Answered step by step

Verified Expert Solution

Question

1 Approved Answer

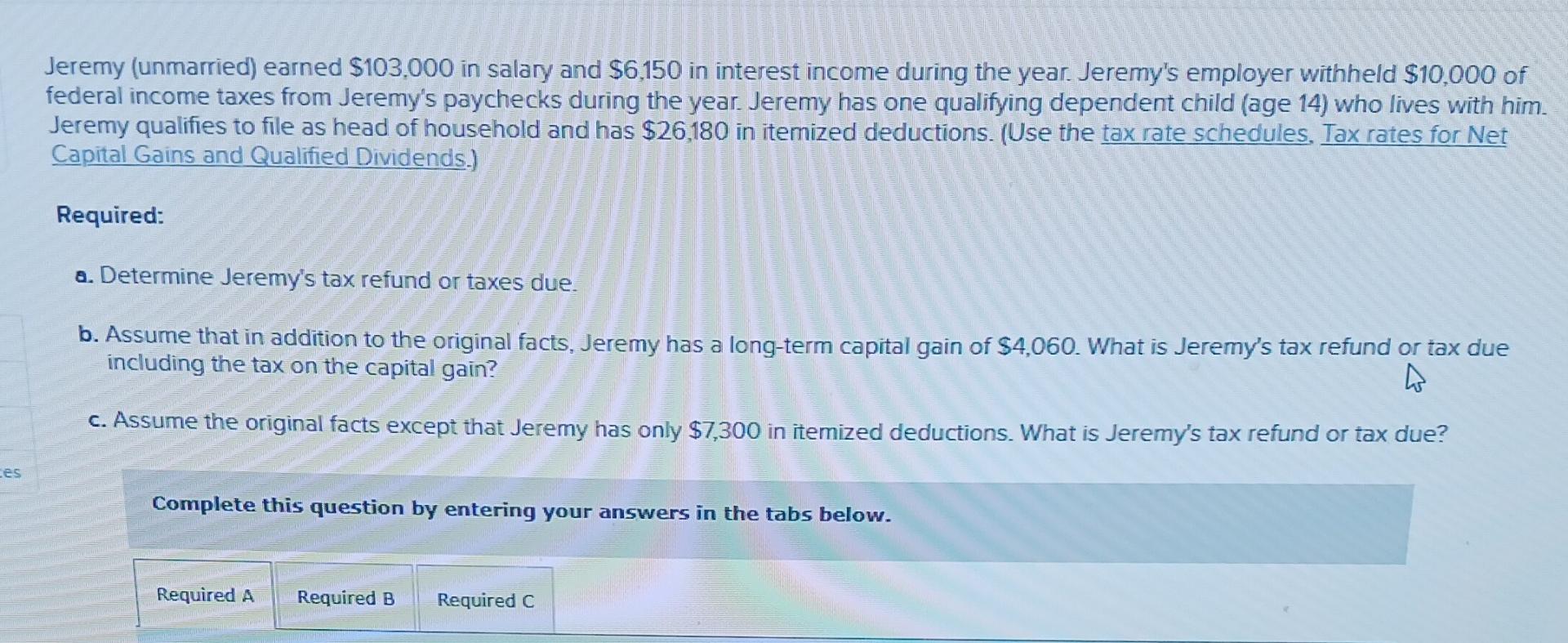

ces Jeremy (unmarried) earned $103,000 in salary and $6,150 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from

