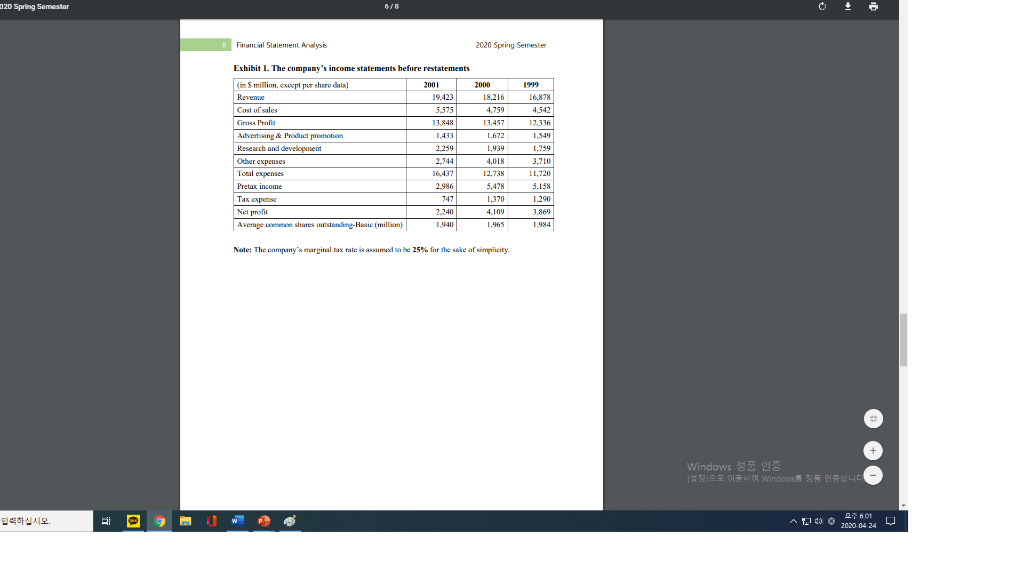

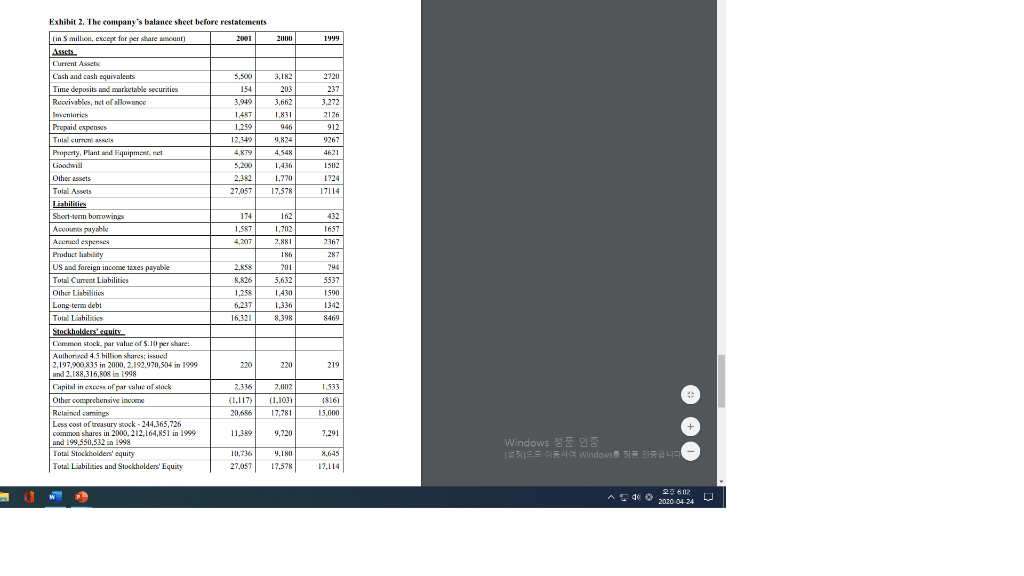

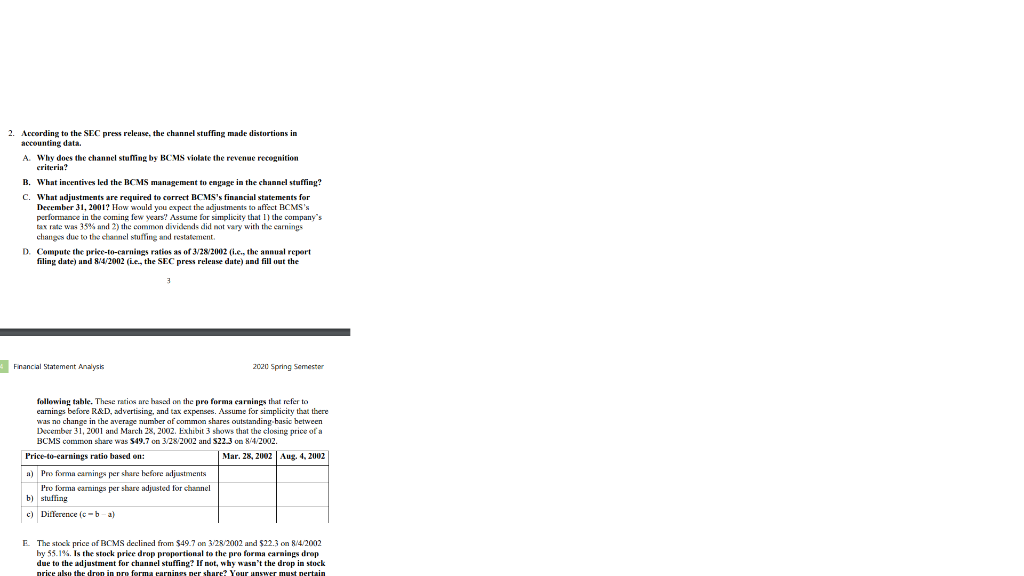

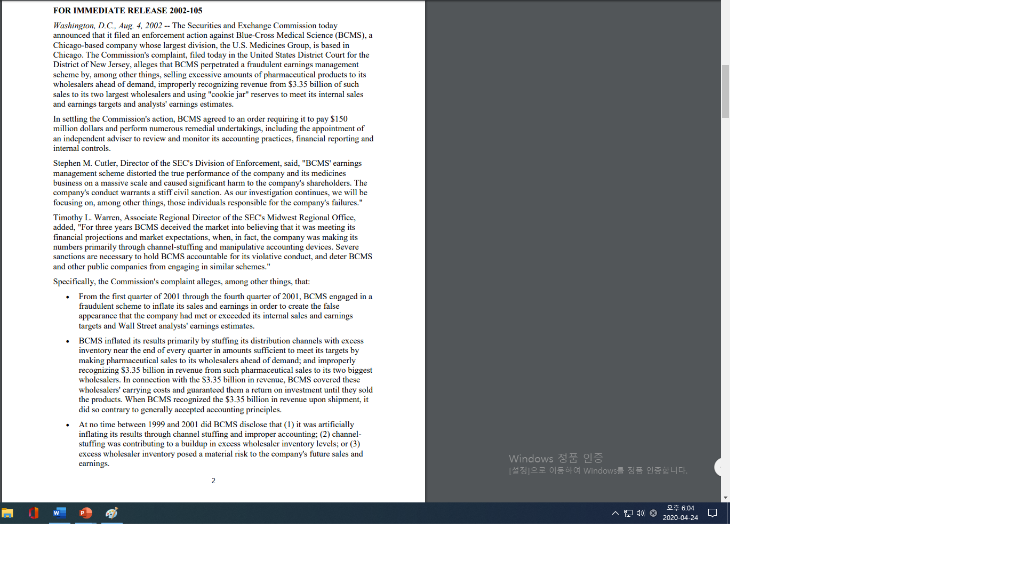

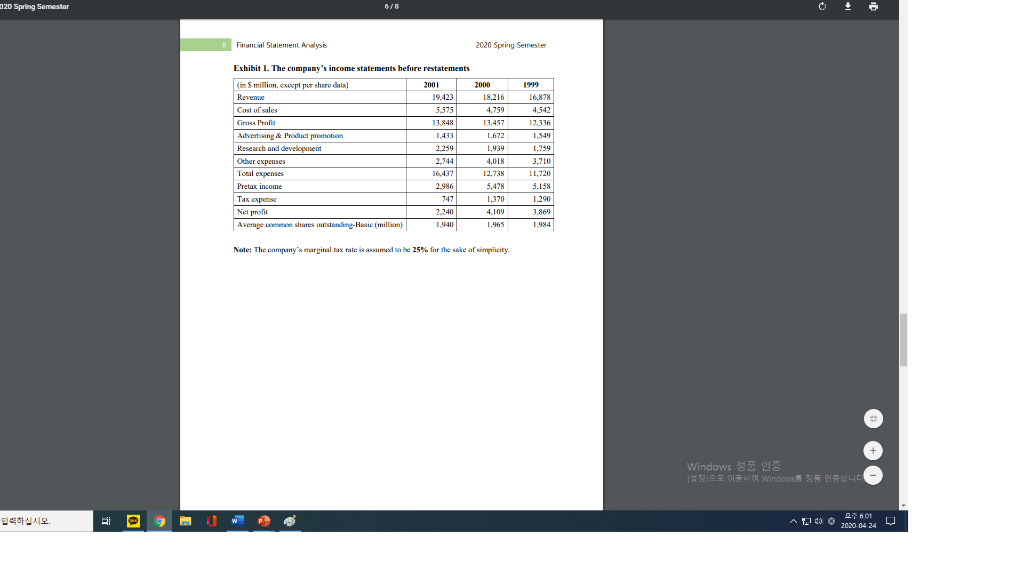

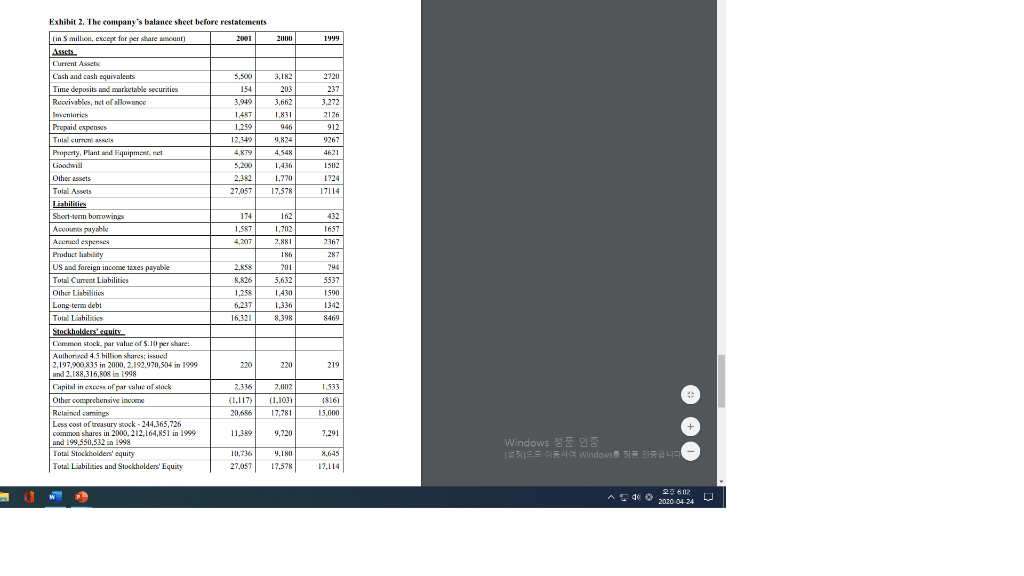

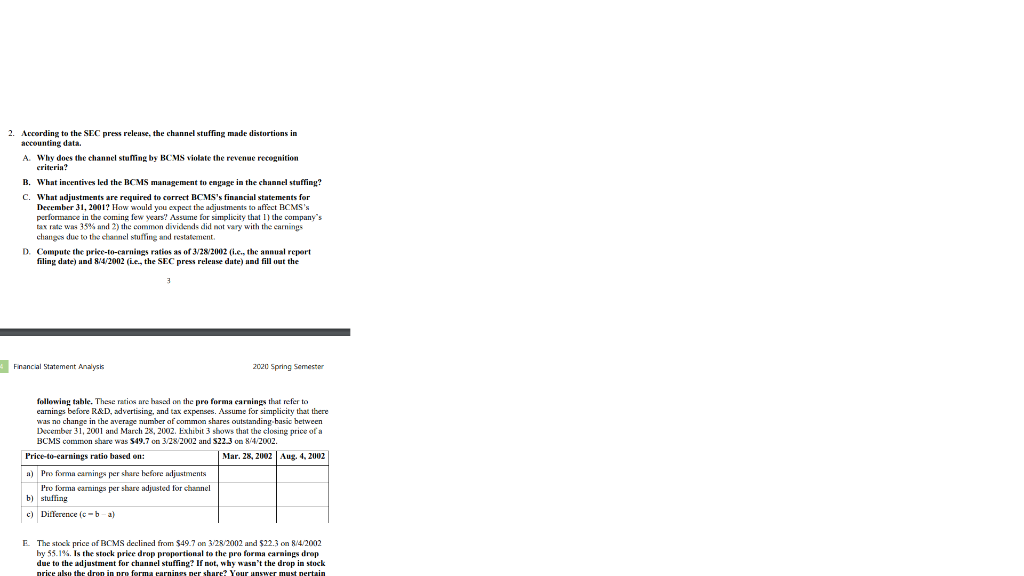

FOR IMMEDIATE RELEASE 2002-105 Washington, DC Aug 4.2002 - The Securities and Exchange Commission today announced that it filed an enforcement action against Blue Cross Medical Science (BCMS), a Chicago-based company whose largest division, the U.S. Medicines Group, is based in Chicago. The Commission's complaint, filed today in the United States Distinct Court for the District of New Jersey, alleges that BCMS perpetrated a fraudulent earnings management scheme by, aming other things, selling excessive amounts of Pharmaceutical products to its wholesalers ahead of demand improperly recomizing revenue from $3.35 billion of such sales to its two largest wholesalers and using "cookiejar reserves to meet its internal sales and earnings targets and analysts' carnings estimates In settling the Commission's action, BCMS agreed to an order requiring it to pay SISU million dollars and perform numerous remedial undertakinps, including the appointment of an independent adviser to review and monitor its contine practices, financial reporting and intemal controls. Stephen M. Cutler, Director of the SCCs Division of Enforcement, said. "BCMS' earnings management scheme distorted the true performance of the company and its medicines business on a missive scale and caused significant harm to the company's shareholders. The company's conduct warrants a stiff civil sanction. As our investigation continues, we will he focusing on, among other things, thase individuals responsible for the company's failures." Timothy I Warren, Associate Regional Director of the SECS Midwest Regional Office, added, "For three years BCMS deceived the market into believing that it was meeting its financial projections and market expectations, when, in fact, the company was making its numbers primarily through channel-stulling and manipulative Counting devices. Severe sanctions are necessary to hold RCMS accountable for its violative conduct, and deter BCMS and other