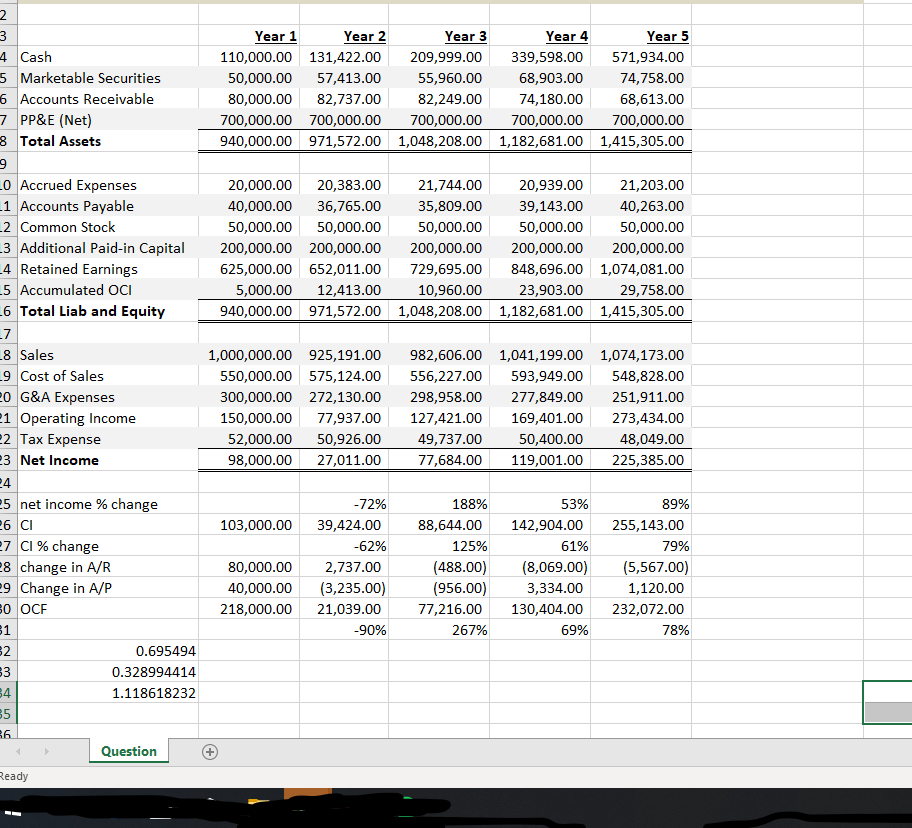

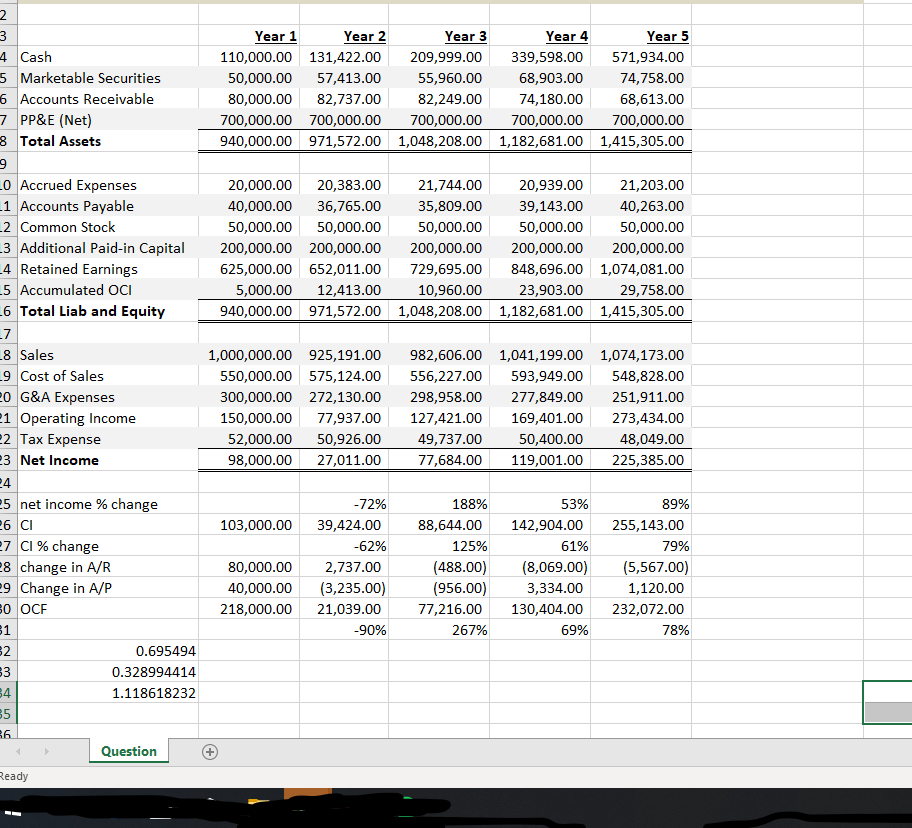

For each year, calculate the percentage change in:

Net Income

Comprehensive Income (Remember: Comp Inc = Net Income + Other Comp Income)

Operating Cash Flow

Using the percentage change for the Years 3, 4 and 5, calculate the standard deviation (assuming the population) for:

Net Income

Comprehensive Income

Operating Cash Flow

(Hint: make sure you know the difference between =stdev() and =stdevp() in excel.)

