For my original calculations I got the following ratios wrong, I included my original formulas and calculations that I got.

- Total asset ratio:

| 2013 | 2014 | 2015 |

| 365/ account receivable turnover ratio | | |

| 5.09 days | 5.12 Days | 5.01 Days |

Account receivable turnover ratio

| 2013 | 2014 | 2015 |

| Net sales/ account receivable | | |

| 71.65 | 71.33 | 72.83 |

debt ratio

| 2013 | 2014 | 2015 |

| long term + short term debt / liabilities | | |

| 0.25 | 0.28 | 0.29 |

debt to equity ratio

| 2013 | 2014 | 2015 |

| long term + short term debt / equity | | |

| 0.62 | 0.73 | 0.9 |

operating profit margin

| 2013 | 2014 | 2015 |

| earnings before interest & taxes / sales | | |

| 5% | 5% | 7% |

Below I included the info sheet used to find these calculations, please help me find the correct calculations for the following equations

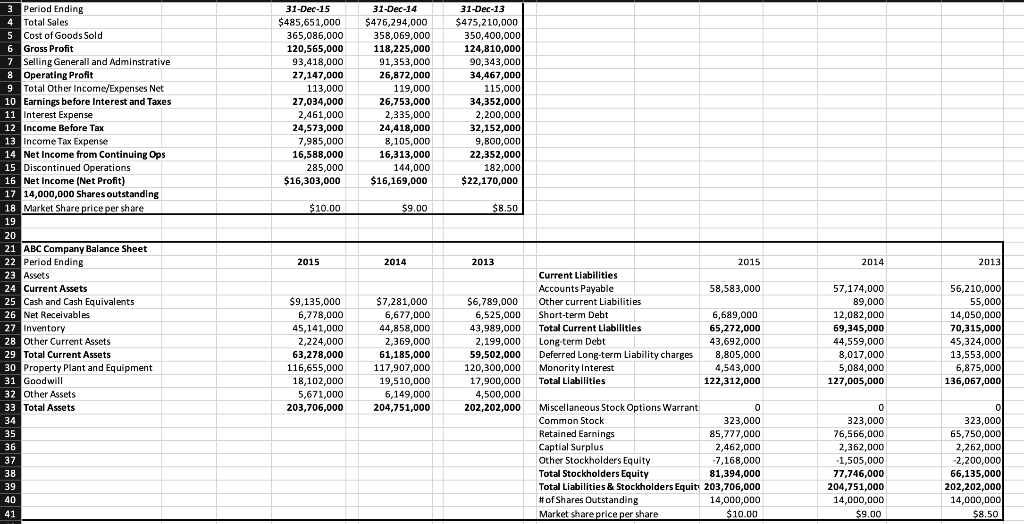

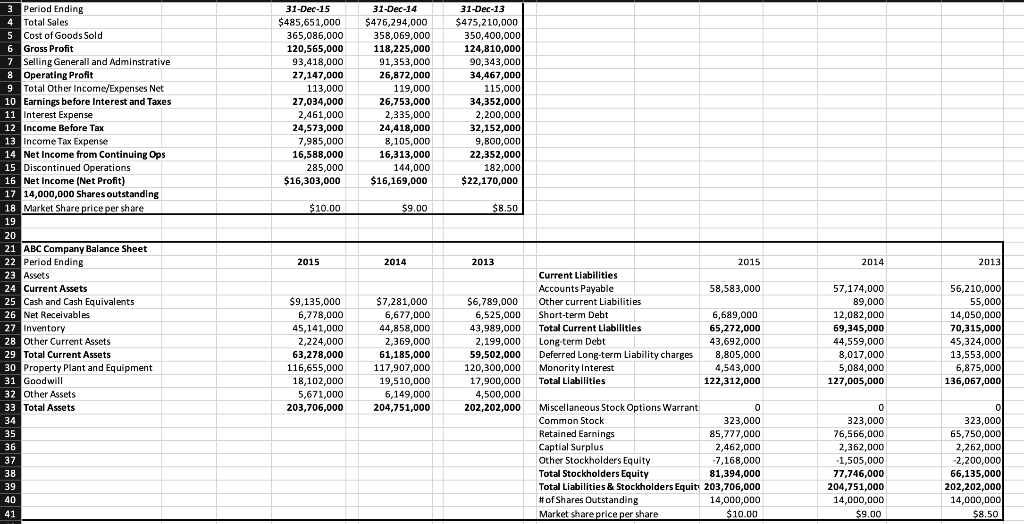

3 Period Ending 4 Total Sales 5 Cost of Goods Sold 6 Gross Profit 7 Selling Generall and Adminstrative 8 Operating Profit 9 Total Other Income/Expenses Net 10 Earnings before Interest and Taxes 11 Interest Expense 12 Income Before Tax 13 Income Tax Expense 14 Net Income from Continuing Ops 15 Discontinued Operations 16 Net Income (Net Profit) 17 14,000,000 Shares outstanding 18 Market Share price per share 19 20 21 ABC Company Balance Sheet 22 Period Ending 23 Assets 24 Current Assets 25 Cash and Cash Equivalents 26 Net Receivables 27 Inventory 28 Other Current Assets 29 Total Current Assets 30 Property Plant and Equipment 31 Goodwill 32 Other Assets 33 Total Assets 34 35 36 37 38 39 40 41 31-Dec-15 $485,651,000 365,086,000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 $10.00 2015 $9,135,000 6,778,000 45,141,000 2,224,000 63,278.000 116,655,000 18,102,000 5,671,000 203,706,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 $9.00 2014 $7,281,000 6,677,000 44,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 31-Dec-13 $475,210,000 350,400,000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352.000 182,000 $22,170,000 $8.50 2013 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 2015 Current Liabilities Accounts Payable 58,583,000 Other current Liabilities. Short-term Debt 6,689,000 65,272,000 Total Current Liabilities Long-term Debt 43,692,000 Deferred Long-term Liability charges 8,805,000 4,543,000 Monority Interest Total Liabilities 122,312,000 Miscellaneous Stock Options Warrant 