public companies from engaging in similar schemes." Specifically, the Commission's complaint alleges, among other things that: From the first quarter of 2001 through the fourth quarter of 2001, BCMS engaged in a fraudulent scheme to inflate its sales and earnings in order to create the false appearance that the company hand or exceeded its internal sales and carings targets and Wall Street analysts camins estimates BCMS inflated its results primarily by Nuffing its distribution channels with excess inventory near the end of every quarter in amounts sufficient to meet its targets by makine pharmaceutical sales to its wholesalers ahead of demand, and improperly recognizing S3.35 billion in revenue from such pharmaceutical sales to its two biggest wholesalers. In connection with the S3.35 billion in reunuc, BCMS covered these wholesalers' carrying costs and guaranteed them a return on investment until they sold the products. When BCMS recognized the $3.35 billion in revenue upon shipment, it did se contrary to generally accepted accounting principles At no time between 1999 and 2001 did RCMS disclose that it was artificially inflating its results through channel stuffing and improper accounting (2) channel- stuffing was contributing to a buildup in excess wholesaler inventory levels, or (3) CXCCs wholesaler inventory poseda materials to the company's future sales and earnings. Windows 2003 010 Windows 8 DISELE A140 S60 AT20 2020.04.24 W BCMS has agreed, without admitting or denying the allegations in the Commission's complete the following ref . a permanent injunction against future violations of certain antifraud, s orting books and records and internal controls provisions of the federal securities disgorgement of Sl: a civil penalty of S100 million: an additional S50 million payment into a fund for the benefit of shareholders, various remedial undertakings, including the appointment of an independent adviser to review, assess and monitor BCMS' accounting practices, financial reporting and disclosure proses and interal control systems Exhibits 1 and 2 present the financial statements of this company before restatement 020 Spring Semester 6 Finanwl Statement Analysis 2020 Spring Semester Exhibit 1. The company's income