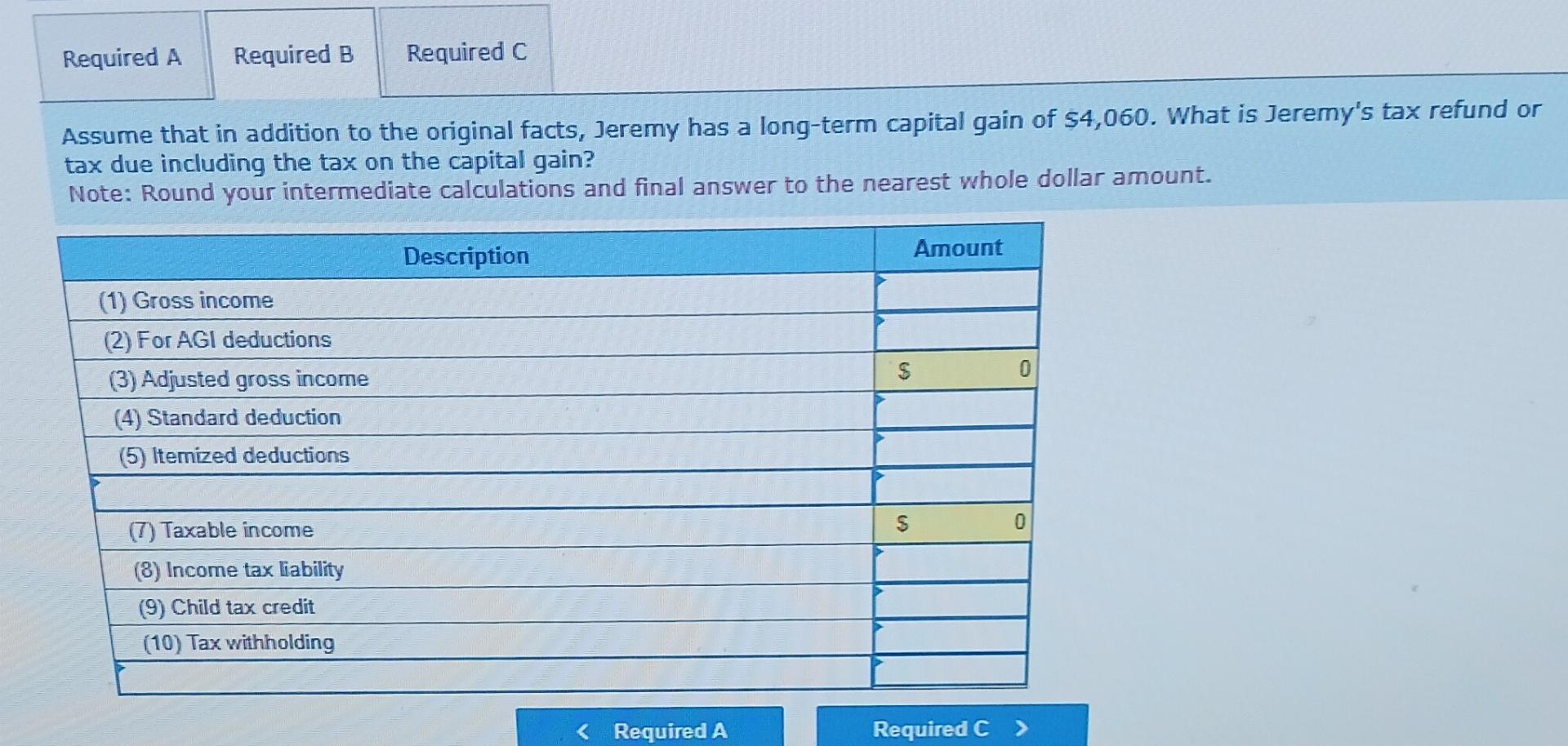

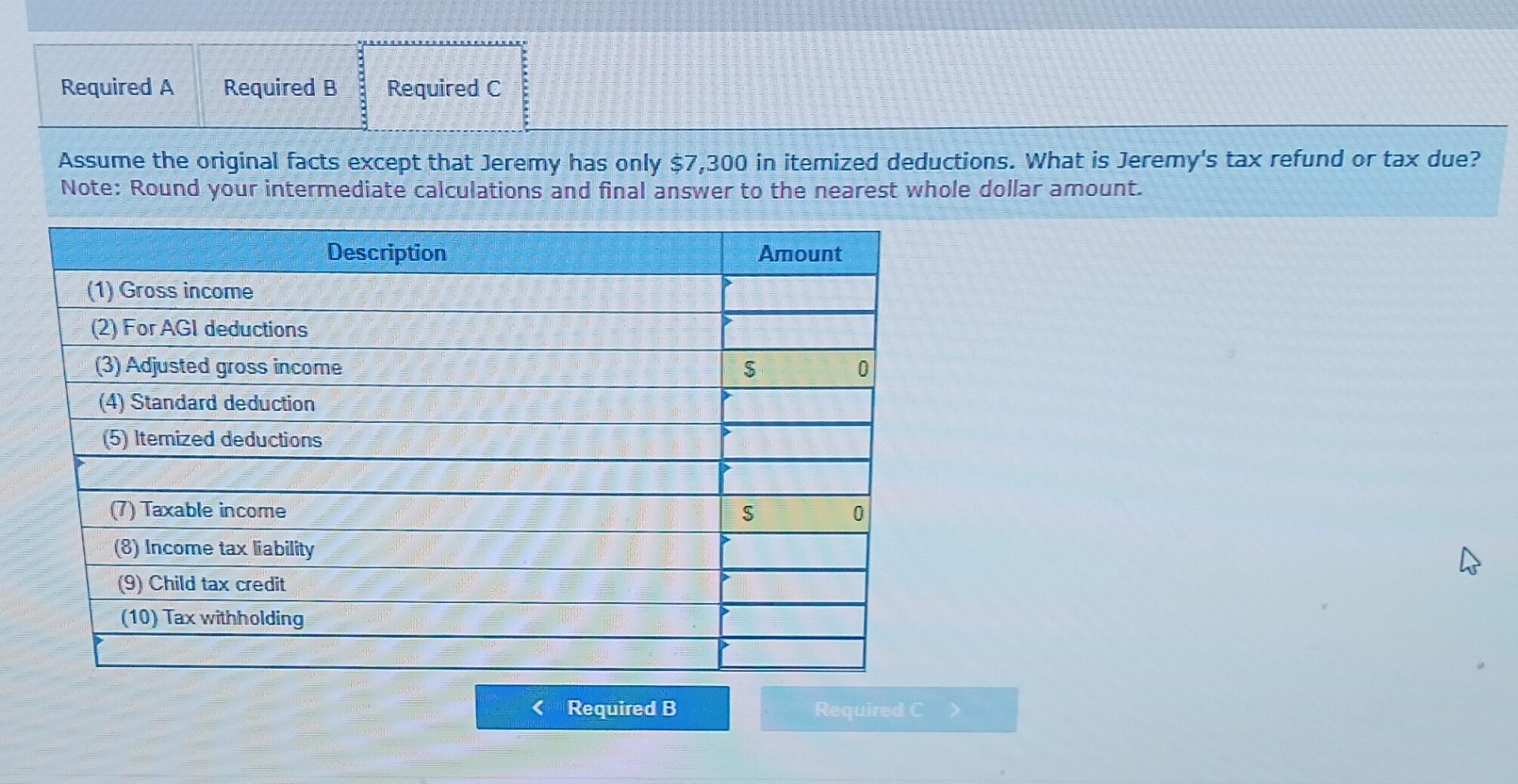

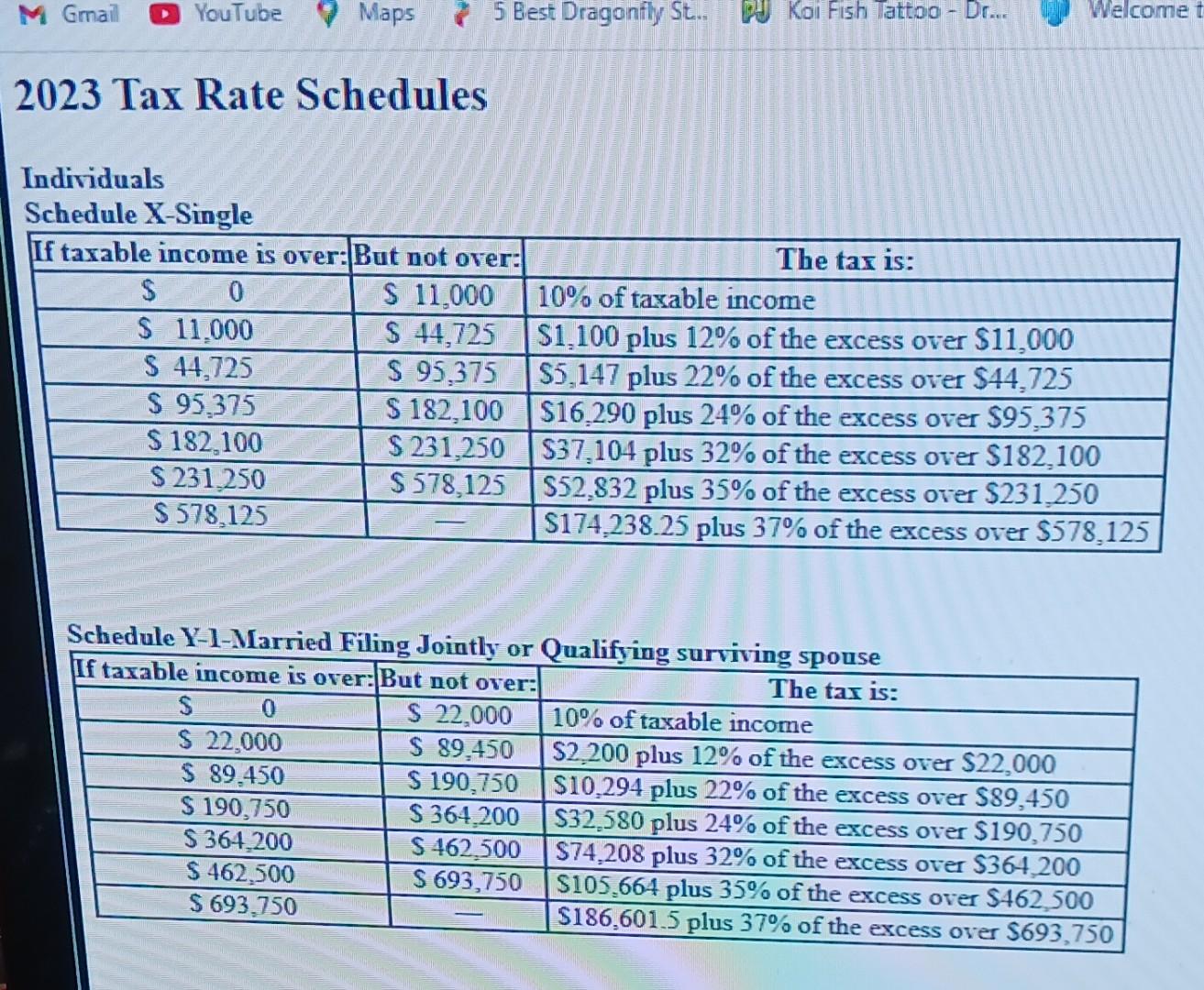

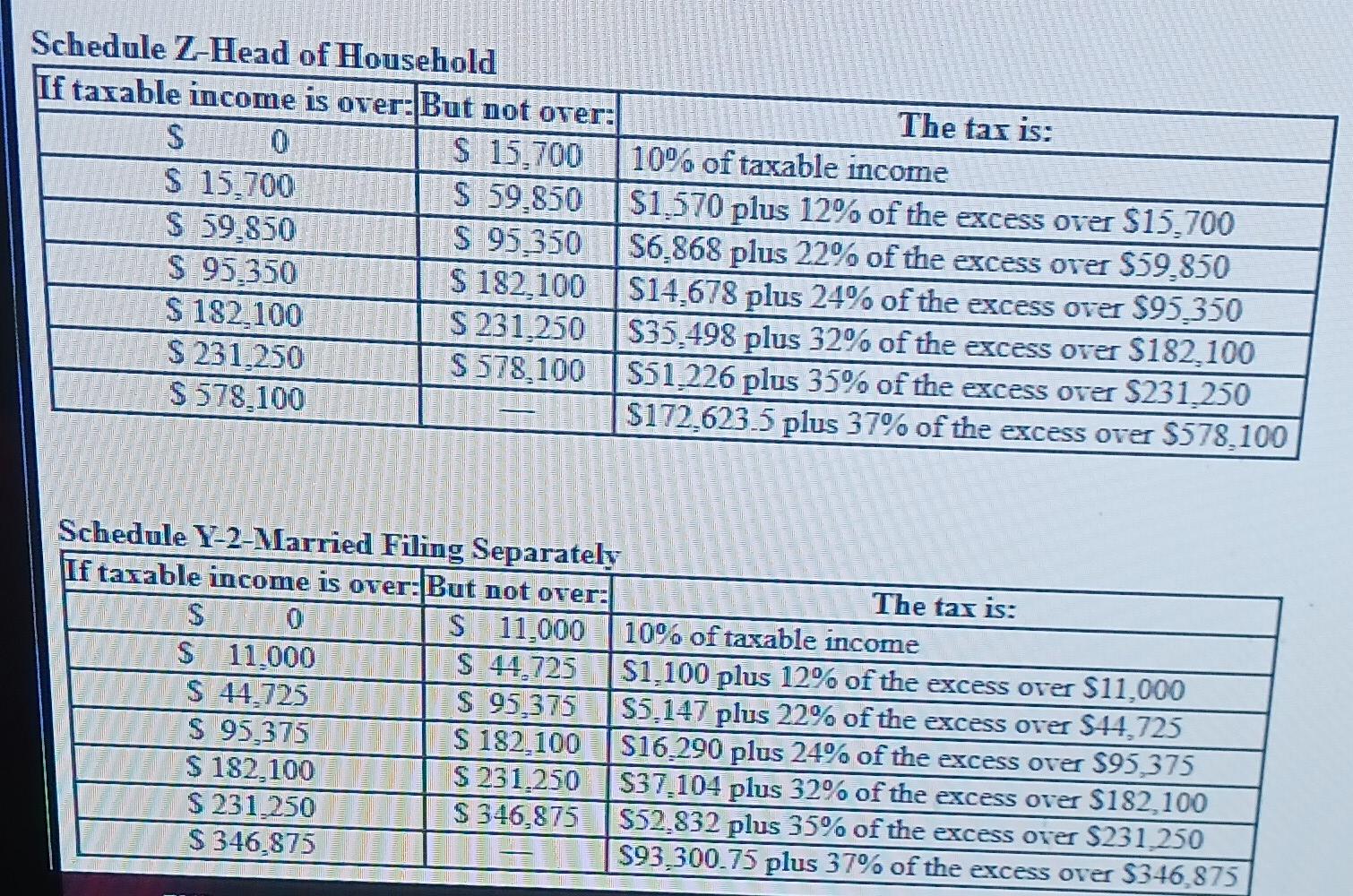

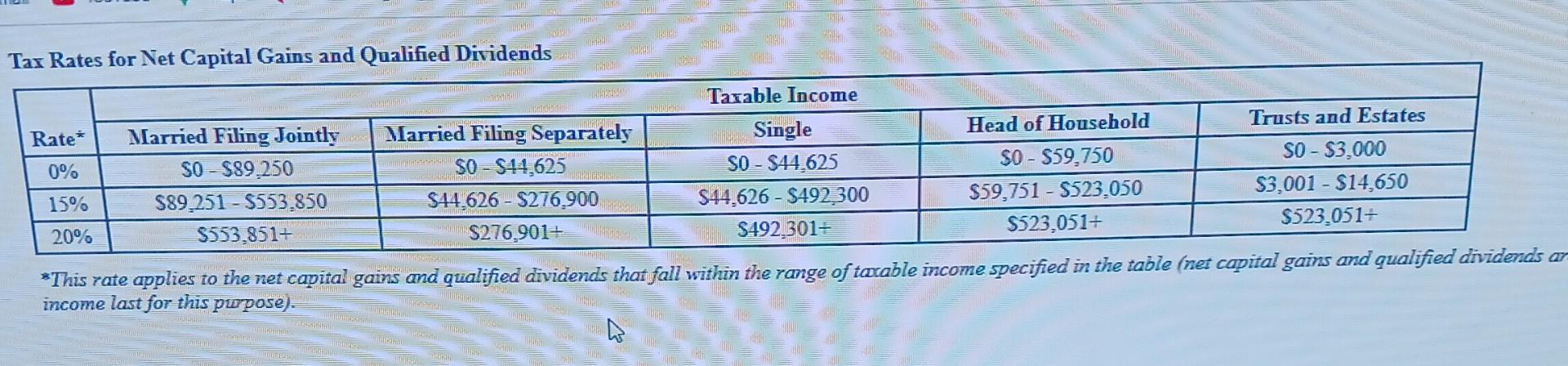

ces Jeremy (unmarried) earned $103,000 in salary and $6,150 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $26,180 in itemized deductions. (Use the tax rate schedules, Tax rates for Net Capital Gains and Qualified Dividends.) Required: a. Determine Jeremy's tax refund or taxes due. b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,060. What is Jeremy's tax refund or tax due including the tax on the capital gain? c. Assume the original facts except that Jeremy has only $7,300 in itemized deductions. What is Jeremy's tax refund or tax due? