Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For many years Joseph paid someone else to file his income tax return. After taking a personal finance course at his local college, Joseph feels

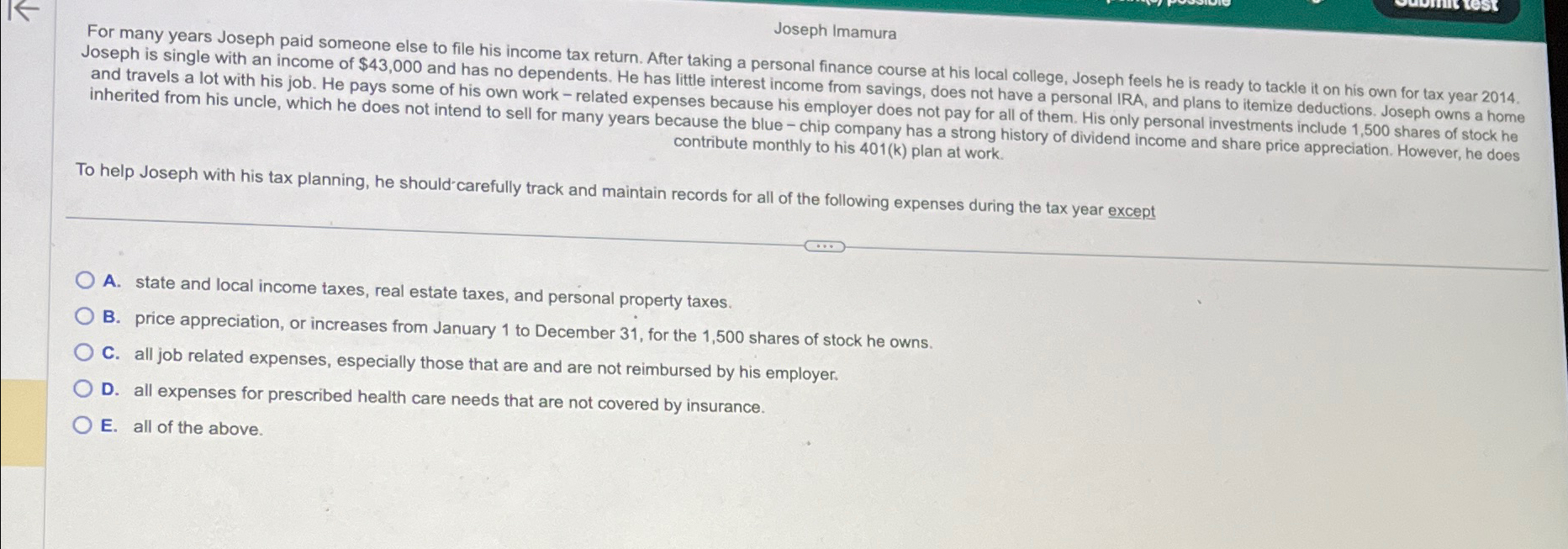

For many years Joseph paid someone else to file his income tax return. After taking a personal finance course at his local college, Joseph feels he is ready to tackle it on his own for tax year Joseph is single with an income of $ and has no dependents. He has little interest income from savings, does not have a personal IRA, and plans to itemize deductions. Joseph owns a home and travels a lot with his job. He pays some of his own work related expenses because his employer does not pay for all of them. His only personal investments include shares of stock he contribute monthly to his plan at work.

To help Joseph with his tax planning, he should carefully track and maintain records for all of the following expenses during the tax year except

A state and local income taxes, real estate taxes, and personal property taxes.

B price appreciation, or increases from January to December for the shares of stock he owns.

C all job related expenses, especially those that are and are not reimbursed by his employer.

D all expenses for prescribed health care needs that are not covered by insurance.

E all of the above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started