statements before restatements in Smillion, copper share data) 2001 19.123 Corsi of sales Ciness Prati 5575 13.848 1.433 2.259 2000 18.216 4.759 13,457 1.672 1,939 1999 16,878 4.542 12.336 1.549 1.759 3.710 11.720 2.744 16437 12.738 Advertising & Product promotion Research and development Other expenses Total expenses Pretax income Tax sp Nel fit Average shares o nd 3.478 2.986 747 2240 1940 5,158 1.290 3,869 1984 1.370 ,109 1965 4 e million) Note: The company's marginal tax assum e 25% for the sake of simplicity Windows 702 00 O Windows SLC Qe2. 26.01 1 Exhibit 2. The company's balance sheet before restatements in Smillie, except for per share sunt 2001 2000 1999 5.500 3,182 2720 154 237 2126 Current Assets Cash and cash equivalents Time deposits and marketable securities Roosivables, nct of all me Inventuries Prepaid expenses Touren Property, Plant widquipment, Het Goodwill Other assets Total Ass Liabilities Short-term borrowing Acuxus royable 1.259 12.149 4,879 9,824 912 9267 4621 1502 1,270 17.578 27,057 Acered expenses Product liability US and foreign income taxes payable Total Current Liabilities Other Libilities Long term debt 174 162 1.587 1.702 1657 4,207 2.881 2367 186 287 2.858 201 8.8265,6325537 1.28 1,430 1590 6.217 1.336 16.321 8398 220 219 1.533 Stockholders'cauity Common stock, par value of $.10 per share: Author 4.5 billions; ied 2.197.000 835 in 2000, 2.192070 504 in 1999 and 2.188.316.00 in 1998 Capital in excess of par value of stock Other comprehensive income Retail camins Loss cost of treasury stock - 244,365,726 common shares in 2000, 212.164.851 in 1999 and 199.550.512 in 100 Total Stockholders' equity Total Liabilities and Stockholders' Equity 2,336 2002 (1.117) (1.103) 2068617781 (816) 15.000 11.189 9,720 7,291 9.190 Windows SE CIEC Windows DELIC 10,736 27,057 17,578 8.645 19.114 A 4 3020 0424 2. According to the SEC press release, the channel stuffing made distortions in accounting data A Why does the channel stuffing by BCMS violate the revenue recognition criteri B. What incentives led the BCMS management to engage in the channel stuffing? C. What adjustments are required to correct BCMS's financial statements for December 31, 2001? How would you expect the adjustments to affect