Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For many years, Egghead has owned 25% of Beaver Company and exhibited significant influence. On December 31, 2023, Egghead reported Equity Investment in Beaver of

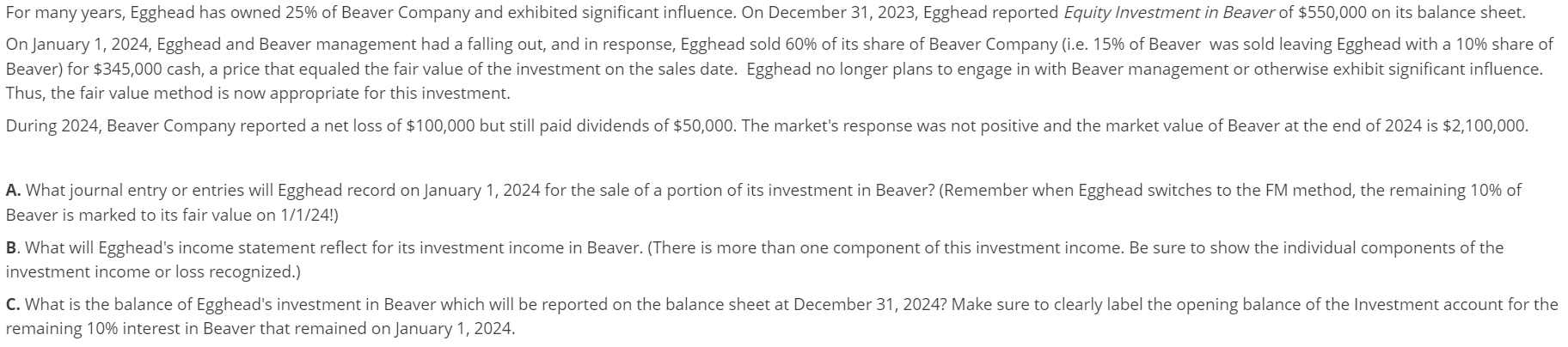

For many years, Egghead has owned 25% of Beaver Company and exhibited significant influence. On December 31, 2023, Egghead reported Equity Investment in Beaver of $550,000 on its balance sheet. On January 1, 2024, Egghead and Beaver management had a falling out, and in response, Egghead sold 60\% of its share of Beaver Company (i.e. 15\% of Beaver was sold leaving Egghead with a 10\% share of Beaver) for $345,000 cash, a price that equaled the fair value of the investment on the sales date. Egghead no longer plans to engage in with Beaver management or otherwise exhibit significant influence. Thus, the fair value method is now appropriate for this investment. During 2024, Beaver Company reported a net loss of $100,000 but still paid dividends of $50,000. The market's response was not positive and the market value of Beaver at the end of 2024 is $2,100,000. A. What journal entry or entries will Egghead record on January 1, 2024 for the sale of a portion of its investment in Beaver? (Remember when Egghead switches to the FM method, the remaining 10\% of Beaver is marked to its fair value on 1/1/24!) 3. What will Egghead's income statement reflect for its investment income in Beaver. (There is more than one component of this investment income. Be sure to show the individual components of the nvestment income or loss recognized.) C. What is the balance of Egghead's investment in Beaver which will be reported on the balance sheet at December 31, 2024? Make sure to clearly label the opening balance of the Investment account for the emaining 10\% interest in Beaver that remained on January 1, 2024

For many years, Egghead has owned 25% of Beaver Company and exhibited significant influence. On December 31, 2023, Egghead reported Equity Investment in Beaver of $550,000 on its balance sheet. On January 1, 2024, Egghead and Beaver management had a falling out, and in response, Egghead sold 60\% of its share of Beaver Company (i.e. 15\% of Beaver was sold leaving Egghead with a 10\% share of Beaver) for $345,000 cash, a price that equaled the fair value of the investment on the sales date. Egghead no longer plans to engage in with Beaver management or otherwise exhibit significant influence. Thus, the fair value method is now appropriate for this investment. During 2024, Beaver Company reported a net loss of $100,000 but still paid dividends of $50,000. The market's response was not positive and the market value of Beaver at the end of 2024 is $2,100,000. A. What journal entry or entries will Egghead record on January 1, 2024 for the sale of a portion of its investment in Beaver? (Remember when Egghead switches to the FM method, the remaining 10\% of Beaver is marked to its fair value on 1/1/24!) 3. What will Egghead's income statement reflect for its investment income in Beaver. (There is more than one component of this investment income. Be sure to show the individual components of the nvestment income or loss recognized.) C. What is the balance of Egghead's investment in Beaver which will be reported on the balance sheet at December 31, 2024? Make sure to clearly label the opening balance of the Investment account for the emaining 10\% interest in Beaver that remained on January 1, 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started