Answered step by step

Verified Expert Solution

Question

1 Approved Answer

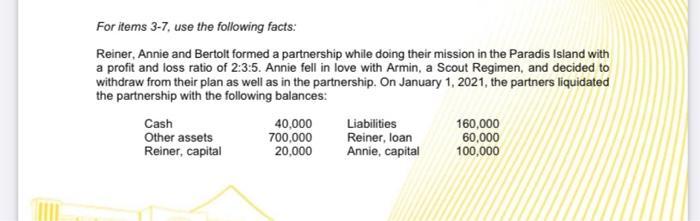

For items 3-7, use the following facts: Reiner, Annie and Bertolt formed a partnership while doing their mission in the Paradis Island with a

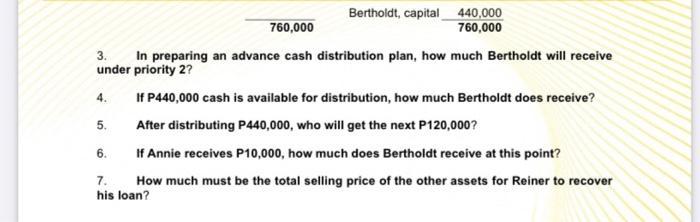

For items 3-7, use the following facts: Reiner, Annie and Bertolt formed a partnership while doing their mission in the Paradis Island with a profit and loss ratio of 2:3:5. Annie fell in love with Armin, a Scout Regimen, and decided to withdraw from their plan as well as in the partnership. On January 1, 2021, the partners liquidated the partnership with the following balances: Cash Other assets Reiner, capital 40,000 700,000 20,000 Liabilities Reiner, loan Annie, capital 160,000 60,000 100,000 760,000 3. In preparing an advance cash distribution plan, how much Bertholdt will receive under priority 2? Bertholdt, capital 440,000 760,000 4. If P440,000 cash is available for distribution, how much Bertholdt does receive? After distributing P440,000, who will get the next P120,000? 6. If Annie receives P10,000, how much does Bertholdt receive at this point? 7. How much must be the total selling price of the other assets for Reiner to recover his loan? 5.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

314 12 510 V from which I from which I Thus 4 11 68 02 2247j124295 6j8 The current in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started