Answered step by step

Verified Expert Solution

Question

1 Approved Answer

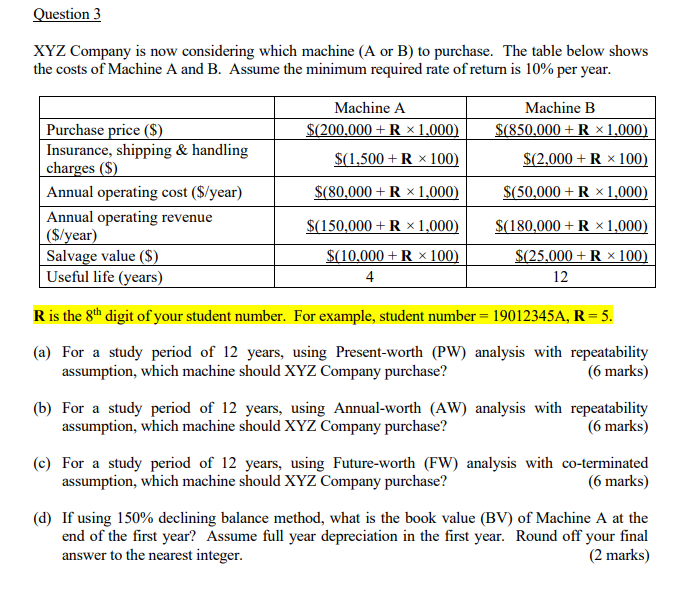

For R=5 e.g(Rx1000)=5x1000=5000 Question 3 XYZ Company is now considering which machine (A or B) to purchase. The table below shows the costs of Machine

For R=5 e.g(Rx1000)=5x1000=5000

Question 3 XYZ Company is now considering which machine (A or B) to purchase. The table below shows the costs of Machine A and B. Assume the minimum required rate of return is 10% per year. Machine A $(200,000+R 1,000) $(1,500+R 100) Machine B $(850,000+R 1,000) $(2,000 + R x 100) $(80,000+R 1,000) $(50,000+R 1,000) Purchase price ($) Insurance, shipping & handling charges ($) Annual operating cost ($/year) Annual operating revenue ($/year) Salvage value ($) Useful life (years) $(180,000+R 1,000) $(150,000+R 1,000) $(10,000+ R x 100) 4 $(25,000 + R x 100) 12 R is the gth digit of your student number. For example, student number = 19012345A, R= 5. (a) For a study period of 12 years, using Present-worth (PW) analysis with repeatability assumption, which machine should XYZ Company purchase? (6 marks) (6) For a study period of 12 years, using Annual-worth (AW) analysis with repeatability assumption, which machine should XYZ Company purchase? (6 marks) (C) For a study period of 12 years, using Future-worth (FW) analysis with co-terminated assumption, which machine should XYZ Company purchase? (6 marks) (d) If using 150% declining balance method, what is the book value (BV) of Machine A at the end of the first year? Assume full year depreciation in the first year. Round off your final answer to the nearest integer. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started