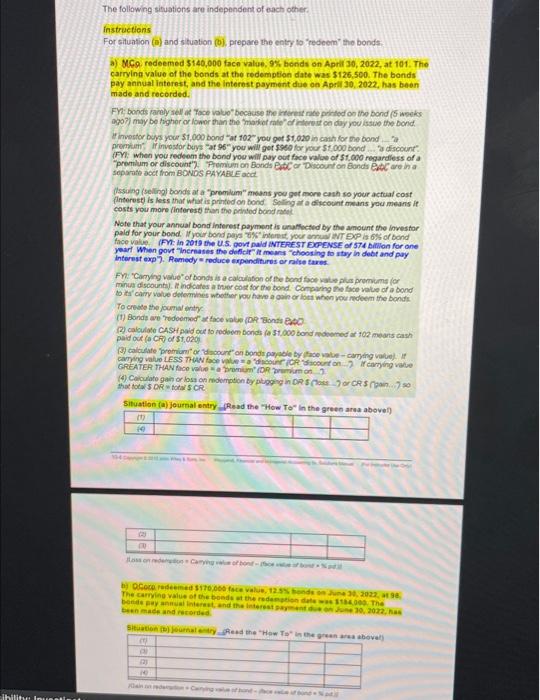

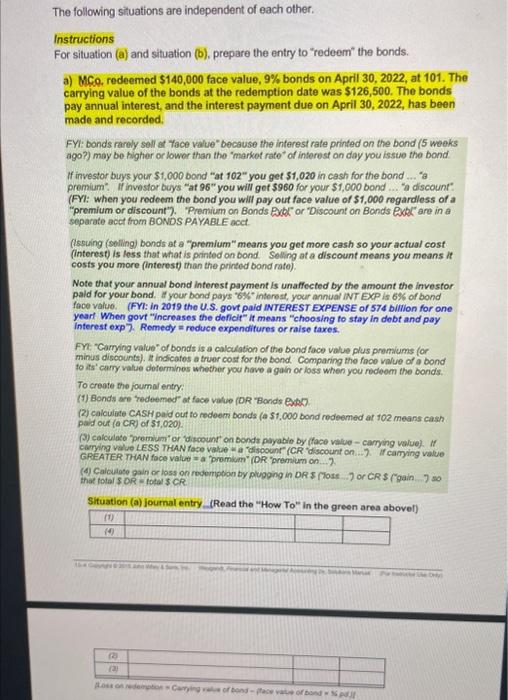

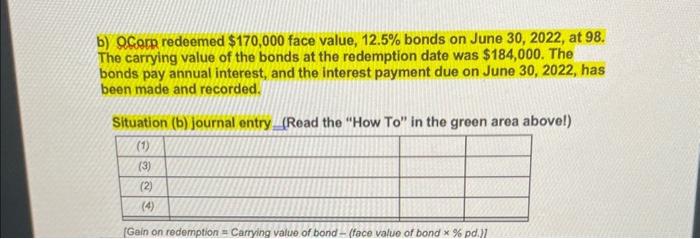

For situation (D) and stuation (0), prepare the entry to "redeem" the bonds. a) VCa, redeemed $140,000 face value, 9% bonds on April 30, 2022, at 101. The carrying value of the bends at the redemption date was $126,500. The bonds pay annual isterest, and the Interest payment due on Apsil 30, 2022, has been made and recorded. FY: bonds parely sell at Tace valuo "beciuse the intereit nee printod on the bond (5 woeks ago7) may be figher or lower than the "mavet mite" of irterest on doy you isstie the bond. It invertor buys your $1,000 bond "at 1027 you get $1,020 in aath for the bond 72 premien" If investor buys "at 96" you will get 5960 for your 51,000 bond ... If discount". (FY): when you redeem the bond yoe will pay out face value of 51.000 regardless of a separate acet from BONOS PAYABIE Face. (1ssieng (selingl bonds at a "promium" mesns you got more cash so your actual cost (Interesti is less that whyt is prited on bond certing af a divcount means you means it costs you more linterest thar the printed band mate. Note that your annual bond interest paymont is unalhectid by the anount the investor face volue. IFh: In 2019 the U.S. govt pald iNTEREST EXFENSE of 574 bullilen for one yearl When govt "incrnases the deficit" it moans "choosing to attyy in debt and pay. interest exp 7). Remedy = reduce expenditures or nilse taves. Fy: "Carying value" of bonds is a calaulaton of fie bond taoe katwe plita premiums (or minur discountil. If ind bates a trier cost for the tond Compaing the tace vatue of a bond to ta' cacry value detemities whether vou have a oin or ibte when you redeem the bonds. To crecele the joumaterity paid out (e cent of 57,020 ) that todal 5 or w tota' 5CR. Situation (a) journal entry upesd the "How To" in the areen araw ahovel) b) OCore reseemed siteroos face value, 12.55 tonds on hine 30,2022 , at 9 a, been mase and recorded. 1structions or situation (a) and situation (b), prepare the entry to "redeem" the bonds. a) MCo, redeemed $140,000 face value, 9\% bonds on April 30, 2022, at 101. The carrying value of the bonds at the redemption date was $126,500. The bonds pay annual interest, and the interest payment due on April 30, 2022, has been made and recorded. FY: bands rardy soll at 7ace value" because the interest rate printed on the band ( 5 weeks ago?) may be higher or lower than the "markot rate" of interest an day you issue the bond" If investor buys your $1,000 bond "at 102 " you get $1,020 in cash for the bond.... "a (FYl: when you redeem the bond you will pay out face value of $1,000 regardless of a "premium or discount"). "Premium on Bonds Publ' or "Discount on Bonds exbl" are in a separate acct from BONDS PAYABLE acct. (issuing (solling) bonds at a "premlum" means you get more cash so your actual cost (interest) is less that what is printed on bond. Solling at a discount means you means it costs you more (interest) than the printed bond rate). Note that your annual bond interest payment is unaffected by the amount the investor paid for your bond. If your bond pays "6w" interest, your annual iNT EXP is 65 of bond face value. (FYI: in 2019 the U.S. govt paid INTEREST EXPENSE of 574 billion for one yeart When govt "increases the deficit" it means "choosing to stay in debt and pay Interest exp7. Romedy = reduce expenditures or ralse taxes. FF: "Carrying value" of bonds is a calculation of the bond face value plus premiums for minus discounts), It indicotes a truer cost for the bond. Comparing the face value of a bond to its' carry value dotermines whether you have a gah or loss when you redeom the bonds. To creote the foumal entry: (1) Bonds are tedeemed" at face vatuo (DR "Bonds EADD. (2) calculite CASH pald out to modeem bonds (a 51.000 bend redeemed at 102 means cash pad out (a CR) of $1,020). (3) calculate "premium" or "ditoount on bonds payabio by (tace value - carrying value). If GREATER THAN foce vatuo = a "Promium' (DR "premium on..7. (4) Calculose gain or loss on redempton by plupping in DR $ (lose..7 or CR $ (gain. 7 so that total \$ OR = fotal $CR. Situstion (a) joumal entry_(Read the "How To" in the areen ama ahnowel) b) OCorp redeemed $170,000 face value, 12.5% bonds on June 30,2022 , at 98 . The carrying value of the bonds at the redemption date was $184,000. The bonds pay annual interest, and the interest payment due on June 30,2022 , has been made and recorded. Situation (b) journal entry, (Read the "How To" in the green area abovel)