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required A Required B Required C Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,060. What is Jeremy's tax refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding Description < Required A Amount $ S 0 0 Required C> Required A Required B Required C Assume the original facts except that Jeremy has only $7,300 in itemized deductions. What is Jeremy's tax refund or tax due? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding COMPOZANIML Auch WWEAVAN is niet Time in < Required B S Amount 0 Required C > M Gmail YouTube Maps 75 Best Dragonfly St... 2023 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $0 $ 11,000 $ 44,725 $ 95,375 $ 182,100 $ 231,250 $578,125 $ 11,000 $ 44,725 $ 95.375 $ 182,100 $231,250 $578,125 $ 0 $ 22,000 $ 89,450 $ 190,750 $364,200 $ 462,500 $ 693,750 PJKoi Fish Tattoo - Dr... $ 22,000 $ 89,450 $ 190,750 S 364,200 $ 462,500 $ 693,750 The tax is: Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse If taxable income is over: But not over: The tax is: Welcome t 10% of taxable income $1,100 plus 12% of the excess over $11,000 $5,147 plus 22% of the excess over $44,725 $16.290 plus 24% of the excess over $95,375 $37,104 plus 32% of the excess over $182,100 $52,832 plus 35% of the excess over $231,250 $174.238.25 plus 37% of the excess over $578,125 10% of taxable income $2,200 plus 12% of the excess over $22,000 $10,294 plus 22% of the excess over $89,450 $32,580 plus 24% of the excess over $190,750 $74,208 plus 32% of the excess over $364,200 $105,664 plus 35% of the excess over $462,500 $186,601.5 plus 37% of the excess over $693,750 Schedule Z-Head of Household If taxable income is over: But not over: $ 15.700 $ 59,850 $ 95.350 $ 182,100 $ 231.250 $ 578,100 S 0 $ 15.700 $ 59.850 $ 95.350 $ 182,100 $ 231,250 $578,100 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: SO S 11,000 $ 44,725 $ 95,375 $ 182,100 $231.250 $ 346,875 $ 11.000 $ 44,725 $ 95,375 $ 182,100 $ 231.250 $ 346,875 The tax is: 10% of taxable income $1.570 plus 12% of the excess over $15,700 $6,868 plus 22% of the excess over $59,850 $14,678 plus 24% of the excess over $95.350 $35.498 plus 32% of the excess over $182,100 $51.226 plus 35% of the excess over $231.250 $172,623.5 plus 37% of the excess over $578,100 The tax is: 10% of taxable income $1,100 plus 12% of the excess over $11,000 $5,147 plus 22% of the excess over $44,725 $16.290 plus 24% of the excess over $95,375 $37,104 plus 32% of the excess over $182,100 $52,832 plus 35% of the excess over $231,250 $93,300.75 plus 37% of the excess over $346,875 Rate* 0% 15% 20% Tax Rates for Net Capital Gains and Qualified Dividends CHAIN DAMTALE derbil CARNET TIROSOLES Married Filing Jointly SO - $89,250 $89,251 $553.850 Thamar gean HOM MOT CHAPASW $553,851+ INTER Emighton MATIONE income last for this purpose). PREDEL PUEDES TEE maner Exbordadas Dann VETENSKIMI SHIBL www.hamcastan NOWer pim JAMBA mature Lugbun INTER Modern TWD THENSHEDantuinwe tabul S stati LOREDESAIN BUC *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends ar Com Atstan REINI 2010 Married Filing Separately THULPED UNIPER Warhatons Hem tin Ca SO - $44,625 $44,626 $276.900 $276,901+ L mbilicat HUBERTELST P E SH GAL UPAL 464 S MEDEND Taxable Income Marshma MEHR! Single SO - $44.625 $44,626-$492 300 $492,301+ TRAFFICA 20 Head of Household $0-$59,750 $59,751-$523,050 $523,051+ Trusts and Estates SO - $3,000 $3,001-$14,650 $523,051+

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Soluttion To calculate Jeremys tax refund or taxes due we need to determine his taxable income and apply the relevant tax rates and deductions Lets ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started