for first question, needs year 1 and 2. thank you!

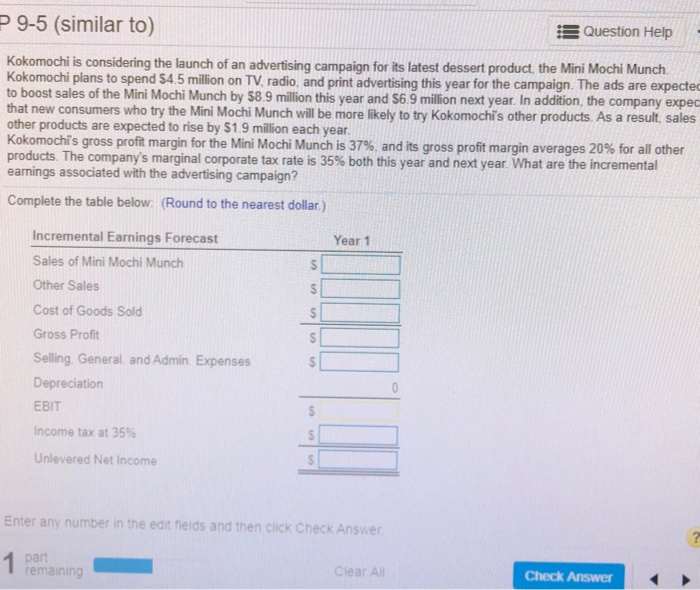

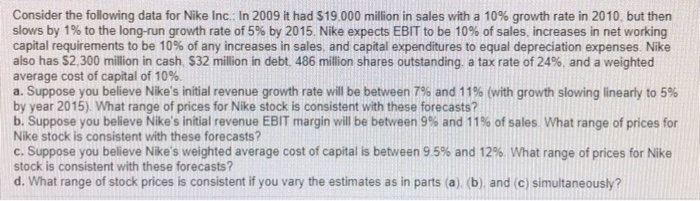

P 9-5 (similar to) Question Help Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch Kokomochi plans to spend 54.5 million on TV, radio, and print advertising this year for the campaign. The ads are expected to boost sales of the Mini Mochi Munch by $8.9 million this year and 56.9 million next year. In addition, the company expec that new consumers who try the Mini Mochi Munch will be more likely to try Kokomochi's other products. As a result, sales other products are expected to rise by $1.9 million each year. Kokomochi's gross profit margin for the Mini Mochi Munch is 37%and its gross profit margin averages 20% for all other products. The company's marginal corporate tax rate is 35% both this year and next year. What are the incremental earnings associated with the advertising campaign? Complete the table below. (Round to the nearest dollar.) Year 1 s Incremental Earnings Forecast Sales of Mini Mochi Munch Other Sales Cost of Goods Sold Gross Profit Selling, General, and Admin Expenses Depreciation EBIT $ $ $ 0 Income tax at 35% Unlevered Net Income Enter any number in the editfelds and then click Check Answer 1 part remaining Clear All Check Answer Consider the following data for Nike Inc.: In 2009 it had $19.000 million in sales with a 10% growth rate in 2010, but then slows by 1% to the long-run growth rate of 5% by 2015 Nike expects EBIT to be 10% of sales, increases in net working capital requirements to be 10% of any increases in sales and capital expenditures to equal depreciation expenses Nike also has $2,300 million in cash, 532 million in debt. 486 million shares outstanding, a tax rate of 24%, and a weighted average cost of capital of 10%. a. Suppose you believe Nike's initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2015). What range of prices for Nike stock is consistent with these forecasts? b. Suppose you believe Nike's initial revenue EBIT margin will be between 9% and 11% of sales What range of prices for Nike stock is consistent with these forecasts? c. Suppose you believe Nike's weighted average cost of capital is between 9.5% and 12% What range of prices for Nike stock is consistent with these forecasts? d. What range of stock prices is consistent if you vary the estimates as in parts (a), (b) and (c) simultaneously