Round your answers to the nearest percentage point (e.g. 29.64983% should be entered as 30, not .30).

Find Standard deviation for net income, comprehensive income, and operating Cash flow

3 4 Cash 5 Marketable Securities 6 Accounts Receivable 7 PP&E (Net) 3 Total Assets Year 1 Year 2 110,000.00 131,422.00 50,000.00 57,413.00 80,000.00 82,737.00 700,000.00 700,000.00 940,000.00 971,572.00 Year 3 209,999.00 55,960.00 82,249.00 700,000.00 1,048,208.00 Year 4 339,598.00 68,903.00 74,180.00 700,000.00 1,182,681.00 Year 5 571,934.00 74,758.00 68,613.00 700,000.00 1,415,305.00 LO Accrued Expenses 1 Accounts Payable L2 Common Stock 3 Additional Paid-in Capital _4 Retained Earnings -5 Accumulated OCI 46 Total Liab and Equity 20,000.00 20,383.00 40,000.00 36,765.00 50,000.00 50,000.00 200,000.00 200,000.00 625,000.00 652,011.00 5,000.00 12,413.00 940,000.00 971,572.00 21,744.00 35,809.00 50,000.00 200,000.00 729,695.00 10,960.00 1,048,208.00 20,939.00 39,143.00 50,000.00 200,000.00 848,696.00 23,903.00 1,182,681.00 21,203.00 40,263.00 50,000.00 200,000.00 1,074,081.00 29,758.00 1,415,305.00 L8 Sales 9 Cost of Sales 20 G&A Expenses 21 Operating Income 22 Tax Expense 23 Net Income 1,000,000.00 925,191.00 550,000.00 575,124.00 300,000.00 272,130.00 150,000.00 77,937.00 52,000.00 50,926.00 98,000.00 27,011.00 982,606.00 556,227.00 298,958.00 127,421.00 49,737.00 77,684.00 1,041,199.00 593,949.00 277,849.00 169,401.00 50,400.00 119,001.00 1,074,173.00 548,828.00 251,911.00 273,434.00 48,049.00 225,385.00 103,000.00 25 net income % change 26 CI 27 CI % change 28 change in A/R 29 Change in A/P 50 OCF 80,000.00 40,000.00 218,000.00 -72% 39,424.00 -62% 2,737.00 (3,235.00) 21,039.00 -90% 188% 88,644.00 125% (488.00) (956.00) 77,216.00 267% 53% 142,904.00 61% (8,069.00) 3,334.00 130,404.00 69% 89% 255,143.00 79% (5,567.00) 1,120.00 232,072.00 78% 0.695494 0.328994414 1.118618232 Question Ready 3 4 Cash 5 Marketable Securities 6 Accounts Receivable 7 PP&E (Net) 3 Total Assets Year 1 Year 2 110,000.00 131,422.00 50,000.00 57,413.00 80,000.00 82,737.00 700,000.00 700,000.00 940,000.00 971,572.00 Year 3 209,999.00 55,960.00 82,249.00 700,000.00 1,048,208.00 Year 4 339,598.00 68,903.00 74,180.00 700,000.00 1,182,681.00 Year 5 571,934.00 74,758.00 68,613.00 700,000.00 1,415,305.00 LO Accrued Expenses 1 Accounts Payable L2 Common Stock 3 Additional Paid-in Capital _4 Retained Earnings -5 Accumulated OCI 46 Total Liab and Equity 20,000.00 20,383.00 40,000.00 36,765.00 50,000.00 50,000.00 200,000.00 200,000.00 625,000.00 652,011.00 5,000.00 12,413.00 940,000.00 971,572.00 21,744.00 35,809.00 50,000.00 200,000.00 729,695.00 10,960.00 1,048,208.00 20,939.00 39,143.00 50,000.00 200,000.00 848,696.00 23,903.00 1,182,681.00 21,203.00 40,263.00 50,000.00 200,000.00 1,074,081.00 29,758.00 1,415,305.00 L8 Sales 9 Cost of Sales 20 G&A Expenses 21 Operating Income 22 Tax Expense 23 Net Income 1,000,000.00 925,191.00 550,000.00 575,124.00 300,000.00 272,130.00 150,000.00 77,937.00 52,000.00 50,926.00 98,000.00 27,011.00 982,606.00 556,227.00 298,958.00 127,421.00 49,737.00 77,684.00 1,041,199.00 593,949.00 277,849.00 169,401.00 50,400.00 119,001.00 1,074,173.00 548,828.00 251,911.00 273,434.00 48,049.00 225,385.00 103,000.00 25 net income % change 26 CI 27 CI % change 28 change in A/R 29 Change in A/P 50 OCF 80,000.00 40,000.00 218,000.00 -72% 39,424.00 -62% 2,737.00 (3,235.00) 21,039.00 -90% 188% 88,644.00 125% (488.00) (956.00) 77,216.00 267% 53% 142,904.00 61% (8,069.00) 3,334.00 130,404.00 69% 89% 255,143.00 79% (5,567.00) 1,120.00 232,072.00 78% 0.695494 0.328994414 1.118618232 Question Ready