Answered step by step

Verified Expert Solution

Question

1 Approved Answer

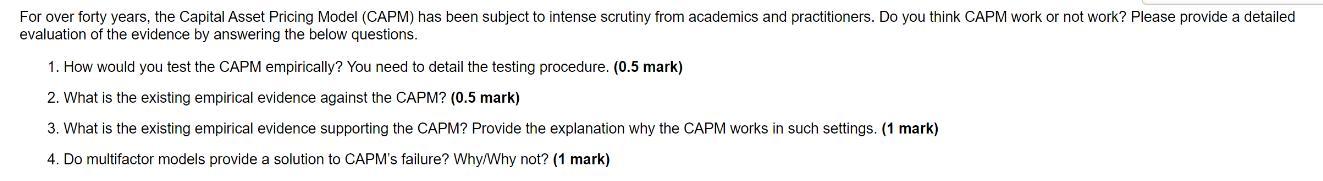

For over forty years, the Capital Asset Pricing Model (CAPM) has been subject to intense scrutiny from academics and practitioners. Do you think CAPM

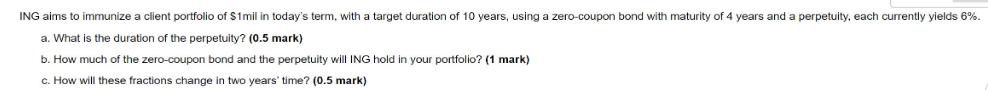

For over forty years, the Capital Asset Pricing Model (CAPM) has been subject to intense scrutiny from academics and practitioners. Do you think CAPM work or not work? Please provide a detailed evaluation of the evidence by answering the below questions. 1. How would you test the CAPM empirically? You need to detail the testing procedure. (0.5 mark) 2. What is the existing empirical evidence against the CAPM? (0.5 mark) 3. What is the existing empirical evidence supporting the CAPM? Provide the explanation why the CAPM works in such settings. (1 mark) 4. Do multifactor models provide a solution to CAPM's failure? Why/Why not? (1 mark) ING aims to immunize a client portfolio of $1mil in today's term, with a target duration of 10 years, using a zero-coupon bond with maturity of 4 years and a perpetuity, each currently yields 6%. a. What is the duration of the perpetuity? (0.5 mark) b. How much of the zero-coupon bond and the perpetuity will ING hold in your portfolio? (1 mark) c. How will these fractions change in two years' time? (0.5 mark)

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 To empirically test the CAPM one would follow these steps13 a Define the lefthandside assets which are the securities or portfolios for which expect...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started