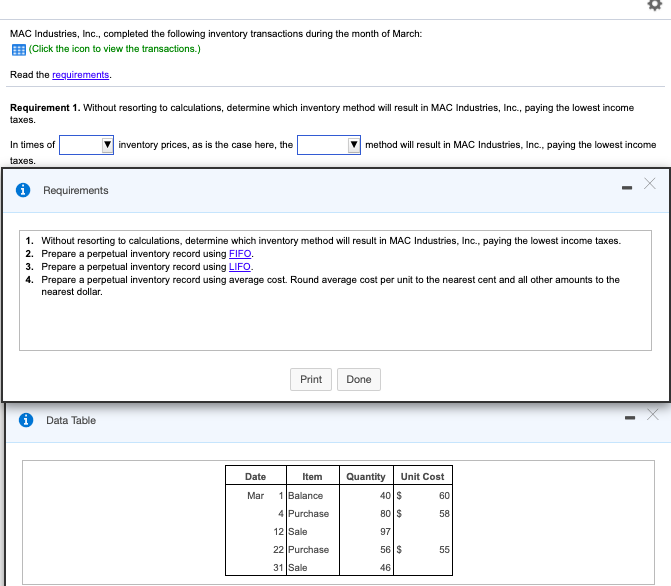

For requirement 1 the drop down options for the first box are either decreasing, constant, or increasing. The options for the second drop down box are average cost, FIFO, and LIFO. PLEASE DO REQUIREMENTS 1-4!

For requirement 1 the drop down options for the first box are either decreasing, constant, or increasing. The options for the second drop down box are average cost, FIFO, and LIFO. PLEASE DO REQUIREMENTS 1-4!