BCMS' performance in the coming few years? Assume for simplicity that I) the company's tax rate was 35% and 2) the common dividend did not vary with the earnings chang due to the channel Nuffing and restatement D. Compute the price-to-carnings ratios as of 328/2002 (le, the annual report filing date) and 8/4/2002 (ie, the SEC press release date) and fill out the Francial Statement Analysis 2020 Spring Semester following table. These ratio are based on the pro forma earnings that refer to earnings before R&D, advertising and tax expenses. Assume for simplicity that there was no change in the average number of common shares outstanding basic between December 31, 2001 and March 2, 2002. Exhibit 3 shows that the closing price of a BCMS c on sbare was 549. 7 3/28/2002 and 5223 on 84/2002 Price-to-earnings ratio based on: Mar. 28, 2002 Aug. 4. 2002 a) Pro forma camines per share before adjustments Pro forma camins per share adjusted for channel b) stuffing c) Dillicence (caba) E. The stock price of BCMS declined from $49.7 on 3/28/2002 and 522.3 on 8/4/2002 by 55.19 Is the stock price drop proportional to the preforma earnings drop due to the adjustment for channel stuffing? If not, why wasn't the drop in stock riep hr drinn forma arnincs mer sharpur Uns mestnentain FOR IMMEDIATE RELEASE 2002-105 Washington, DC Aug 4.2002 - The Securities and Exchange Commission today announced that it filed an enforcement action against Blue Cross Medical Science (BCMS), a Chicago-based company whose largest division, the U.S. Medicines Group, is based in Chicago. The Commission's complaint, filed today in the United States Distinct Court for the District of New Jersey, alleges that BCMS perpetrated a fraudulent earnings management scheme by, aming other things, selling excessive amounts of Pharmaceutical products to its wholesalers ahead of demand improperly recomizing revenue from $3.35 billion of such sales to its two largest wholesalers and using "cookiejar reserves to meet its internal sales and earnings targets and analysts' carnings estimates In settling the Commission's action, BCMS agreed to an order requiring it to pay SISU million dollars and perform numerous remedial undertakinps, including the appointment of an independent adviser