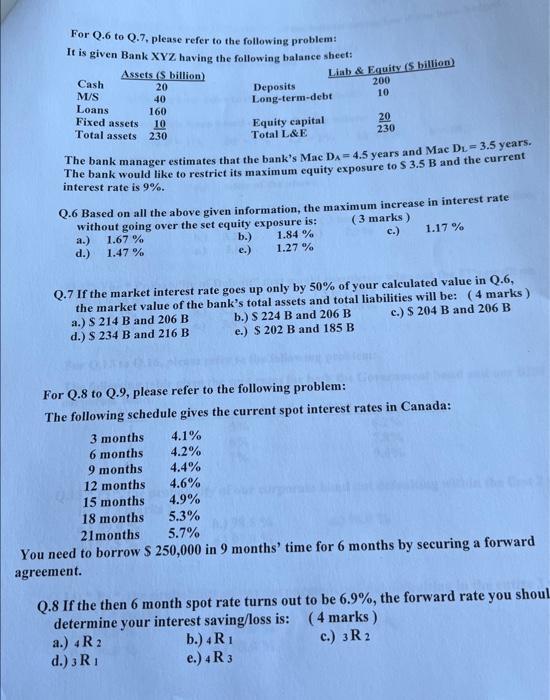

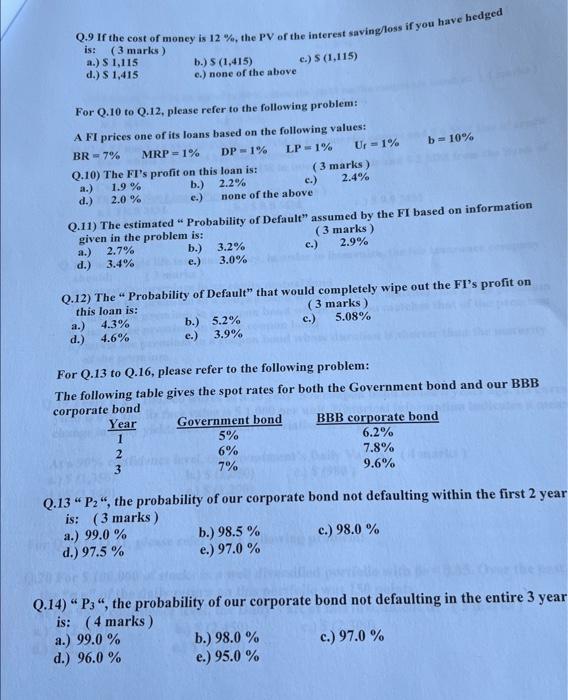

For Q.6 to Q.7, please refer to the following problem: It is given Bank XYZ having the following balance sheet: The bank manager estimates that the bank's Mac DA=4.5 years and Mac DL=3.5 years. The bank would like to restrict its maximum equity exposure to $3.5B and the current interest rate is 9%. Q.6 Based on all the above given information, the maximum increase in interest rate without going over the set equity exposure is: a.) 1.67% b.) 1.84% (3 marks) d.) 1.47% c.) 1.17% Q.7 If the market interest rate goes up only by 50% of your calculated value in Q.6, the market value of the bank's total assets and total liabilities will be: ( 4 marks) a.) $214B and 206B b.) $224B and 206B c.) $204B and 206B d.) $234B and 216B e.) $202B and 185B For Q.8 to Q.9, please refer to the following problem: The following schedule gives the current spot interest rates in Canada: 3months6months9months12months15months18months21months4.1%4.2%4.4%4.6%4.9%5.3%5.7% You need to borrow $250,000 in 9 months' time for 6 months by securing a forward agreement. Q.8 If the then 6 month spot rate turns out to be 6.9%, the forward rate you shoul determine your interest saving/loss is: ( 4 marks) a.) 4R2 b.) 4R1 c.) 3R2 d.) 3R1 e. 4R3 Q.9 If the cost of money is 12%, the PV of the interest savingloss if you have hedged is: ( 3 marks) a.) $1,115 b.) 5(1,415) c.) $(1,115) di) S1,415 c.) none of the above For Q.10 to Q.12, please refer to the following problem: A FI prices one of its Joans based on the following values: BR =7%MRP=1%DP=1%LP=1%Ur=1%b=10% Q.10) The FI's a.) 1.9% d.) 2.0% b.) 2.2% b.) 2.2% none of the above Q.11) The estimated "Probability of Default" assumed by the FI based on information given in the problem is: a.) 2.7% b.) 3.2% (3 marks) d.) 3.4% e.) 3.0% Q.12) The "Probability of Default" that would completely wipe out the FI's profit on this loan is: a.) 4.3% b.) 5.2% (3 marks) d.) 4.6% e.) 3.9% c.) 5.08% For Q.13 to Q.16, please refer to the following problem: The following table gives the spot rates for both the Government bond and our BBB Q.13 " P2 ", the probability of our corporate bond not defaulting within the first 2 year is: (3 marks) a.) 99.0% b.) 98.5% c.) 98.0% d.) 97.5% e.) 97.0% Q.14) " P3 ", the probability of our corporate bond not defaulting in the entire 3 year is: ( 4 marks) a.) 