Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zinc Limited (ZL) has entered into the following transactions: (i) On 1 January 2022, ZL purchased 1.5 million bonds of Copper Limited having face

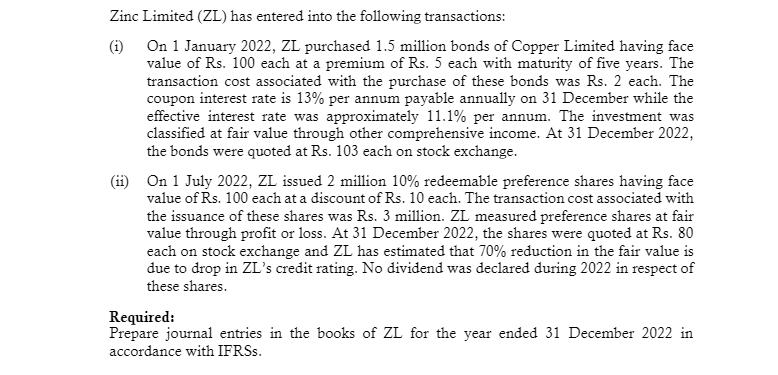

Zinc Limited (ZL) has entered into the following transactions: (i) On 1 January 2022, ZL purchased 1.5 million bonds of Copper Limited having face value of Rs. 100 each at a premium of Rs. 5 each with maturity of five years. The transaction cost associated with the purchase of these bonds was Rs. 2 each. The coupon interest rate is 13% per annum payable annually on 31 December while the effective interest rate was approximately 11.1% per annum. The investment was classified at fair value through other comprehensive income. At 31 December 2022, the bonds were quoted at Rs. 103 each on stock exchange. (ii) On 1 July 2022, ZL issued 2 million 10% redeemable preference shares having face value of Rs. 100 each at a discount of Rs. 10 each. The transaction cost associated with the issuance of these shares was Rs. 3 million. ZL measured preference shares at fair value through profit or loss. At 31 December 2022, the shares were quoted at Rs. 80 each on stock exchange and ZL has estimated that 70% reduction in the fair value is due to drop in ZL's credit rating. No dividend was declared during 2022 in respect of these shares. Required: Prepare journal entries in the books of ZL for the year ended 31 December 2022 in accordance with IFRSS.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information the journal entries in the books of Zinc Limited ZL for the year ende...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started