Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Five unrelated U.S. individuals own all of the shares of Popping, a corporation organized and operating fully in the country of Vivace. Mariam, one

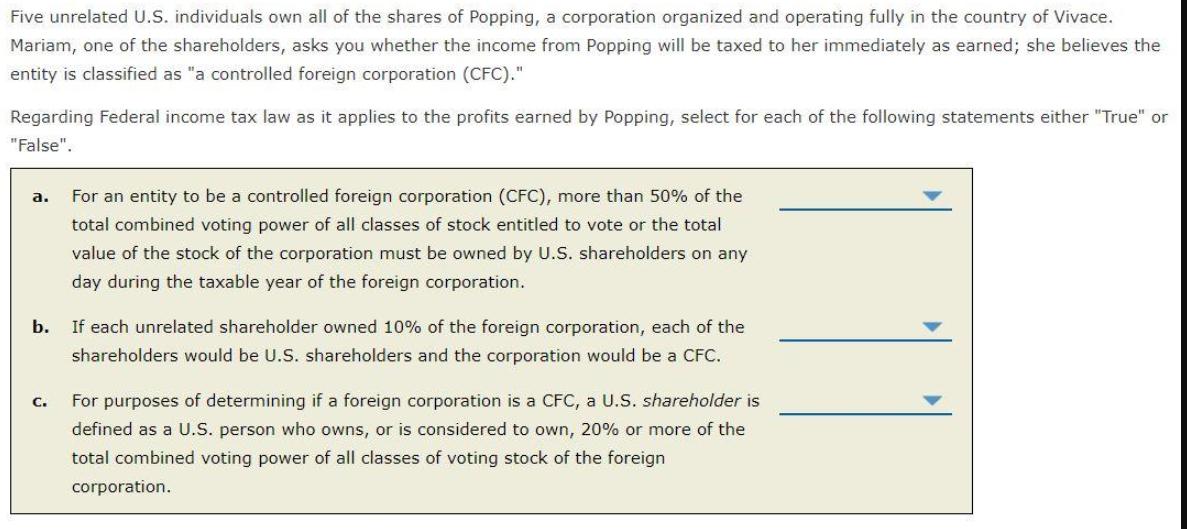

Five unrelated U.S. individuals own all of the shares of Popping, a corporation organized and operating fully in the country of Vivace. Mariam, one of the shareholders, asks you whether the income from Popping will be taxed to her immediately as earned; she believes the entity is classified as "a controlled foreign corporation (CFC)." Regarding Federal income tax law as it applies to the profits earned by Popping, select for each of the following statements either "True" or "False". . For an entity to be a controlled foreign corporation (CFC), more than 50% of the total combined voting power of all classes of stock entitled to vote or the total value of the stock of the corporation must be owned by U.S. shareholders on any day during the taxable year of the foreign corporation. b. If each unrelated shareholder owned 10% of the foreign corporation, each of the shareholders would be U.S. shareholders and the corporation would be a CFC. For purposes of determining if a foreign corporation is a CFC, a U.S. shareholder is C. defined as a U.S. person who owns, or is considered to own, 20% or more of the total combined voting power of all classes of voting stock of the foreign corporation.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A TRUE BFALSE reasoning As per IRS section 957a read alon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d685643205_175306.pdf

180 KBs PDF File

635d685643205_175306.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started