Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for (ii) it says the conditions for Redington immunization. A company owes 500 and 1000 to be paid in 2 years and 6 years from

for (ii) it says the conditions for Redington immunization.

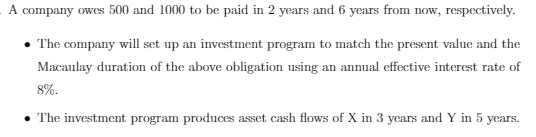

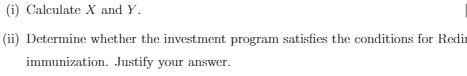

A company owes 500 and 1000 to be paid in 2 years and 6 years from now, respectively. The company will set up an investment program to match the present value and the Macaulay duration of the above obligation using an annual effective interest rate of 8%. The investment program produces asset cash flows of X in 3 years and Y in 5 years. (i) Calculate X and Y. (ii) Determine whether the investment program satisfies the conditions for Redi immunization. Justify your answer. A company owes 500 and 1000 to be paid in 2 years and 6 years from now, respectively. The company will set up an investment program to match the present value and the Macaulay duration of the above obligation using an annual effective interest rate of 8%. The investment program produces asset cash flows of X in 3 years and Y in 5 years. (i) Calculate X and Y. (ii) Determine whether the investment program satisfies the conditions for Redi immunization. Justify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started