to review and monitor its contine practices, financial reporting and intemal controls. Stephen M. Cutler, Director of the SCCs Division of Enforcement, said. "BCMS' earnings management scheme distorted the true performance of the company and its medicines business on a missive scale and caused significant harm to the company's shareholders. The company's conduct warrants a stiff civil sanction. As our investigation continues, we will he focusing on, among other things, thase individuals responsible for the company's failures." Timothy I Warren, Associate Regional Director of the SECS Midwest Regional Office, added, "For three years BCMS deceived the market into believing that it was meeting its financial projections and market expectations, when, in fact, the company was making its numbers primarily through channel-stulling and manipulative Counting devices. Severe sanctions are necessary to hold RCMS accountable for its violative conduct, and deter BCMS and other public companies from engaging in similar schemes." Specifically, the Commission's complaint alleges, among other things that: From the first quarter of 2001 through the fourth quarter of 2001, BCMS engaged in a fraudulent scheme to inflate its sales and earnings in order to create the false appearance that the company hand or exceeded its internal sales and carings targets and Wall Street analysts camins estimates BCMS inflated its results primarily by Nuffing its distribution channels with excess inventory near the end of every quarter in amounts sufficient to meet its targets by makine pharmaceutical sales to its wholesalers ahead of demand, and improperly recognizing S3.35 billion in revenue from such pharmaceutical sales to its two biggest wholesalers. In connection with the S3.35 billion in reunuc, BCMS covered these wholesalers' carrying costs and guaranteed them a return on investment until they sold the products. When BCMS recognized the $3.35 billion in revenue upon shipment, it did se contrary to generally accepted accounting principles At no time between 1999 and 2001 did RCMS disclose that it was artificially inflating its results through channel stuffing and improper accounting (2) channel- stuffing was contributing to a buildup in excess