Answered step by step

Verified Expert Solution

Question

1 Approved Answer

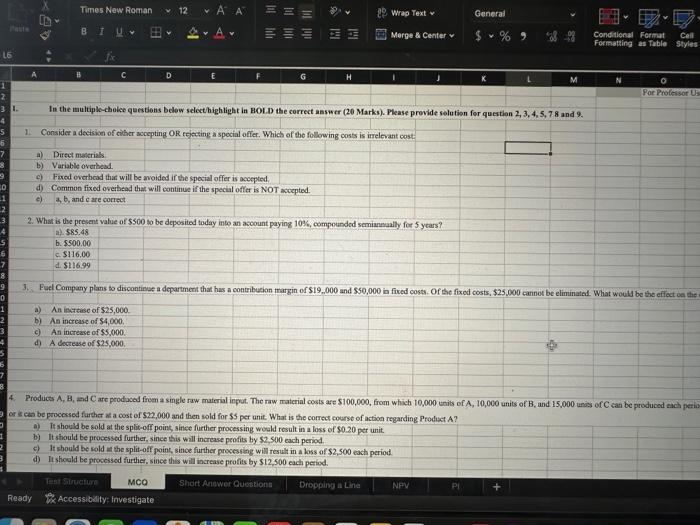

For Professor Use Only I. In the multiple-choice questions below select/highlight in BOLD the correct answer (20 Marks). Please provide solution for question 2, 3,

| For Professor Use Only | |||||||||||||||||||||

| I. In the multiple-choice questions below select/highlight in BOLD the correct answer (20 Marks). Please provide solution for question 2, 3, 4, 5, 7 8 and 9. | |||||||||||||||||||||

| 1. Consider a decision of either accepting OR rejecting a special offer. Which of the following costs is irrelevant cost: | |||||||||||||||||||||

| a) Direct materials. | |||||||||||||||||||||

| b) Variable overhead. | |||||||||||||||||||||

| c) Fixed overhead that will be avoided if the special offer is accepted. | |||||||||||||||||||||

| d) Common fixed overhead that will continue if the special offer is NOT accepted. | |||||||||||||||||||||

| e) | a, b, and c are correct | ||||||||||||||||||||

| 2. What is the present value of $500 to be deposited today into an account paying 10%, compounded semiannually for 5 years? | |||||||||||||||||||||

| a). $85.48 | |||||||||||||||||||||

| b. $500.00 | |||||||||||||||||||||

| c. $116.00 | |||||||||||||||||||||

| d. $116.99 | |||||||||||||||||||||

| 3. Fuel Company plans to discontinue a department that has a contribution margin of $19,,000 and $50,000 in fixed costs. Of the fixed costs, $25,000 cannot be eliminated. What would be the effect on the operating income of Manor Company of discontinuing this department? | |||||||||||||||||||||

| a) An increase of $25,000. | |||||||||||||||||||||

| b) An increase of $4,000. | |||||||||||||||||||||

| c) An increase of $5,000. | |||||||||||||||||||||

| d) A decrease of $25,000. | |||||||||||||||||||||

| 4. Products A, B, and C are produced from a single raw material input. The raw material costs are $100,000, from which 10,000 units of A, 10,000 units of B, and 15,000 units of C can be produced each period. Product A can be sold at the split-off point for $3 per unit, or it can be processed further at a cost of $22,000 and then sold for $5 per unit. What is the correct course of action regarding Product A? | |||||||||||||||||||||

| a) It should be sold at the split-off point, since further processing would result in a loss of $0.20 per unit. | |||||||||||||||||||||

| b) It should be processed further, since this will increase profits by $2,500 each period. | |||||||||||||||||||||

| c) It should be sold at the split-off point, since further processing will result in a loss of $2,500 each period. | |||||||||||||||||||||

| d) It should be processed further, since this will increase profits by $12,500 each period. | |||||||||||||||||||||

