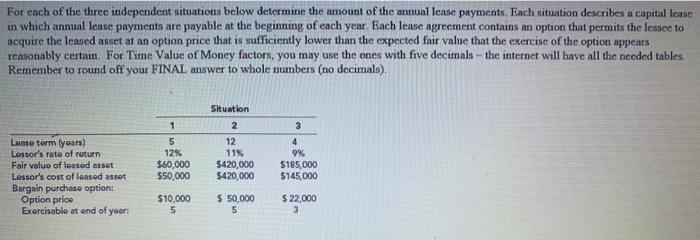

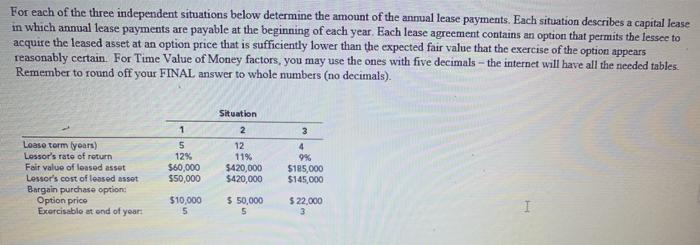

For ench of the three independent situations below determine the amount of the annual lease payments. Each situation describes a capital lease in which annual lease payments are payable at the beginning of each year Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain. For Time Value of Money factors, you may use the ones with five decimals - the internet will have all the needed tables. Remember to round off your FINAL answer to whole numbers (no decimals). Lease term years) Lessor's rate of return Fair value of leased asset Lossor's cost of loased asset Bargain purchase option: Option price Exorcisable at end of year: 1 5 12% $60,000 $50,000 Situation 2 12 11% $420,000 $420,000 3 4 9% $185,000 5145,000 $10,000 5 $ 50,000 5 $ 22,000 3 For each of the three independent situations below determine the amount of the annual lease payments. Each situation describes a capital lease in which annual lease payments are payable at the beginning of each year. Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain For Time Value of Money factors, you may use the ones with five decimals - the internet will have all the needed tables. Remember to round off your FINAL answer to whole numbers (no decimals). 3 Loase tormlyears) Lessor's rate of return Fair value of leased asset Lessor's cost of leased asset Bargain purchase option: Option price Exorcisable at end of years 1 5 12% $60,000 $50,000 Situation 2 12 11% $420,000 $420,000 4 9% $185,000 $145,000 $10,000 5 $ 50,000 5 $ 22,000 3 I For ench of the three independent situations below determine the amount of the annual lease payments. Each situation describes a capital lease in which annual lease payments are payable at the beginning of each year Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain. For Time Value of Money factors, you may use the ones with five decimals - the internet will have all the needed tables. Remember to round off your FINAL answer to whole numbers (no decimals). Lease term years) Lessor's rate of return Fair value of leased asset Lossor's cost of loased asset Bargain purchase option: Option price Exorcisable at end of year: 1 5 12% $60,000 $50,000 Situation 2 12 11% $420,000 $420,000 3 4 9% $185,000 5145,000 $10,000 5 $ 50,000 5 $ 22,000 3 For each of the three independent situations below determine the amount of the annual lease payments. Each situation describes a capital lease in which annual lease payments are payable at the beginning of each year. Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain For Time Value of Money factors, you may use the ones with five decimals - the internet will have all the needed tables. Remember to round off your FINAL answer to whole numbers (no decimals). 3 Loase tormlyears) Lessor's rate of return Fair value of leased asset Lessor's cost of leased asset Bargain purchase option: Option price Exorcisable at end of years 1 5 12% $60,000 $50,000 Situation 2 12 11% $420,000 $420,000 4 9% $185,000 $145,000 $10,000 5 $ 50,000 5 $ 22,000 3