Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for questions 2 and three what would be the formula in excel to compute this Data. b. For the time period, enter the start date

for questions 2 and three what would be the formula in excel to compute this

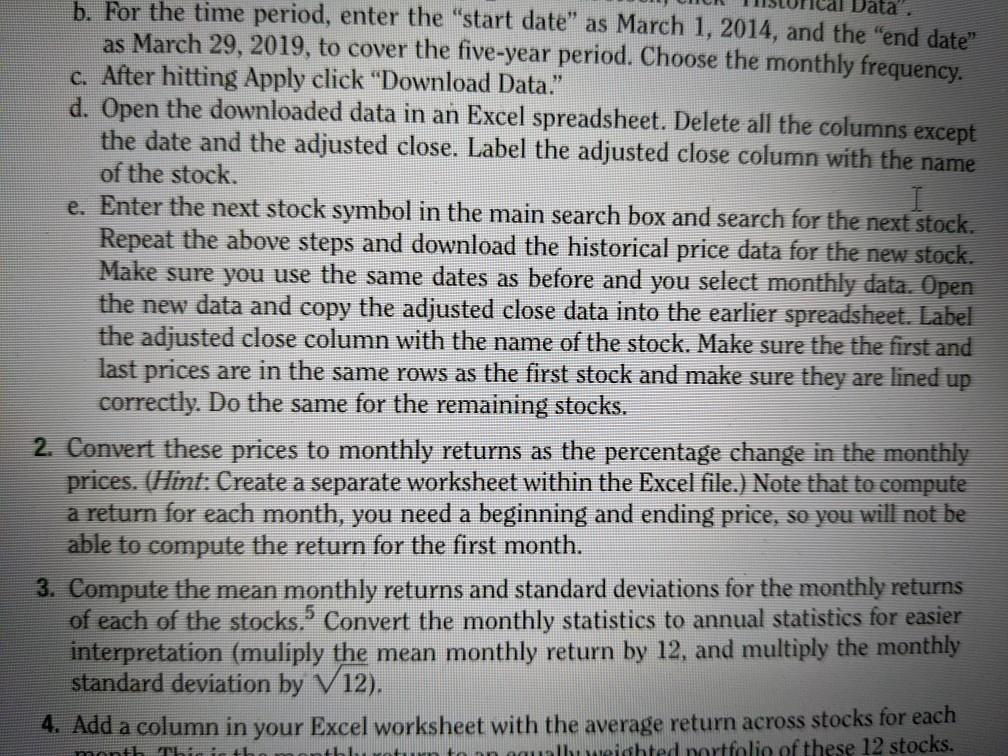

Data. b. For the time period, enter the "start date as March 1, 2014, and the "end date as March 29, 2019, to cover the five-year period. Choose the monthly frequency. c. After hitting Apply click "Download Data." d. Open the downloaded data in an Excel spreadsheet. Delete all the columns except the date and the adjusted close. Label the adjusted close column with the name of the stock. e. Enter the next stock symbol in the main search box and search for the next stock. I Repeat the above steps and download the historical price data for the new stock. Make sure you use the same dates as before and you select monthly data. Open the new data and copy the adjusted close data into the earlier spreadsheet. Label the adjusted close column with the name of the stock. Make sure the the first and last prices are in the same rows as the first stock and make sure they are lined up correctly. Do the same for the remaining stocks. 2. Convert these prices to monthly returns as the percentage change in the monthly prices. (Hint: Create a separate worksheet within the Excel file.) Note that to compute a return for each month, you need a beginning and ending price, so you will not be able to compute the return for the first month. 3. Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Convert the monthly statistics to annual statistics for easier interpretation (muliply the mean monthly return by 12, and multiply the monthly standard deviation by V12). 4. Add a column in your Excel worksheet with the average return across stocks for each albueirihted portfolio of these 12 stocks. 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started