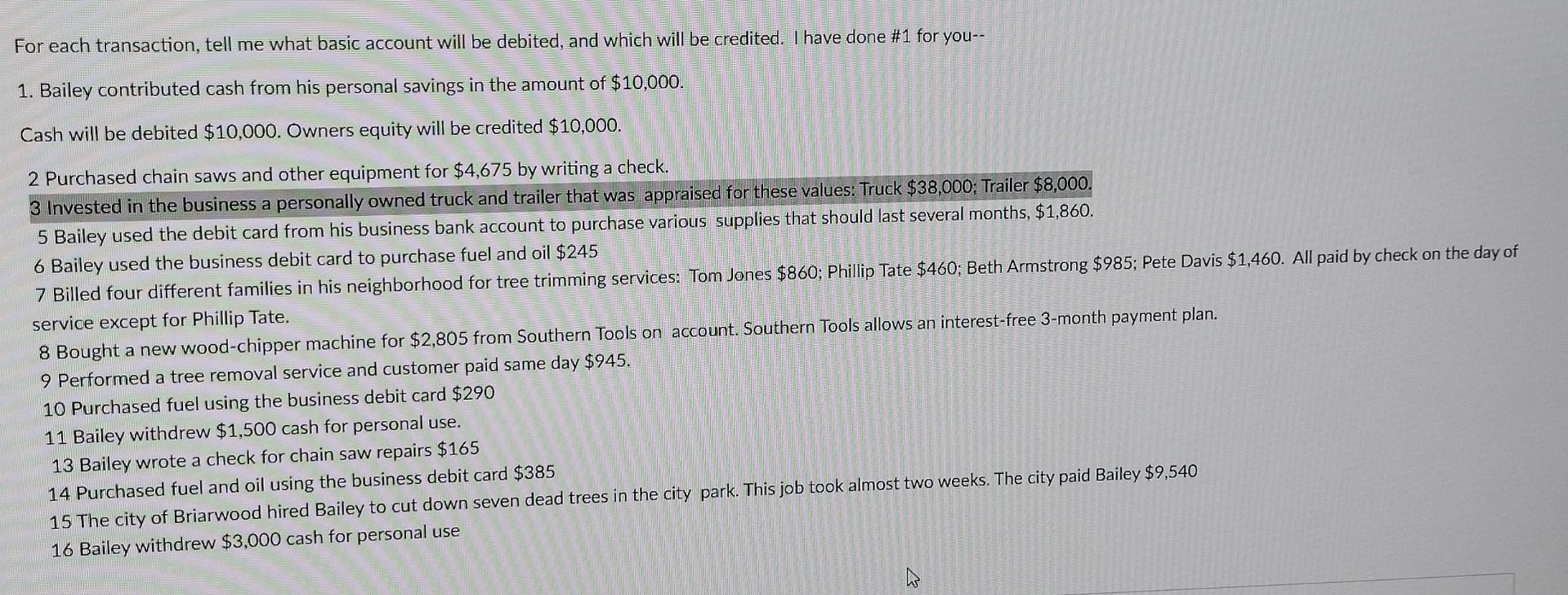

For each transaction, tell me what basic account will be debited, and which will be credited. I have done #1 for you-- 1. Bailey contributed cash from his personal savings in the amount of $10,000. Cash will be debited $10,000. Owners equity will be credited $10,000. 2 Purchased chain saws and other equipment for $4,675 by writing a check. 3 Invested in the business a personally owned truck and trailer that was appraised for these values: Truck $38,000; Trailer $8,000. 5 Bailey used the debit card from his business bank account to purchase various supplies that should last several months, $1,860. 6 Bailey used the business debit card to purchase fuel and oil $245 7 Billed four different families in his neighborhood for tree trimming services: Tom Jones $860; Phillip Tate $460; Beth Armstrong $985; Pete Davis $1,460. All paid by check on the day of service except for Phillip Tate. 8 Bought a new wood-chipper machine for $2,805 from Southern Tools on account. Southern Tools allows an interest-free 3-month payment plan. 9 Performed a tree removal service and customer paid same day $945. 10 Purchased fuel using the business debit card $290 11 Bailey withdrew $1,500 cash for personal use. 13 Bailey wrote a check for chain saw repairs $165 14 Purchased fuel and oil using the business debit card $385 15 The city of Briarwood hired Bailey to cut down seven dead trees in the city park. This job took almost two weeks. The city paid Bailey $9,540 16 Bailey withdrew $3,000 cash for personal use W

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Purchased chain saws and other equipment for 4675 by writing a check Equipment will be debited 4675 Cash will be credited 4675 Invested in the busines...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started