Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For questions 1 - 9: A recent university graduate is purchasing a new Honda Civic LX Sedan for $20,345, which includes destination and handling charges.

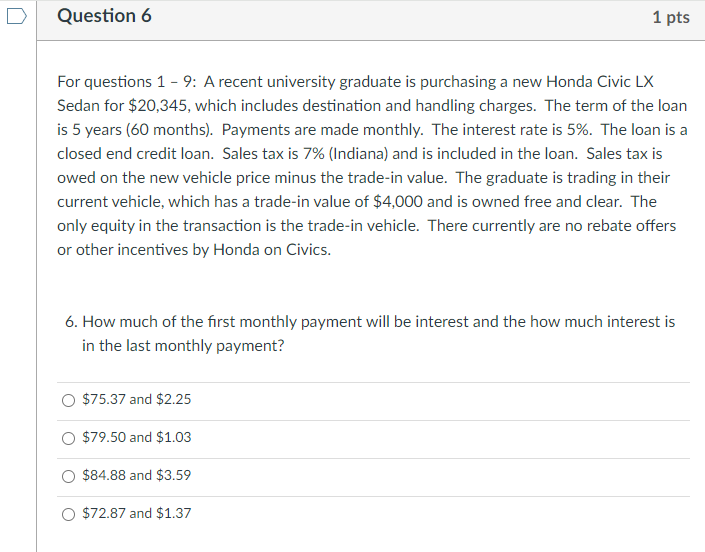

For questions 1 - 9: A recent university graduate is purchasing a new Honda Civic LX Sedan for $20,345, which includes destination and handling charges. The term of the loan is 5 years (60 months). Payments are made monthly. The interest rate is 5%. The loan is a closed end credit loan. Sales tax is 7\% (Indiana) and is included in the loan. Sales tax is owed on the new vehicle price minus the trade-in value. The graduate is trading in their current vehicle, which has a trade-in value of $4,000 and is owned free and clear. The only equity in the transaction is the trade-in vehicle. There currently are no rebate offers or other incentives by Honda on Civics. 6. How much of the first monthly payment will be interest and the how much interest is in the last monthly payment? $75.37 and $2.25 $79.50 and $1.03 $84.88 and $3.59 $72.87 and $1.37

For questions 1 - 9: A recent university graduate is purchasing a new Honda Civic LX Sedan for $20,345, which includes destination and handling charges. The term of the loan is 5 years (60 months). Payments are made monthly. The interest rate is 5%. The loan is a closed end credit loan. Sales tax is 7\% (Indiana) and is included in the loan. Sales tax is owed on the new vehicle price minus the trade-in value. The graduate is trading in their current vehicle, which has a trade-in value of $4,000 and is owned free and clear. The only equity in the transaction is the trade-in vehicle. There currently are no rebate offers or other incentives by Honda on Civics. 6. How much of the first monthly payment will be interest and the how much interest is in the last monthly payment? $75.37 and $2.25 $79.50 and $1.03 $84.88 and $3.59 $72.87 and $1.37 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started