0 Common Stock 323,000 Retained Earnings 85,777,000 Captial Surplus 2,462,000 Other Stockholders Equity -7,168,000 Total Stockholders Equity 81,394,000 Total Liabilities & Stockholders Equity 203,706,000 14,000,000 # of Shares Outstanding Market share price per share $10.00 2014 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 2013 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 0 323,000 65,750,000 2,262,000 -2,200,000 66,135.000 202,202,000 14,000,000 $8.50 3 Period Ending 4 Total Sales 5 Cost of Goods Sold 6 Gross Profit 7 Selling Generall and Adminstrative 8 Operating Profit 9 Total Other Income/Expenses Net 10 Earnings before Interest and Taxes 11 Interest Expense 12 Income Before Tax 13 Income Tax Expense 14 Net Income from Continuing Ops 15 Discontinued Operations 16 Net Income (Net Profit) 17 14,000,000 Shares outstanding 18 Market Share price per share 19 20 21 ABC Company Balance Sheet 22 Period Ending 23 Assets 24 Current Assets 25 Cash and Cash Equivalents 26 Net Receivables 27 Inventory 28 Other Current Assets 29 Total Current Assets 30 Property Plant and Equipment 31 Goodwill 32 Other Assets 33 Total Assets 34 35 36 37 38 39 40 41 31-Dec-15 $485,651,000 365,086,000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 $10.00 2015 $9,135,000 6,778,000 45,141,000 2,224,000 63,278.000 116,655,000 18,102,000 5,671,000 203,706,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 $9.00 2014 $7,281,000 6,677,000 44,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 31-Dec-13 $475,210,000 350,400,000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352.000 182,000 $22,170,000 $8.50 2013 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 2015 Current Liabilities Accounts Payable 58,583,000 Other current Liabilities. Short-term Debt 6,689,000 65,272,000 Total Current Liabilities Long-term Debt 43,692,000 Deferred Long-term Liability charges 8,805,000 4,543,000 Monority Interest Total Liabilities 122,312,000 Miscellaneous Stock Options Warrant 0 Common Stock 323,000 Retained Earnings 85,777,000 Captial Surplus 2,462,000 Other Stockholders Equity -7,168,000 Total Stockholders Equity 81,394,000 Total Liabilities & Stockholders Equity 203,706,000 14,000,000 # of Shares Outstanding Market share price per share $10.00 2014 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 2013 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 0 323,000 65,750,000 2,262,000 -2,200,000 66,135.000 202,202,000 14,000,000 $8.50