99.0% b.) 98.0% c.) 97.0% d.) 96.0% e.) 95.0% For Q.6 to Q.7, please refer to the following problem: It is given Bank XYZ having the following balance sheet: The bank manager estimates that the bank's Mac DA=4.5 years and Mac DL=3.5 years. The bank would like to restrict its maximum equity exposure to $3.5B and the current interest rate is 9%. Q.6 Based on all the above given information, the maximum increase in interest rate without going over the set equity exposure is: a.) 1.67% b.) 1.84% (3 marks) d.) 1.47% c.) 1.17% Q.7 If the market interest rate goes up only by 50% of your calculated value in Q.6, the market value of the bank's total assets and total liabilities will be: ( 4 marks) a.) $214B and 206B b.) $224B and 206B c.) $204B and 206B d.) $234B and 216B e.) $202B and 185B For Q.8 to Q.9, please refer to the following problem: The following schedule gives the current spot interest rates in Canada: 3months6months9months12months15months18months21months4.1%4.2%4.4%4.6%4.9%5.3%5.7% You need to borrow $250,000 in 9 months' time for 6 months by securing a forward agreement. Q.8 If the then 6 month spot rate turns out to be 6.9%, the forward rate you shoul determine your interest saving/loss is: ( 4 marks) a.) 4R2 b.) 4R1 c.) 3R2 d.) 3R1 e. 4R3 Q.9 If the cost of money is 12%, the PV of the interest savingloss if you have hedged is: ( 3 marks) a.) $1,115 b.) 5(1,415) c.) $(1,115) di) S1,415 c.) none of the above For Q.10 to Q.12, please refer to the following problem: A FI prices one of its Joans based on the following values: BR =7%MRP=1%DP=1%LP=1%Ur=1%b=10% Q.10) The FI's a.) 1.9% d.) 2.0% b.) 2.2% b.) 2.2% none of the above Q.11) The estimated "Probability of Default" assumed by the FI based on information given in the problem is: a.) 2.7% b.) 3.2% (3 marks) d.) 3.4% e.) 3.0% Q.12) The "Probability of Default" that would completely wipe out the FI's profit on this loan is: a.) 4.3% b.) 5.2% (3 marks) d.) 4.6% e.) 3.9% c.) 5.08% For Q.13 to Q.16, please refer to the following problem: The following table gives the spot rates for both the Government bond and our BBB Q.13 " P2 ", the probability of our corporate bond not defaulting within the first 2 year is: (3 marks) a.) 99.0% b.) 98.5% c.) 98.0% d.) 97.5% e.) 97.0% Q.14) " P3 ", the probability of our corporate bond not defaulting in the entire 3 year is: ( 4 marks) a.) 99.0% b.) 98.0% c.) 97.0% d.) 96.0% e.) 95.0%