wholesaler inventory levels, or (3) CXCCs wholesaler inventory poseda materials to the company's future sales and earnings. Windows 2003 010 Windows 8 DISELE A140 S60 AT20 2020.04.24 W BCMS has agreed, without admitting or denying the allegations in the Commission's complete the following ref . a permanent injunction against future violations of certain antifraud, s orting books and records and internal controls provisions of the federal securities disgorgement of Sl: a civil penalty of S100 million: an additional S50 million payment into a fund for the benefit of shareholders, various remedial undertakings, including the appointment of an independent adviser to review, assess and monitor BCMS' accounting practices, financial reporting and disclosure proses and interal control systems Exhibits 1 and 2 present the financial statements of this company before restatement 020 Spring Semester 6 Finanwl Statement Analysis 2020 Spring Semester Exhibit 1. The company's income statements before restatements in Smillion, copper share data) 2001 19.123 Corsi of sales Ciness Prati 5575 13.848 1.433 2.259 2000 18.216 4.759 13,457 1.672 1,939 1999 16,878 4.542 12.336 1.549 1.759 3.710 11.720 2.744 16437 12.738 Advertising & Product promotion Research and development Other expenses Total expenses Pretax income Tax sp Nel fit Average shares o nd 3.478 2.986 747 2240 1940 5,158 1.290 3,869 1984 1.370 ,109 1965 4 e million) Note: The company's marginal tax assum e 25% for the sake of simplicity Windows 702 00 O Windows SLC Qe2. 26.01 1 Exhibit 2. The company's balance sheet before restatements in Smillie, except for per share sunt 2001 2000 1999 5.500 3,182 2720 154 237 2126 Current Assets Cash and cash equivalents Time deposits and marketable securities Roosivables, nct of all me Inventuries Prepaid expenses Touren Property, Plant widquipment, Het Goodwill Other assets Total Ass Liabilities Short-term borrowing Acuxus royable 1.259 12.149 4,879 9,824 912 9267 4621 1502 1,270 17.578 27,057 Acered expenses Product liability US and foreign income taxes payable Total Current Liabilities Other Libilities Long term debt 174 162 1.587 1.702 1657 4,207 2.881 2367 186 287 2.858 201 8.8265,6325537 1.28 1,430 1590 6.217 1.336 16.321 8398 220 