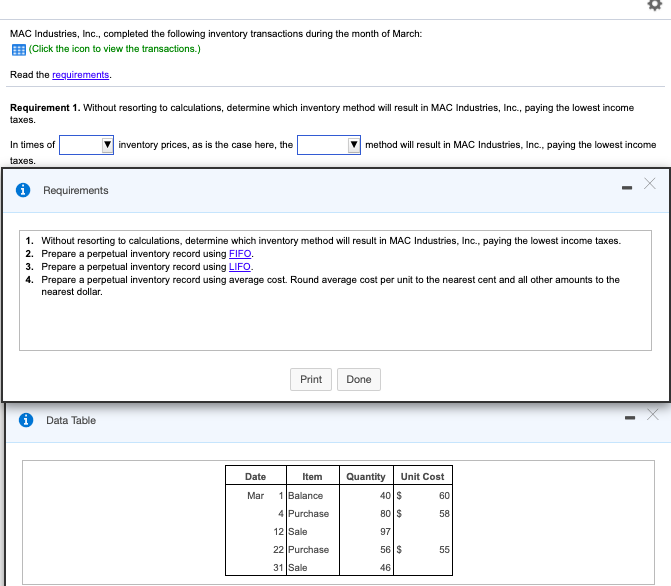

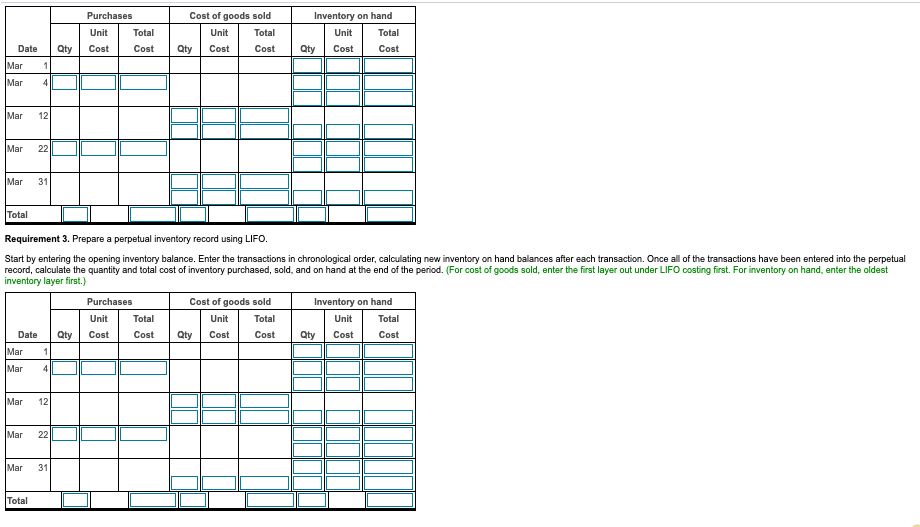

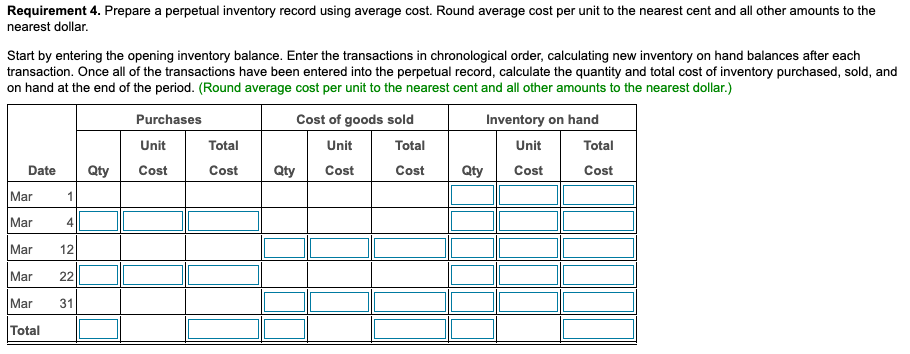

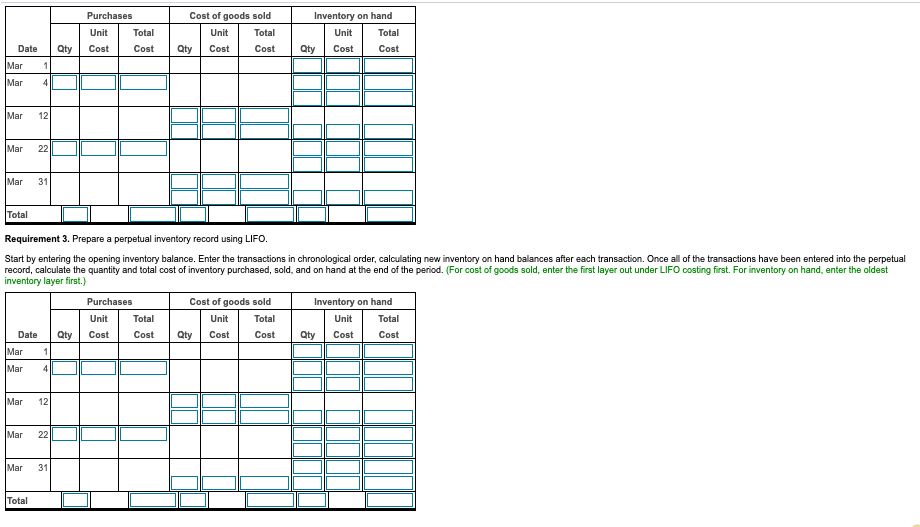

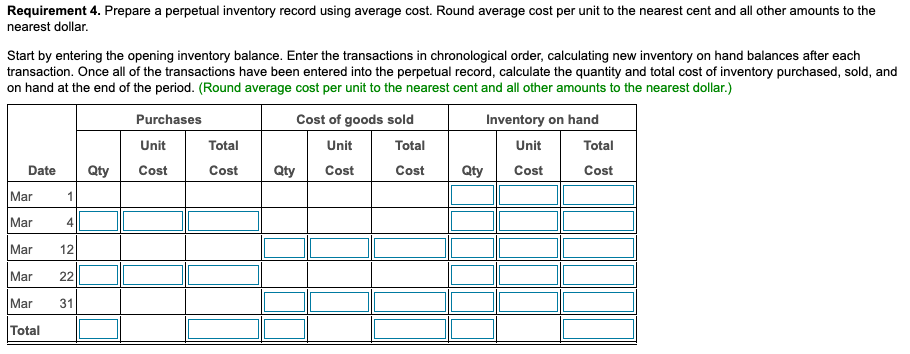

MAC Industries, Inc., completed the following inventory transactions during the month of March: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Without resorting to calculations, determine which inventory method will result in MAC Industries, Inc., paying the lowest income taxes. In times of taxes. inventory prices, as is the case here, the method will result in MAC Industries, Inc., paying the lowest income * Requirements 1. Without resorting to calculations, determine which inventory method will result in MAC Industries, Inc., paying the lowest income taxes. 2. Prepare a perpetual inventory record using FIFO. 3. Prepare a perpetual inventory record using LIFO. 4. Prepare a perpetual inventory record using average cost. Round average cost per unit to the nearest cent and all other amounts to the nearest dollar Print Done Data Table Date Item Quantity Unit Cost 40$ 60 Mar 80$ 58 1 Balance 4 Purchase 12 Sale 22 Purchase 31 Sale 97 56S 55 46 Purchases Unit Total Cost Cost Cost of goods sold Unit Total Qty Cost Cost Inventory on hand Unit Total Qty Cost Cost Qty Date Mar 1 Mar 4 Mar 12 Mar 22 Mar 31 Total Requirement 3. Prepare a perpetual inventory record using LIFO. Start by entering the opening inventory balance. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the end of the period. (For cost of goods sold, enter the first layer out under LIFO costing first. For inventory on hand, enter the oldest inventory layer first.) Purchases Cost of goods sold Inventory on hand Unit Total Unit Total Unit Total Date Qty Cost Cost Qty Cost Cost Qty Cost Cost Mar 1 Mar 4 Mar 12 Mar 22 Mar 31 Total Requirement 4. Prepare a perpetual inventory record using average cost. Round average cost per unit to the nearest cent and all other amounts to the nearest dollar. Start by entering the opening inventory balance. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of inventory purchased, sold, and on hand at the end of the period. (Round average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Purchases Cost of goods sold Inventory on hand Total Unit Total Unit Total Date Qty Cost Cost Qty Cost Cost Qty Cost Cost Mar 1 Unit Mar 4 Mar 12 Mar 22 Mar 31 Total

For requirement 1 the drop down options for the first box are either decreasing, constant, or increasing. The options for the second drop down box are average cost, FIFO, and LIFO. PLEASE DO REQUIREMENTS 1-4!

For requirement 1 the drop down options for the first box are either decreasing, constant, or increasing. The options for the second drop down box are average cost, FIFO, and LIFO. PLEASE DO REQUIREMENTS 1-4!