Answered step by step

Verified Expert Solution

Question

1 Approved Answer

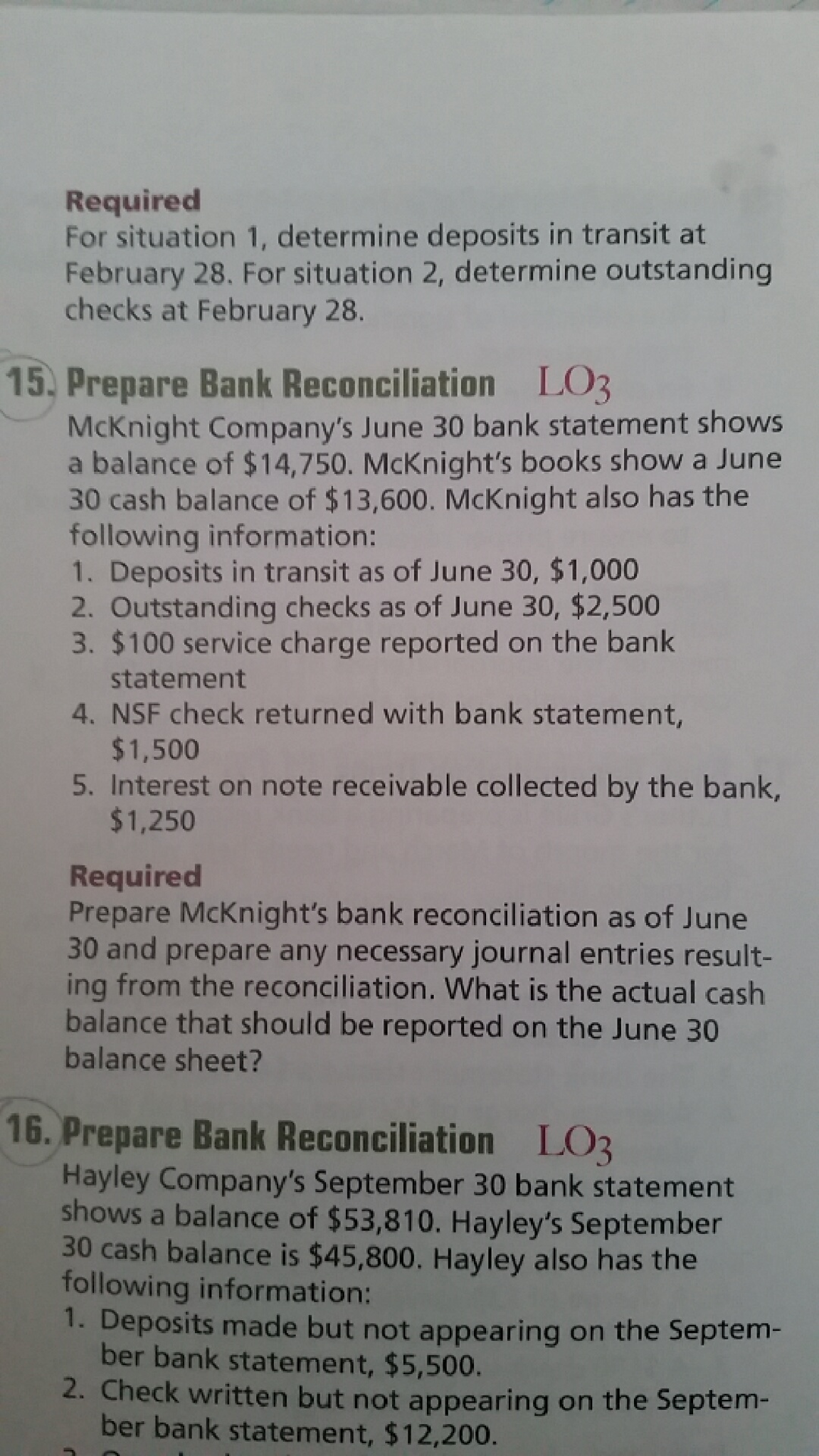

For situation 1, determine deposits in transit at February 28. For situation 2, determine outstanding checks at February 28. McKnight Company's June 30 bank statement

For situation 1, determine deposits in transit at February 28. For situation 2, determine outstanding checks at February 28. McKnight Company's June 30 bank statement shows a balance of $14, 750. McKnight's books show a June 30 cash balance of $13, 600. McKnight also has the following information: Deposits in transit as of June 30, $1, 000 Outstanding checks as of June 30, $2, 500 $100 service charge reported on the bank statement NSF check returned with bank statement, $1, 500 Interest on note receivable collected by the bank, $1, 250 Required Prepare McKnight's bank reconciliation as of June 30 and prepare any necessary journal entries resulting from the reconciliation. What is the actual cash balance that should be reported on the June 30 balance sheet? Hayley Company's September 30 bank statement shows a balance of $53, 810. Hayley's September 30 cash balance is $45, 800. Hayley also has the following information: Deposits made but not appearing on the September bank statement, $5, 500. Check written but not appearing on the September bank statement, $12, 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started