Answered step by step

Verified Expert Solution

Question

1 Approved Answer

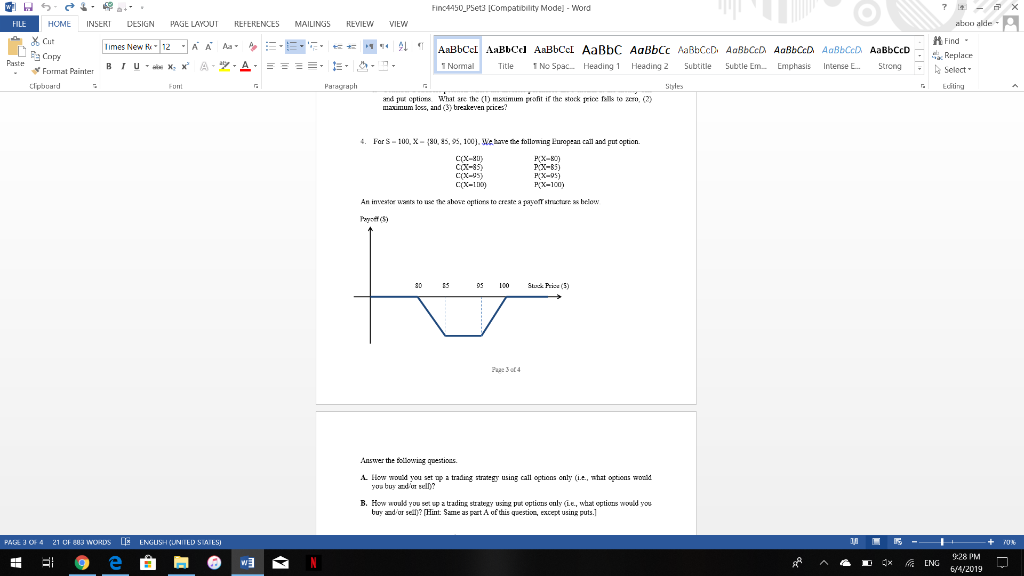

For S = 100, X = {80, 85, 95, 100}, We have the following European call and put option. C(X=80) P(X=80) C(X=85) P(X=85) C(X=95) P(X=95)

- For S = 100, X = {80, 85, 95, 100}, We have the following European call and put option.

C(X=80) P(X=80)

C(X=85) P(X=85)

C(X=95) P(X=95)

C(X=100) P(X=100)

An investor wants to use the above options to create a payoff structure as below.

| Payoff ($) |

| 80 85 95 100 Stock Price ($) |

Answer the following questions.

Answer the following questions.

A. How would you set up a trading strategy using call options only (i.e., what options would you buy and/or sell)?

B. How would you set up a trading strategy using put options only (i.e., what options would you buy and/or sell)? [Hint: Same as part A of this question, except using puts.]

7 w X Finc4450 PSets ICompatibility Mode) - Word aboo alde PAGE LAYOUT HILE E INSERT DESIGN REFERENCES MAILINGS REVIEW VIEW Cut Find Iimes New R 12 A AAa AaBbCcI AaBbCc AaBbCcI AaBbC AaBbCc AaBbCcD AaBbCcD AaBbCcD AaBbCcD AaBbCcD Replace Select Bt Cpy BIU-in X X A A E 1 No Spac Subtle Em 1Normal Title Heading Heading 2 Subtitle Emphasis Intense E Streng Format Painter Fon ! tpurd Styles Eiting ximim profit if the stock rice falk to , (2)y mmum lo and/3) breakeven pcices? For S-100, X-80, 85, 95, 100), Webae the folloming European call and put option. 4. cox-au Cx-85 -) PX-83) C(X-1 -100) An imveator wers to we the aboe options to reste a pavoT stractre below Praff(S) S Price () 0s. Pa: 3 ot 4 Answer the folowing qpestioas octions only (e., hat octions wonld a tradirg strategy usinr. sr ws B. How wuld you se a trading strateay uirg ut entins anly what entims wod vo. buy dr self02 (Hint: Same as port A of this gestion except using puts.T 21 CFB83 WORDS EENGUSH (UNITED SIATES) +1UN PAGE 3 OF 4 PM ENC 6/4/2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started