Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For full credit on Questions 1 and 3, construct the cash flow diagrams with the correct cash inflows and outflows; show the compound interest factors

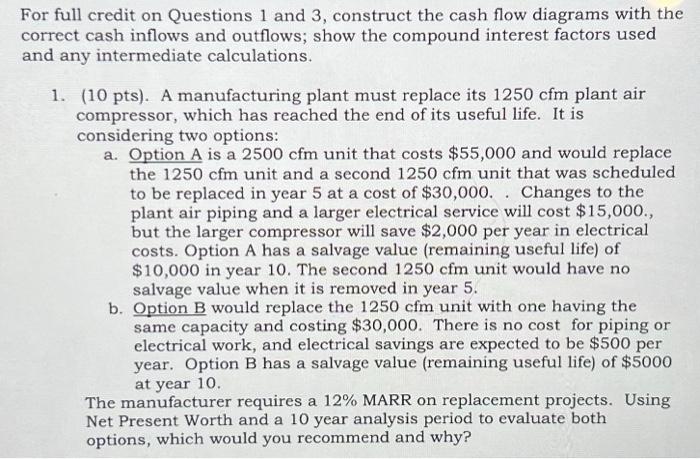

For full credit on Questions 1 and 3, construct the cash flow diagrams with the correct cash inflows and outflows; show the compound interest factors used and any intermediate calculations.

1. A manufacturing plant must replace its 1250 cfm plant air compressor, which has reached the end of its useful life. It is considering two options: a. Option A is a 2500 cfm unit that costs $55,000 and would replace the 1250 cfm unit and a second 1250 cfm unit that was scheduled to be replaced in year 5 at a cost of $30,000. . Changes to the plant air piping and a larger electrical service will cost $15,000., but the larger compressor will save $2,000 per year in electrical costs. Option A has a salvage value (remaining useful life) of $10,000 in year 10. The second 1250 cfm unit would have no salvage value when it is removed in year 5. b. Option B would replace the 1250 cfm unit with one having the same capacity and costing $30,000. There is no cost for piping or electrical work, and electrical savings are expected to be $500 per year. Option B has a salvage value (remaining useful life) of $5000 at year 10. The manufacturer requires a 12% MARR on replacement projects. Using Net Present Worth and a 10 year analysis period to evaluate both options, which would you recommend and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started