Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For simplicity and convenience of calculation, suppose there are only one risk-free asset with a return of 2% and two risky assets, Stock A

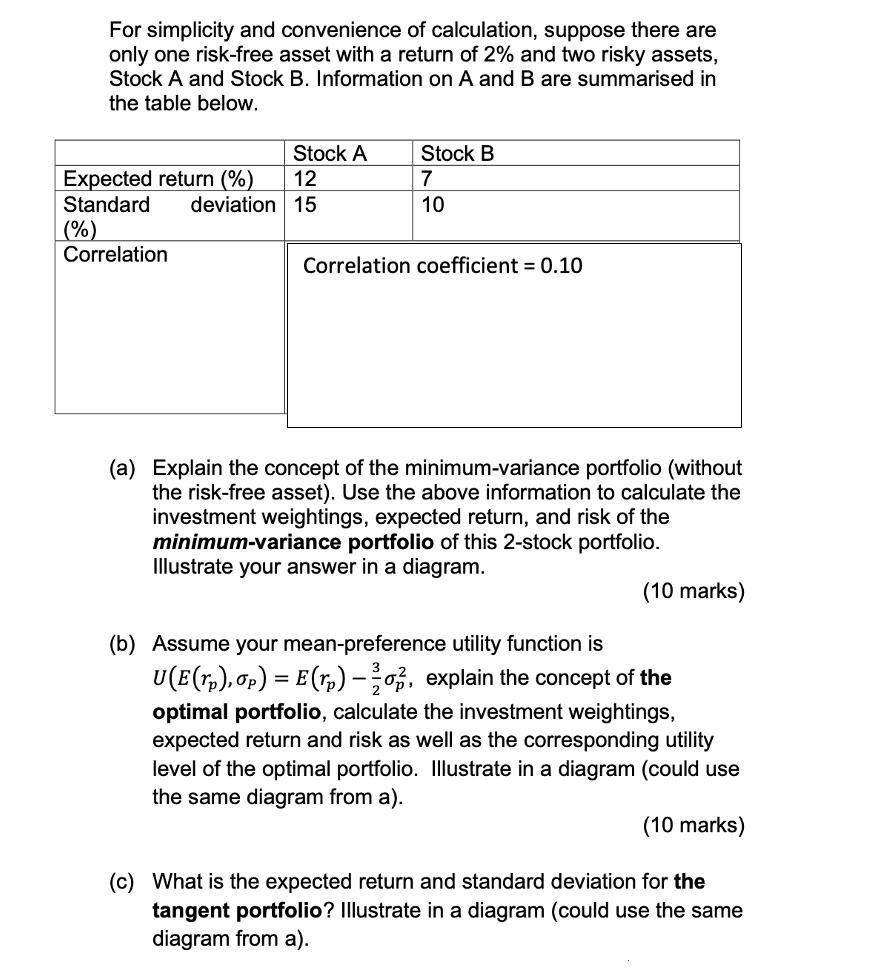

For simplicity and convenience of calculation, suppose there are only one risk-free asset with a return of 2% and two risky assets, Stock A and Stock B. Information on A and B are summarised in the table below. Stock A Expected return (%) 12 Standard deviation 15 (%) Correlation Stock B 7 10 Correlation coefficient = 0.10 (a) Explain the concept of the minimum-variance portfolio (without the risk-free asset). Use the above information to calculate the investment weightings, expected return, and risk of the minimum-variance portfolio of this 2-stock portfolio. Illustrate your answer in a diagram. (10 marks) (b) Assume your mean-preference utility function is U (E(rp), op) = E(r) -, explain the concept of the optimal portfolio, calculate the investment weightings, expected return and risk as well as the corresponding utility level of the optimal portfolio. Illustrate in a diagram (could use the same diagram from a). (10 marks) (c) What is the expected return and standard deviation for the tangent portfolio? Illustrate in a diagram (could use the same diagram from a).

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The minimumvariance portfolio is the portfolio that has the lowest variance It is the portfolio that is the least risky The formula for the minimumvariance portfolio is wA sigmaA2 sigmaB2 sigmaA2 si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started