Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Partnership Ali, Bona, and Citra agreed that the distribution of profit and loss is as follows: Ali received a salary of IDR 10,000,000

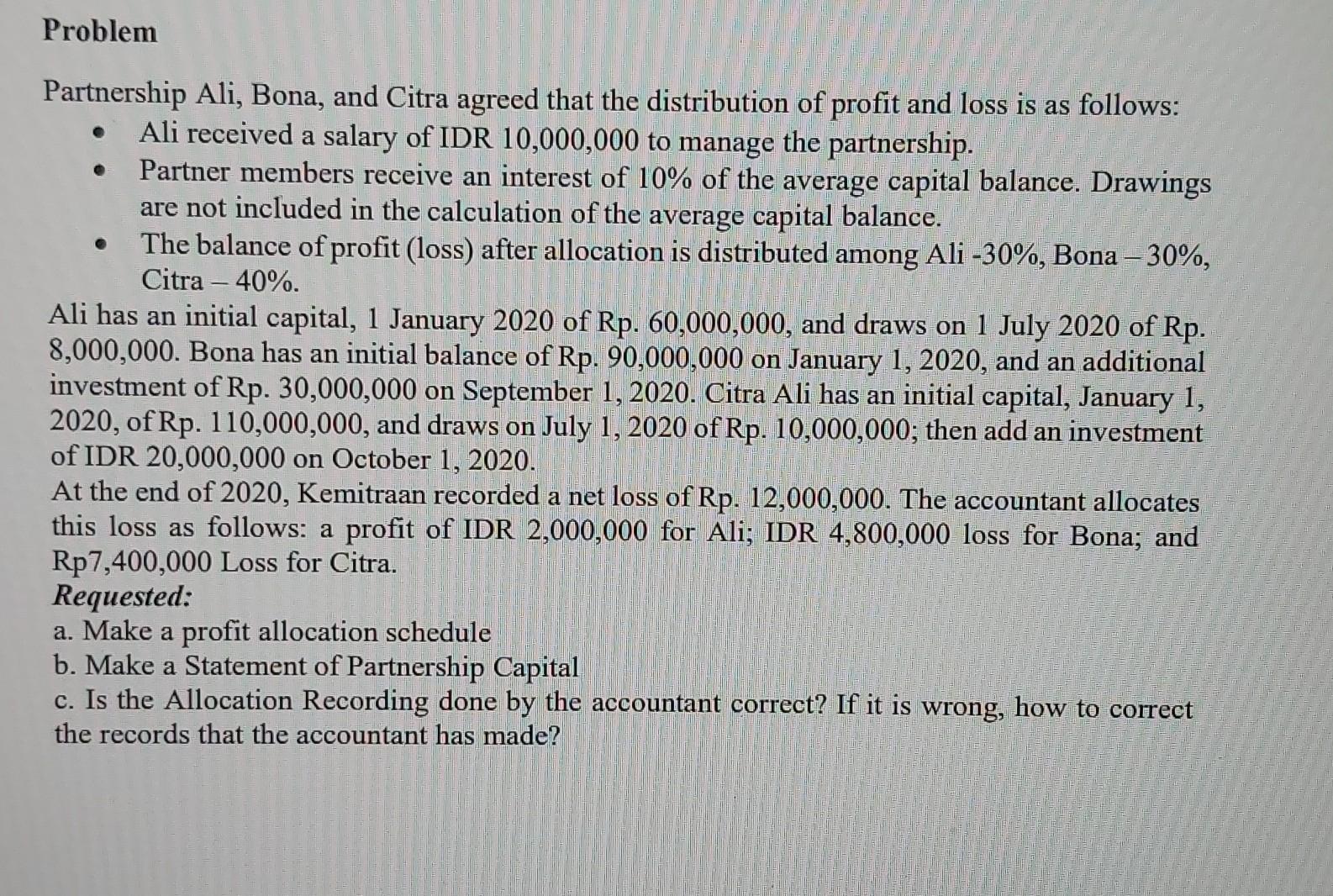

Problem Partnership Ali, Bona, and Citra agreed that the distribution of profit and loss is as follows: Ali received a salary of IDR 10,000,000 to manage the partnership. Partner members receive an interest of 10% of the average capital balance. Drawings are not included in the calculation of the average capital balance. The balance of profit (loss) after allocation is distributed among Ali -30%, Bona - 30%, Citra - 40%. Ali has an initial capital, 1 January 2020 of Rp. 60,000,000, and draws on 1 July 2020 of Rp. 8,000,000. Bona has an initial balance of Rp. 90,000,000 on January 1, 2020, and an additional investment of Rp. 30,000,000 on September 1, 2020. Citra Ali has an initial capital, January 1, 2020, of Rp. 110,000,000, and draws on July 1, 2020 of Rp. 10,000,000; then add an investment of IDR 20,000,000 on October 1, 2020. At the end of 2020, Kemitraan recorded a net loss of Rp. 12,000,000. The accountant allocates this loss as follows: a profit of IDR 2,000,000 for Ali; IDR 4,800,000 loss for Bona; and Rp7,400,000 Loss for Citra. Requested: a. Make a profit allocation schedule b. Make a Statement of Partnership Capital c. Is the Allocation Recording done by the accountant correct? If it is wrong, how to correct the records that the accountant has made?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution 10V Case1 Consider loop ABGH Apply KVL 10 211 411 106141 Consider loop BCFG 1261213 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started