Question

For our Accounting assignment we are going to focus on ratios and comparing companies. Your investment company (i.e. your group) is looking to get into

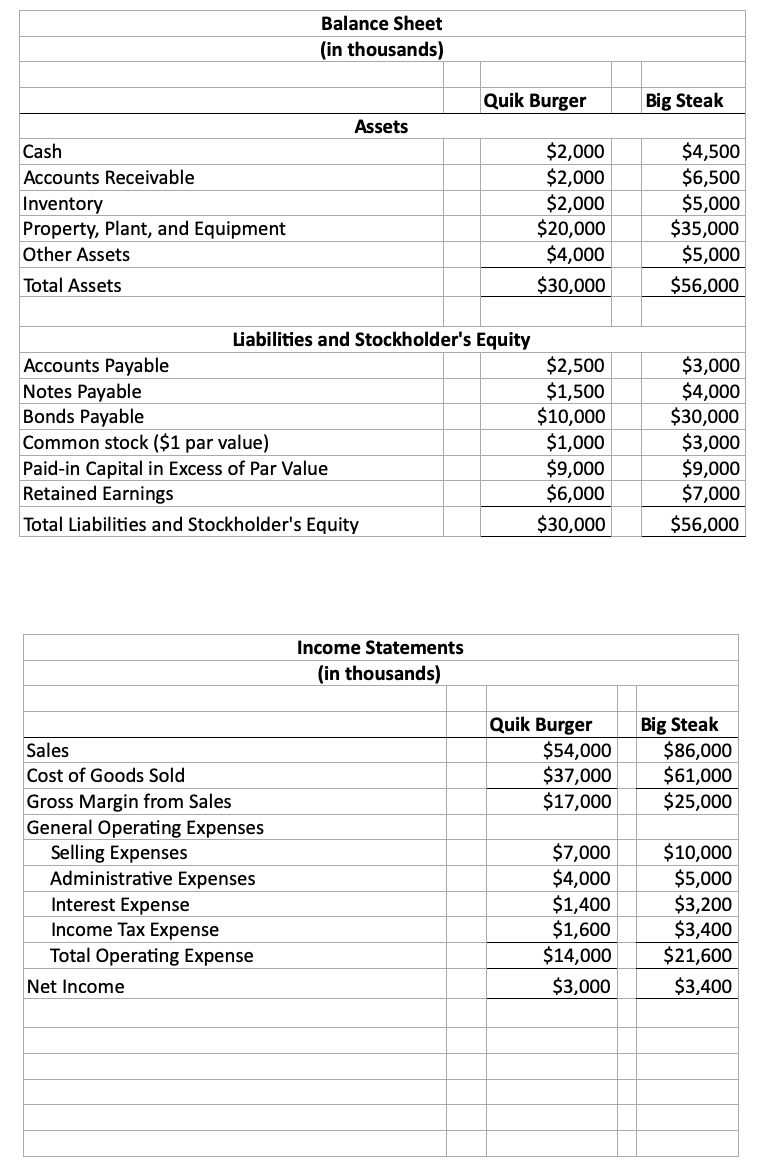

For our Accounting assignment we are going to focus on ratios and comparing companies. Your investment company (i.e. your group) is looking to get into the fast casual market and you have narrowed the contenders down to two. The attached spreadsheet has information on QuickBurger (QB) and BigSteak (BS), your two candidates.

For our Accounting assignment we are going to focus on ratios and comparing companies. Your investment company (i.e. your group) is looking to get into the fast casual market and you have narrowed the contenders down to two. The attached spreadsheet has information on QuickBurger (QB) and BigSteak (BS), your two candidates.

Now I know in real life this decision would be much more complex, but go with the story for now.

Part 1:

The first tab in the spreadsheet is a table that you need to fill out (all except the 2019 column). Calculate the given ratios for the two restaurants and compare them to see which is the more favorable.

A couple notes:

a) stock price: QB: $35, BS: $20.

b) Profit margin is Net Income / Sales (Revenue)

c) Assume that Bonds and Property, Plant and Equipment are long term categories.

d) Shares outstanding would be Common Stock / par value. And in this case par value is $1.

Q1) Which restaurant would you invest in and why?

Part 2:

The power of ratios is in comparison. As a stand alone number they don't tell us anything. In part 1 we used them to compare two businesses. In part 2 we are going to use them to make comparison over time.

Assume you are QB. For the four data points given for 2019, compare the ratio you calculated with the information given.

Q2) What does the change in each ratio over time say about the financial stance of the business. That is, what does each change mean to the business and what is the possible cause / impact.

| Ratio Analysis | ||||||

| Ratio name | QB | BS | Favorable? | 2019 | ||

| Liquidity Analysis | ||||||

| Current ratio | 1.2 | |||||

| Quick ratio | ||||||

| Profitabilty Analysis | ||||||

| Profit Margin | 11.50% | |||||

| Return on Assets | 4.96% | |||||

| Earnings per Share | ||||||

| Price/Earnings ratio | ||||||

| Solvency Analysis | ||||||

| Debt to equity ratio | 2.85% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started