Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for it on 1 February 2022. On 1 May 2022, he exercised the option to take up the shares when the market value was $18

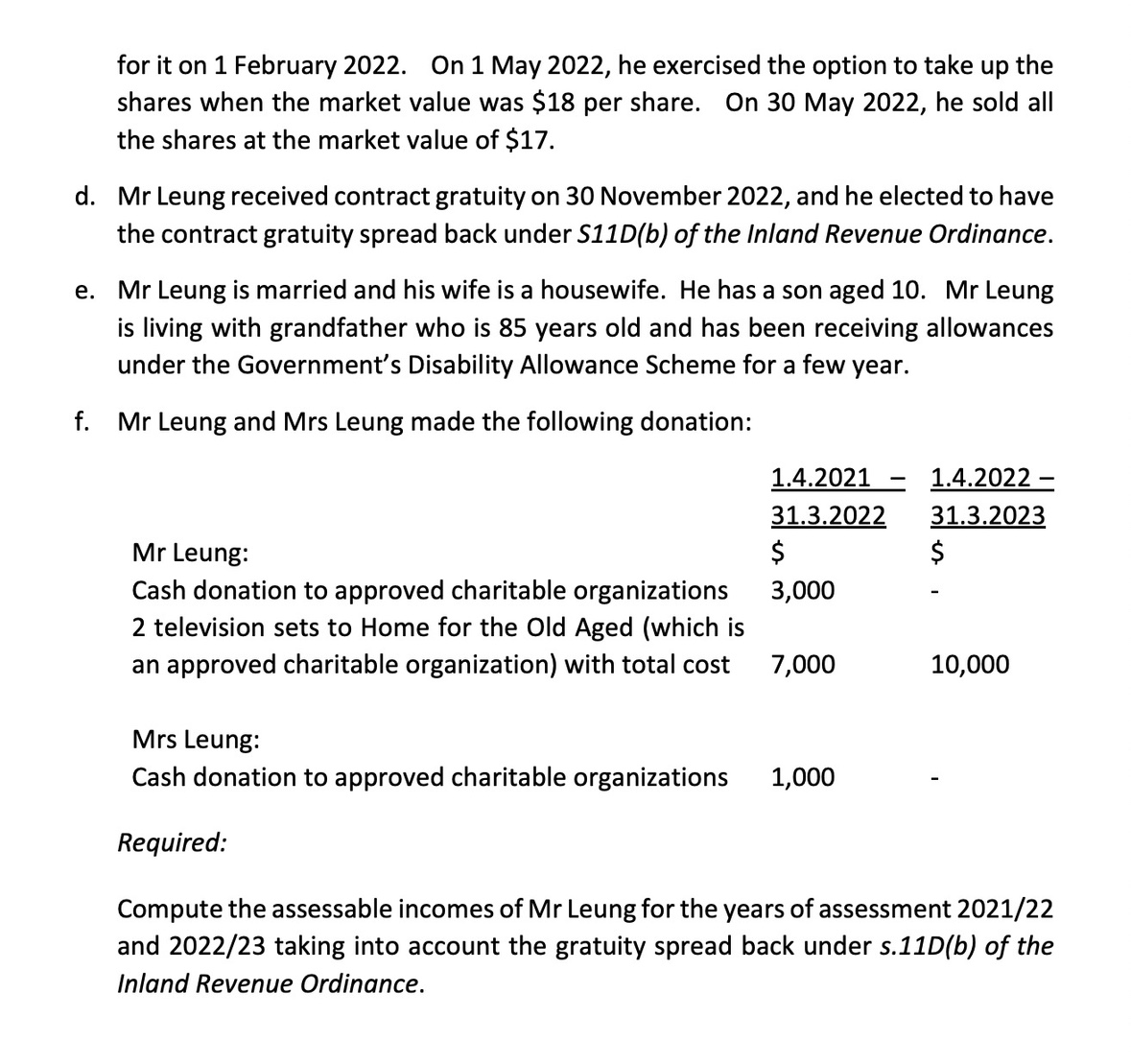

for it on 1 February 2022. On 1 May 2022, he exercised the option to take up the shares when the market value was $18 per share. On 30 May 2022, he sold all the shares at the market value of $17. d. Mr Leung received contract gratuity on 30 November 2022, and he elected to have the contract gratuity spread back under S11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: Required: Compute the assessable incomes of Mr Leung for the years of assessment 2021/22 and 2022/23 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance

for it on 1 February 2022. On 1 May 2022, he exercised the option to take up the shares when the market value was $18 per share. On 30 May 2022, he sold all the shares at the market value of $17. d. Mr Leung received contract gratuity on 30 November 2022, and he elected to have the contract gratuity spread back under S11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: Required: Compute the assessable incomes of Mr Leung for the years of assessment 2021/22 and 2022/23 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started