Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for purposes of determining the marital deduction the total value of the property passing to the surviving spouse must be reduce by. a. generation skipping

for purposes of determining the marital deduction the total value of the property passing to the surviving spouse must be reduce by.

a. generation skipping transfer and federal estatebtaxnpaid out of the martial share. b. generation skipping transfer tax paid out of the marital share. c. federal estate tax paid out of the marital share d. federal estate tax paid out of the total estate.

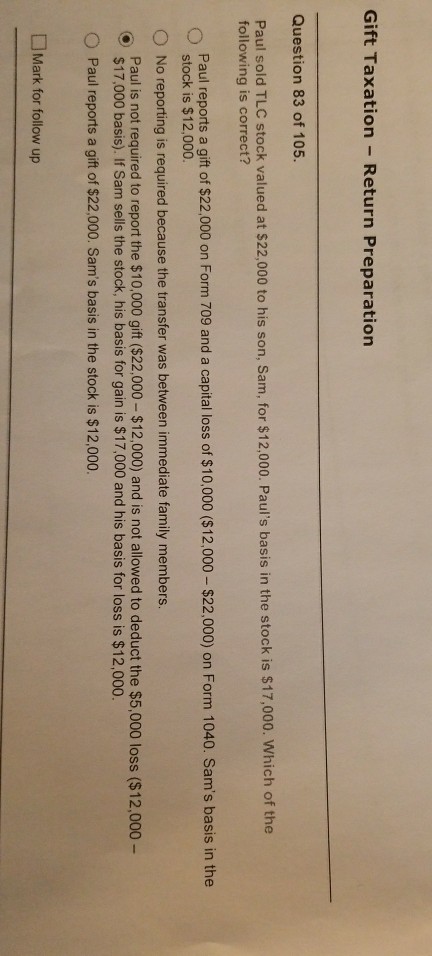

Gift Taxation - Return Preparation Question 83 of 105. Paul sold TLC stock valued at $22,000 to his son, Sam, for $12,000. Paul's basis in the stock is $17,000. Which of the following is correct? Paul reports a gift of $22,000 on Form 709 and a capital loss of $10,000 ($12,000 - $22,000) on Form 1040. Sam's basis in the stock is $12,000. O No reporting is required because the transfer was between immediate family members. Paul is not required to report the $10,000 gift ($22,000- $12,000) and is not allowed to deduct the $5,000 loss ($12,000- $17,000 basis). If Sam sells the stock, his basis for gain is $17,000 and his basis for loss is $12,000. O Paul reports a gift of $22,000. Sam's basis in the stock is $12,000. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started