219 1.533 Stockholders'cauity Common stock, par value of $.10 per share: Author 4.5 billions; ied 2.197.000 835 in 2000, 2.192070 504 in 1999 and 2.188.316.00 in 1998 Capital in excess of par value of stock Other comprehensive income Retail camins Loss cost of treasury stock - 244,365,726 common shares in 2000, 212.164.851 in 1999 and 199.550.512 in 100 Total Stockholders' equity Total Liabilities and Stockholders' Equity 2,336 2002 (1.117) (1.103) 2068617781 (816) 15.000 11.189 9,720 7,291 9.190 Windows SE CIEC Windows DELIC 10,736 27,057 17,578 8.645 19.114 A 4 3020 0424 2. According to the SEC press release, the channel stuffing made distortions in accounting data A Why does the channel stuffing by BCMS violate the revenue recognition criteri B. What incentives led the BCMS management to engage in the channel stuffing? C. What adjustments are required to correct BCMS's financial statements for December 31, 2001? How would you expect the adjustments to affect BCMS' performance in the coming few years? Assume for simplicity that I) the company's tax rate was 35% and 2) the common dividend did not vary with the earnings chang due to the channel Nuffing and restatement D. Compute the price-to-carnings ratios as of 328/2002 (le, the annual report filing date) and 8/4/2002 (ie, the SEC press release date) and fill out the Francial Statement Analysis 2020 Spring Semester following table. These ratio are based on the pro forma earnings that refer to earnings before R&D, advertising and tax expenses. Assume for simplicity that there was no change in the average number of common shares outstanding basic between December 31, 2001 and March 2, 2002. Exhibit 3 shows that the closing price of a BCMS c on sbare was 549. 7 3/28/2002 and 5223 on 84/2002 Price-to-earnings ratio based on: Mar. 28, 2002 Aug. 4. 2002 a) Pro forma camines per share before adjustments Pro forma camins per share adjusted for channel b) stuffing c) Dillicence (caba) E. The stock price of BCMS declined from $49.7 on 3/28/2002 and 522.3 on 8/4/2002 by 55.19 Is the stock price drop proportional to the preforma earnings drop due to the adjustment for channel stuffing? If not, why wasn't the drop in stock riep hr drinn forma arnincs mer sharpur Uns mestnentain