Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Medium Plc purchased a plant at a cost of Rs.100 Mn on 1 April 2011.At the date of acquisition it was decided to depreciate

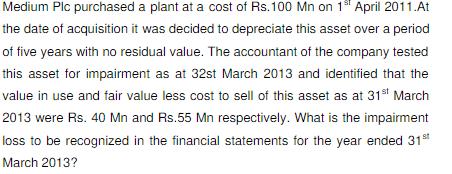

Medium Plc purchased a plant at a cost of Rs.100 Mn on 1 April 2011.At the date of acquisition it was decided to depreciate this asset over a period of five years with no residual value. The accountant of the company tested this asset for impairment as at 32st March 2013 and identified that the value in use and fair value less cost to sell of this asset as at 31st March 2013 were Rs. 40 Mn and Rs.55 Mn respectively. What is the impairment loss to be recognized in the financial statements for the year ended 31st March 2013?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The impairment loss to be recognized in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d685fb84aa_175307.pdf

180 KBs PDF File

635d685fb84aa_175307.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started