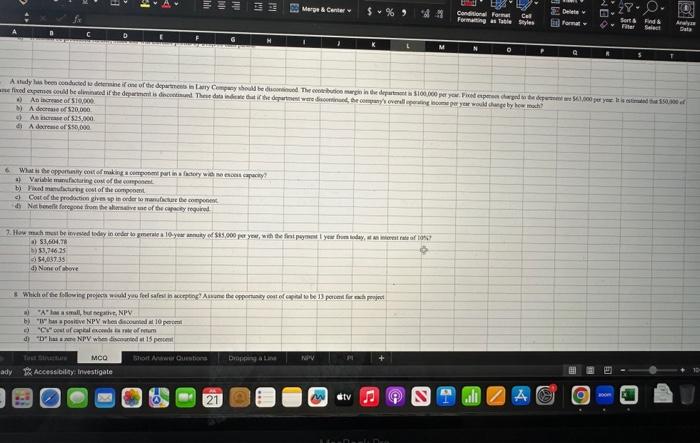

| 5. A study has been conducted to determine if one of the departments in Larry Company should be discontinued. The contribution margin in the department is $100,000 per year. Fixed expenses charged to the department are $63,000 per year. It is estimated that $50,000 of these fixed expenses could be eliminated if the department is discontinued. These data indicate that if the department were discontinued, the company's overall operating income per year would change by how much? | |||||||||||||||||||||

| a) An increase of $10,000. | |||||||||||||||||||||

| b) A decrease of $20,000. | |||||||||||||||||||||

| c) An increase of $25,000. | |||||||||||||||||||||

| d) A decrease of $50,000. | |||||||||||||||||||||

| 6. What is the opportunity cost of making a component part in a factory with no excess capacity? | |||||||||||||||||||||

| a) Variable manufacturing cost of the component. | |||||||||||||||||||||

| b) Fixed manufacturing cost of the component. | |||||||||||||||||||||

| c) Cost of the production given up in order to manufacture the component. | |||||||||||||||||||||

| d) Net benefit foregone from the alternative use of the capacity required. | |||||||||||||||||||||

| 7. How much must be invested today in order to generate a 10-year annuity of $85,000 per year, with the first payment 1 year from today, at an interest rate of 10%? | |||||||||||||||||||||

| a) $3,604.78 | |||||||||||||||||||||

| b) $3,746.25 | |||||||||||||||||||||

| c) $4,037.35 | |||||||||||||||||||||

| d) None of above | |||||||||||||||||||||

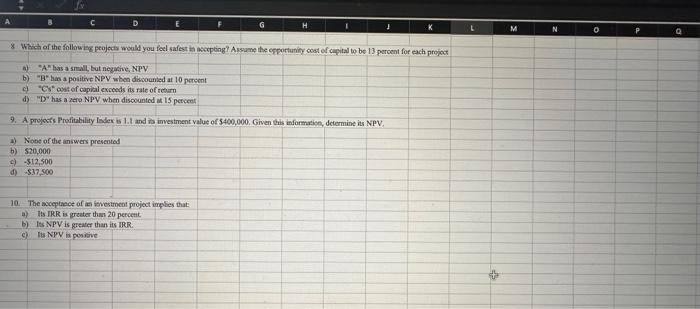

| 8 Which of the following projects would you feel safest in accepting? Assume the opportunity cost of capital to be 13 percent for each project | |||||||||||||||||||||

| a) "A" has a small, but negative, NPV | |||||||||||||||||||||

| b) "B" has a positive NPV when discounted at 10 percent | |||||||||||||||||||||

| c) "C's" cost of capital exceeds its rate of return | |||||||||||||||||||||

| d) "D" has a zero NPV when discounted at 15 percent | |||||||||||||||||||||

| 9. A project's Profitability Index is 1.1 and its investment value of $400,000. Given this information, determine its NPV. | |||||||||||||||||||||

| a) None of the answers presented | |||||||||||||||||||||

| b) $20,000 | |||||||||||||||||||||

| c) -$12,500 | |||||||||||||||||||||

| d) -$37,500 | |||||||||||||||||||||

| 10. The acceptance of an investment project implies that: | |||||||||||||||||||||

| a) Its IRR is greater than 20 percent. | |||||||||||||||||||||

| b) Its NPV is greater than its IRR. | |||||||||||||||||||||

| c) Its NPV is positive | |||||||||||||||||||||

solutions

solutions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started