Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For May and June, find: Direct Labor Hours and difference between $DL incurred vs $DL paiddue to 1500 restriction Wages Paid (in $$) PLEASE SHOW

- For May and June, find:

- Direct Labor Hours and difference between $DL incurred vs $DL paiddue to 1500 restriction

- Wages Paid (in $$)

PLEASE SHOW ALL WORK

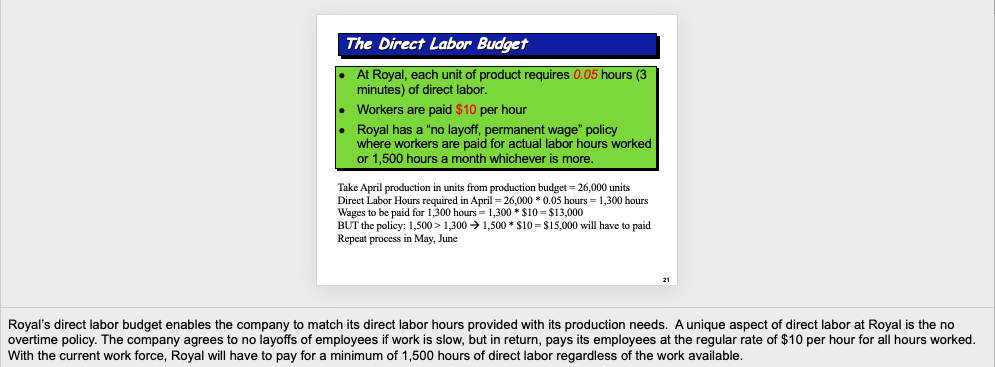

The Direct Labor Budget At Royal, each unit of product requires 0.05 hours (3 minutes) of direct labor. Workers are paid $10 per hour Royal has a "no layoff, permanent wage" policy where workers are paid for actual labor hours worked or 1,500 hours a month whichever is more. Take April production in units from production budget = 26,000 units Direct Labor Hours required in April = 26,000 * 0.05 hours = 1,300 hours Wages to be paid for 1,300 hours = 1,300 * $10 = $13,000 BUT the policy: 1,500 > 1,300 1,500 * $10 = $15,000 will have to paid Repeat process in May, June Royal's direct labor budget enables the company to match its direct labor hours provided with its production needs. A unique aspect of direct labor at Royal is the no overtime policy. The company agrees to no layoffs of employees if work is slow, but in return, pays its employees at the regular rate of $10 per hour for all hours worked. With the current work force, Royal will have to pay for a minimum of 1,500 hours of direct labor regardless of the work availableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started