Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For tax purposes, goodwill is amortized annually and is, therefore, a deductible expense on a company's tax return. ZAGG amortized goodwill over a period of

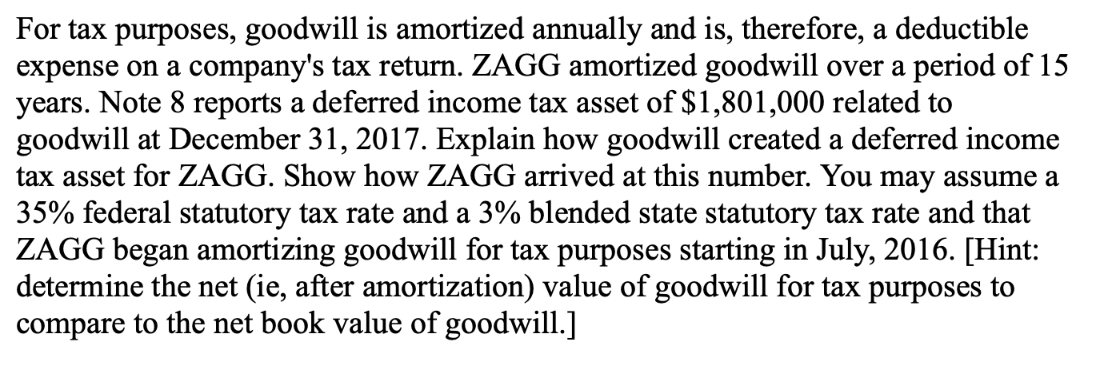

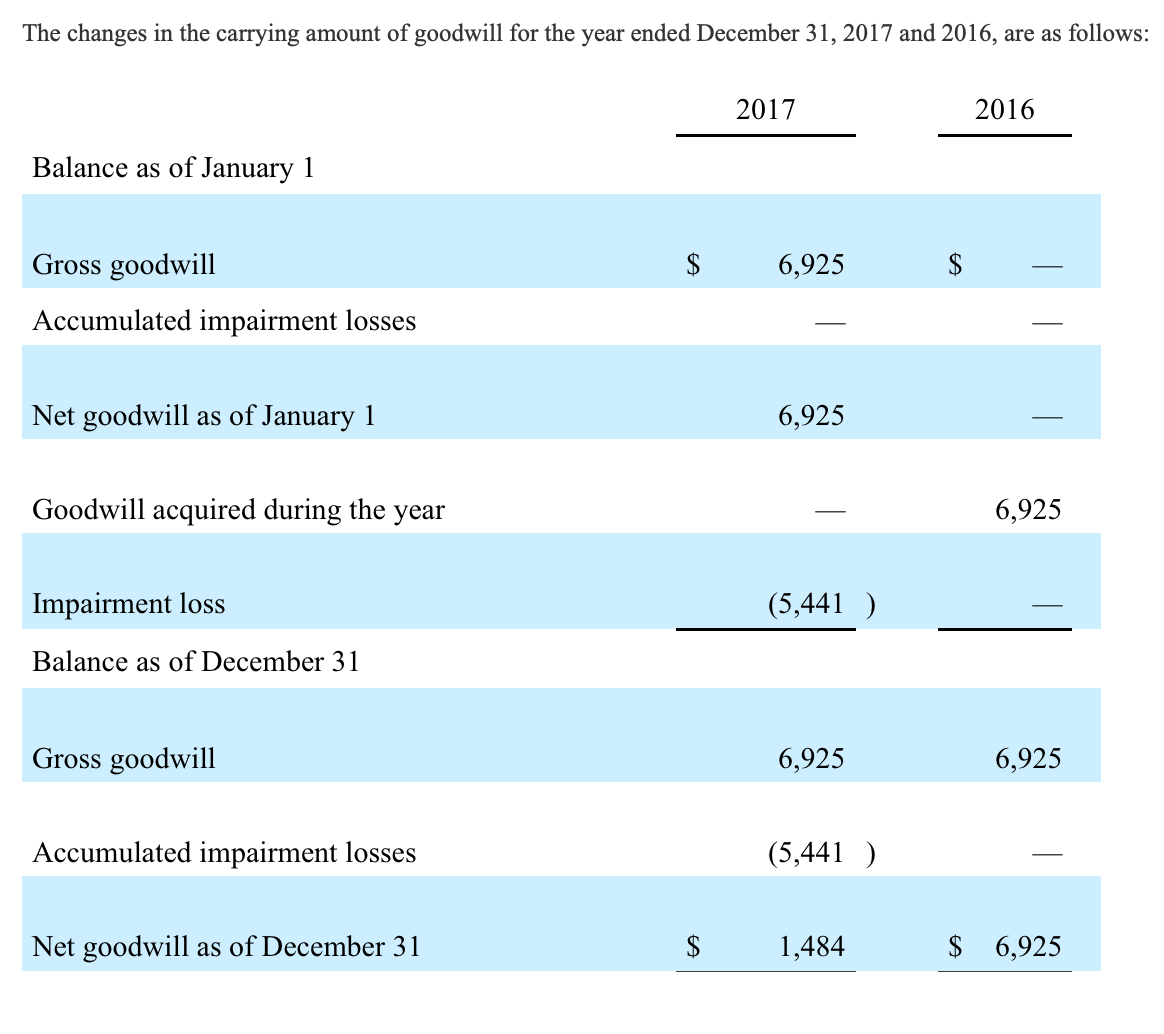

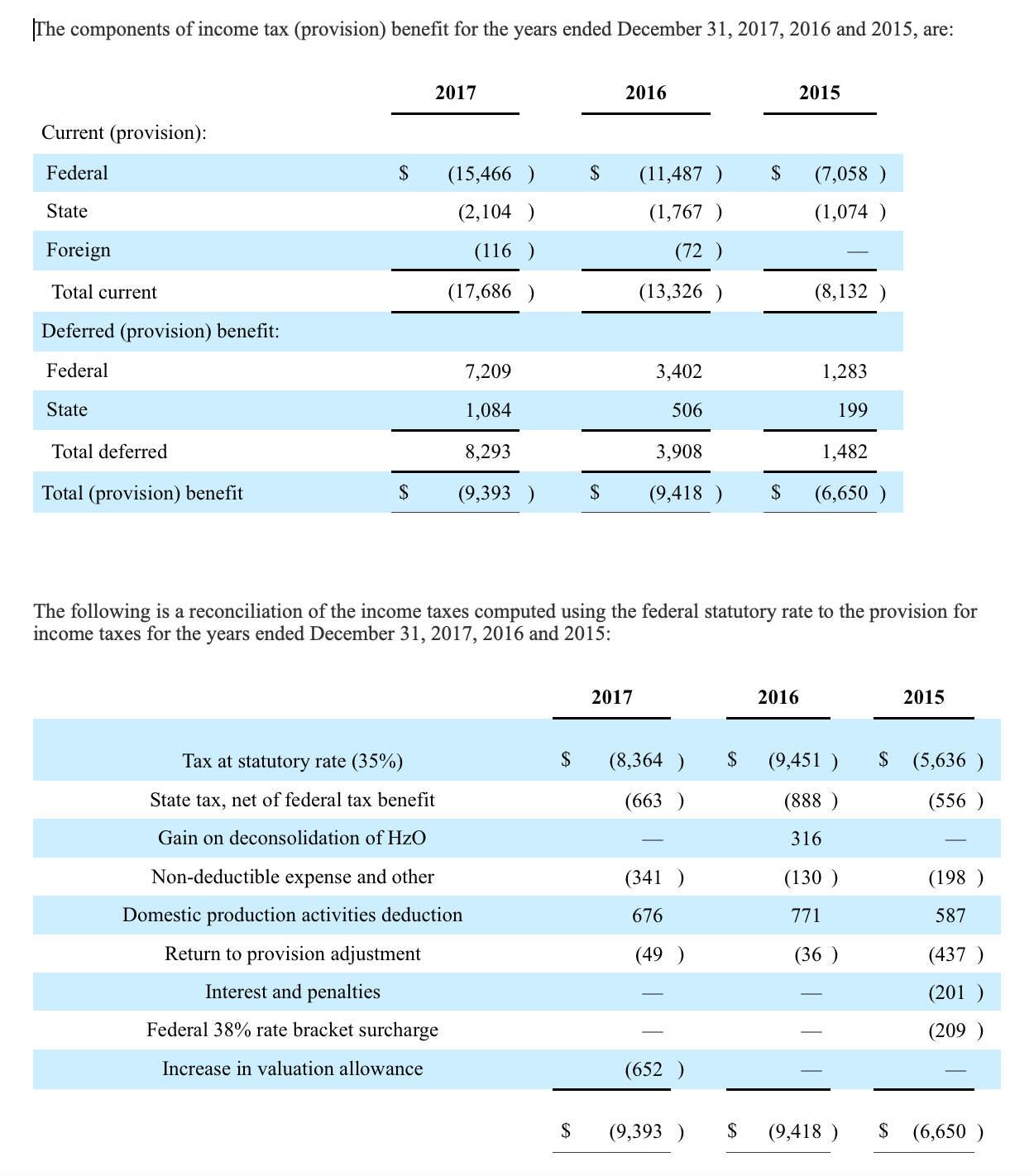

For tax purposes, goodwill is amortized annually and is, therefore, a deductible expense on a company's tax return. ZAGG amortized goodwill over a period of 15 years. Note 8 reports a deferred income tax asset of $1,801,000 related to goodwill at December 31, 2017. Explain how goodwill created a deferred income tax asset for ZAGG. Show how ZAGG arrived at this number. You may assume a 35% federal statutory tax rate and a 3\% blended state statutory tax rate and that ZAGG began amortizing goodwill for tax purposes starting in July, 2016. [Hint: determine the net (ie, after amortization) value of goodwill for tax purposes to compare to the net book value of goodwill.] The changes in the carrying amount of goodwill for the year ended December 31, 2017 and 2016, are as follows: The components of income tax (provision) benefit for the years ended December 31, 2017, 2016 and 2015, are: The following is a reconciliation of the income taxes computed using the federal statutory rate to the provision for income taxes for the years ended December 31, 2017, 2016 and 2015

For tax purposes, goodwill is amortized annually and is, therefore, a deductible expense on a company's tax return. ZAGG amortized goodwill over a period of 15 years. Note 8 reports a deferred income tax asset of $1,801,000 related to goodwill at December 31, 2017. Explain how goodwill created a deferred income tax asset for ZAGG. Show how ZAGG arrived at this number. You may assume a 35% federal statutory tax rate and a 3\% blended state statutory tax rate and that ZAGG began amortizing goodwill for tax purposes starting in July, 2016. [Hint: determine the net (ie, after amortization) value of goodwill for tax purposes to compare to the net book value of goodwill.] The changes in the carrying amount of goodwill for the year ended December 31, 2017 and 2016, are as follows: The components of income tax (provision) benefit for the years ended December 31, 2017, 2016 and 2015, are: The following is a reconciliation of the income taxes computed using the federal statutory rate to the provision for income taxes for the years ended December 31, 2017, 2016 and 2015 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started