Answered step by step

Verified Expert Solution

Question

1 Approved Answer

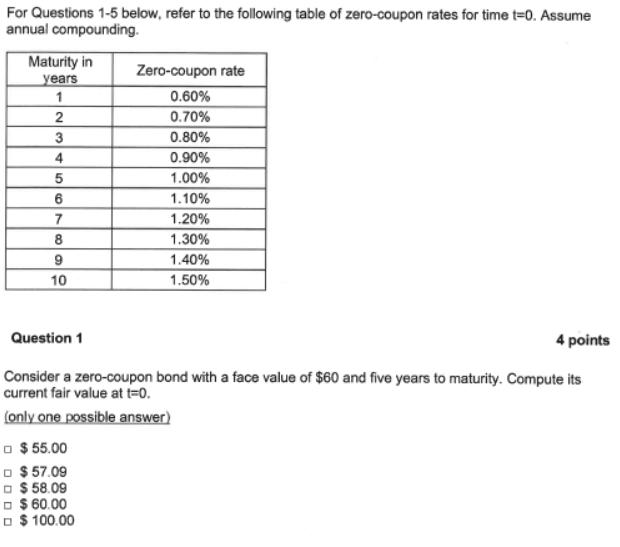

For Questions 1-5 below, refer to the following table of zero-coupon rates for time t=0. Assume annual compounding. Maturity in years 1 23 4

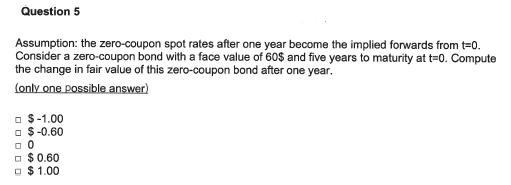

For Questions 1-5 below, refer to the following table of zero-coupon rates for time t=0. Assume annual compounding. Maturity in years 1 23 4 5 6 7 8 9 10 Zero-coupon rate 0.60% 0.70% 0.80% $55.00 $57.09 $58.09 $ 60.00 $100.00 0.90% 1.00% 1.10% 1.20% 1.30% 1.40% 1.50% Question 1 4 points Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its current fair value at t=0. (only one possible answer) Question 2 Consider a zero-coupon bond with a face value of $60 and five years to maturity. Compute its DV01 at t=0. (only one possible answer) $0.0098 $0.0500 $ 0.0283 $0.0471 $0.6000 Question 3 Consider a zero-coupon bond with a face value of $100 and five years to maturity. Compute its (modified) duration at t=0. (only one possible answer) 4.89 4.91 4.93 4.95 4.97 Question 4 Compute the implied (fair) forward rate from Year 4 to Year 5. (only one possible answer) 0.80% 0.90% 1.00% 1.10% 1.20% 4 points 4 points Question 5 Assumption: the zero-coupon spot rates after one year become the implied forwards from t=0. Consider a zero-coupon bond with a face value of 60$ and five years to maturity at t=0. Compute the change in fair value of this zero-coupon bond after one year. (only one possible answer) $-1.00 $-0.60 0 $0.60 $ 1.00

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Think of this function as a product of 4x3 and x5 and first apply the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started