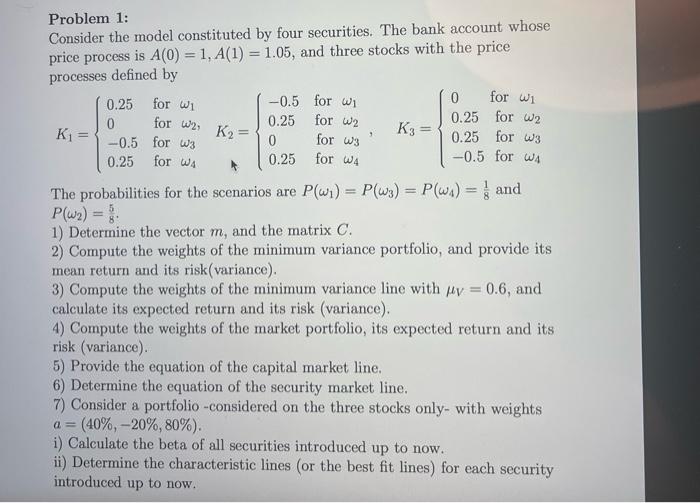

for for for for K3 - 1 for w3 for WA for WA Problem 1: Consider the model constituted by four securities. The bank account whose price process is A(0) = 1, A(1) = 1.05, and three stocks with the price processes defined by 0.25 -0.5 for wi 0 0.25 0.25 for w2 K1 = K2= -0.5 for W3 0 0.25 for w3 0.25 0.25 -0.5 for WA The probabilities for the scenarios are P(wi) = P(W3) = P(W) = 1 and PW2) = 1) Determine the vector m, and the matrix C. 2) Compute the weights of the minimum variance portfolio, and provide its mean return and its risk(variance). 3) Compute the weights of the minimum variance line with my = 0.6, and calculate its expected return and its risk (variance). 4) Compute the weights of the market portfolio, its expected return and its risk (variance). 5) Provide the equation of the capital market line, 6) Determine the equation of the security market line. 7) Consider a portfolio-considered on the three stocks only- with weights (40%, -20%, 80%). i) Calculate the beta of all securities introduced up to now. ii) Determine the characteristic lines (or the best fit lines) for each security introduced up to now. a = for for for for K3 - 1 for w3 for WA for WA Problem 1: Consider the model constituted by four securities. The bank account whose price process is A(0) = 1, A(1) = 1.05, and three stocks with the price processes defined by 0.25 -0.5 for wi 0 0.25 0.25 for w2 K1 = K2= -0.5 for W3 0 0.25 for w3 0.25 0.25 -0.5 for WA The probabilities for the scenarios are P(wi) = P(W3) = P(W) = 1 and PW2) = 1) Determine the vector m, and the matrix C. 2) Compute the weights of the minimum variance portfolio, and provide its mean return and its risk(variance). 3) Compute the weights of the minimum variance line with my = 0.6, and calculate its expected return and its risk (variance). 4) Compute the weights of the market portfolio, its expected return and its risk (variance). 5) Provide the equation of the capital market line, 6) Determine the equation of the security market line. 7) Consider a portfolio-considered on the three stocks only- with weights (40%, -20%, 80%). i) Calculate the beta of all securities introduced up to now. ii) Determine the characteristic lines (or the best fit lines) for each security introduced up to now. a =