Answered step by step

Verified Expert Solution

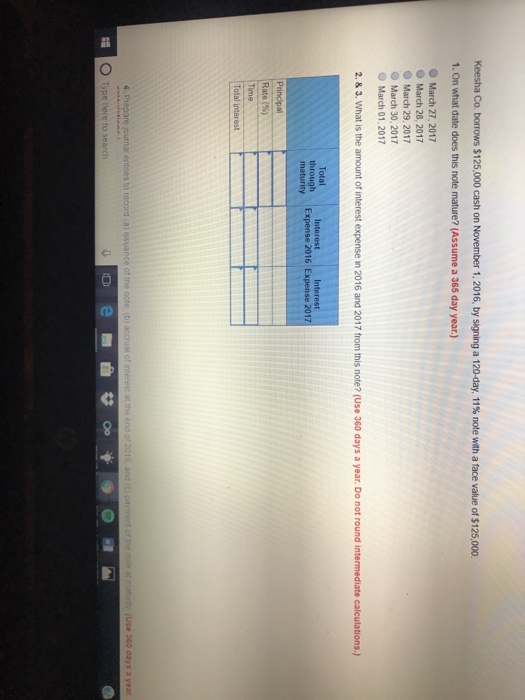

Question

1 Approved Answer

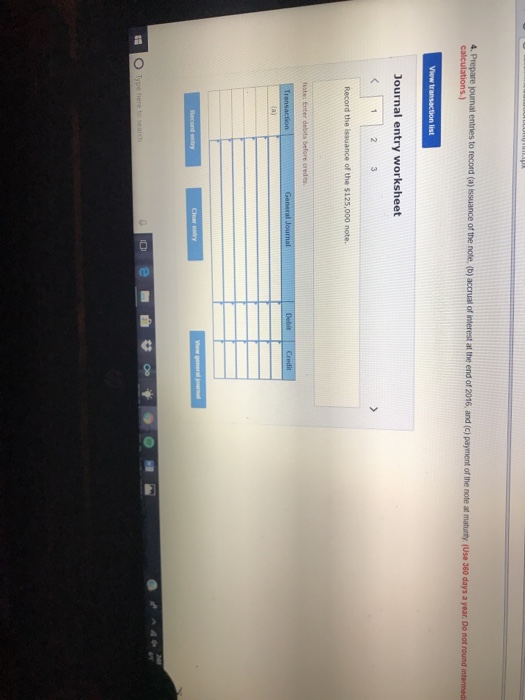

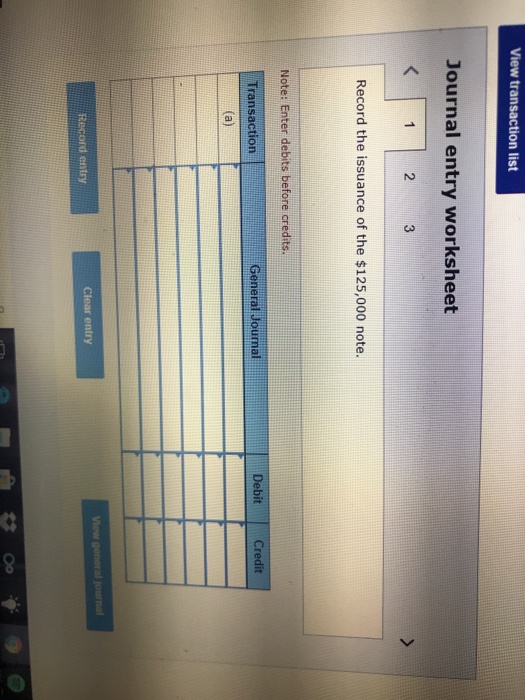

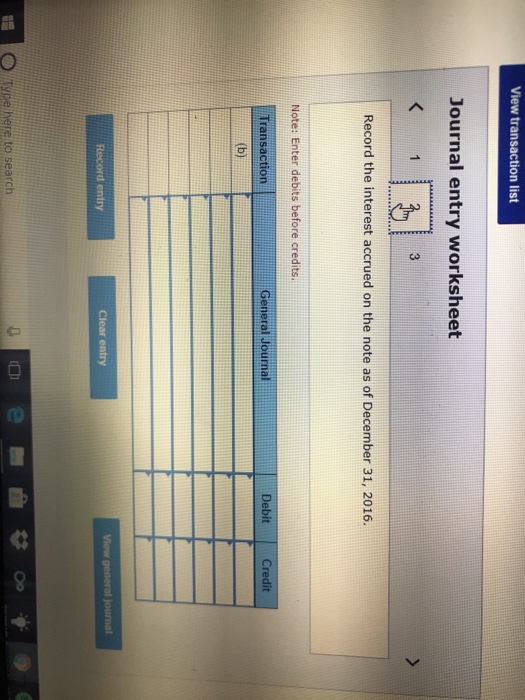

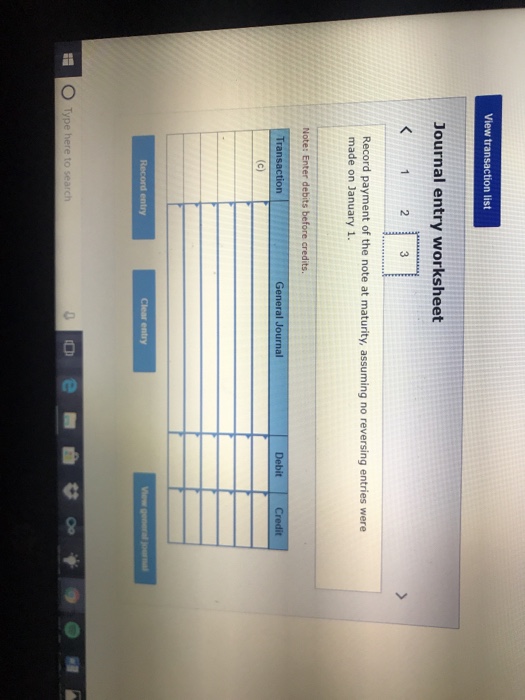

For general journal entry name: Accounts payable Accrued payroll payable Bonus payable Cost of goods sold Cash Deferred income tax liability Earned services revenue Earned

For general journal entry name:

Accounts payable

Accrued payroll payable

Bonus payable

Cost of goods sold

Cash

Deferred income tax liability

Earned services revenue

Earned ticket revenue

Employee bonus expense

Employee fed inc.taxes payable

Employee life insurance payable

Employee medical insurance payable

Employee union dues payable

Estimated warranty liability

Federal unemployment taxes payable

FICA-Medicare taxes payable

FICA-Medicare Social sec.taxes payable

Income taxes expense

Income taxes payable

Interest expense

Interest payable

Merchandise inventory

Notes payable

Office salaries expense

Payroll taxes expense

Repair parts inventory

Salaries payable

Sales

Sales salaries expense

Sales taxes payable

State unemployment taxes payable

Unearned ticket revenue

Unearned service revenue

Vacation benefits expense

Vacation benefits payable

Wages expense

Warranty expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started