Answered step by step

Verified Expert Solution

Question

1 Approved Answer

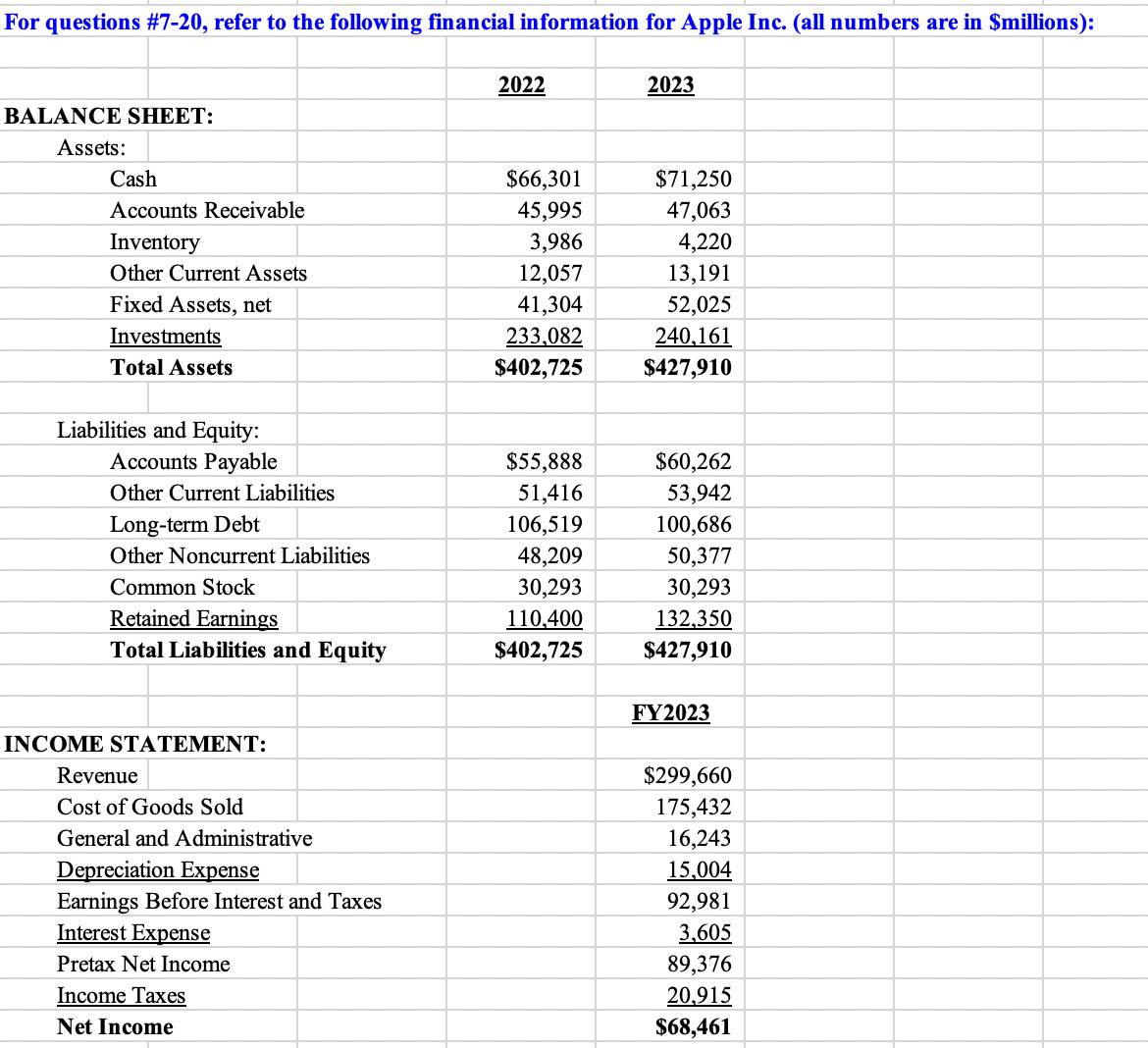

For questions #7-20, refer to the following financial information for Apple Inc. (all numbers are in $millions): 7. If Apple had an average of 4,037

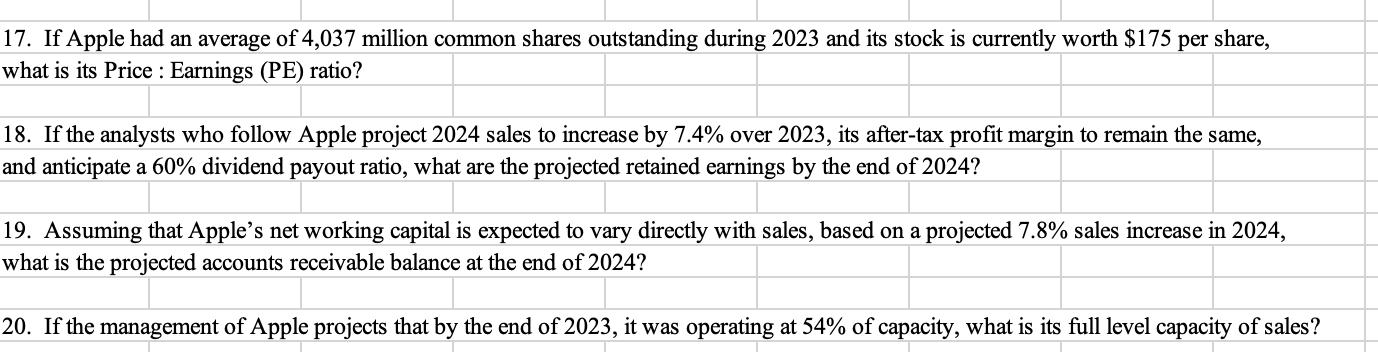

For questions \#7-20, refer to the following financial information for Apple Inc. (all numbers are in \$millions): 7. If Apple had an average of 4,037 million common shares outstanding during 2023 and its stock is currently worth $175 per share, hat is its Price : Earnings (PE) ratio? 8. If the analysts who follow Apple project 2024 sales to increase by 7.4% over 2023 , its after-tax profit margin to remain the same, nd anticipate a 60% dividend payout ratio, what are the projected retained earnings by the end of 2024 ? 9. Assuming that Apple's net working capital is expected to vary directly with sales, based on a projected 7.8% sales increase in 2024 , what is the projected accounts receivable balance at the end of 2024

For questions \#7-20, refer to the following financial information for Apple Inc. (all numbers are in \$millions): 7. If Apple had an average of 4,037 million common shares outstanding during 2023 and its stock is currently worth $175 per share, hat is its Price : Earnings (PE) ratio? 8. If the analysts who follow Apple project 2024 sales to increase by 7.4% over 2023 , its after-tax profit margin to remain the same, nd anticipate a 60% dividend payout ratio, what are the projected retained earnings by the end of 2024 ? 9. Assuming that Apple's net working capital is expected to vary directly with sales, based on a projected 7.8% sales increase in 2024 , what is the projected accounts receivable balance at the end of 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started