For the 6 scenarios in the teaching slides (pp. 16, 18, 20, 22, 24, 26), please compute (Use JUPYTER) their respective monthly IRR.

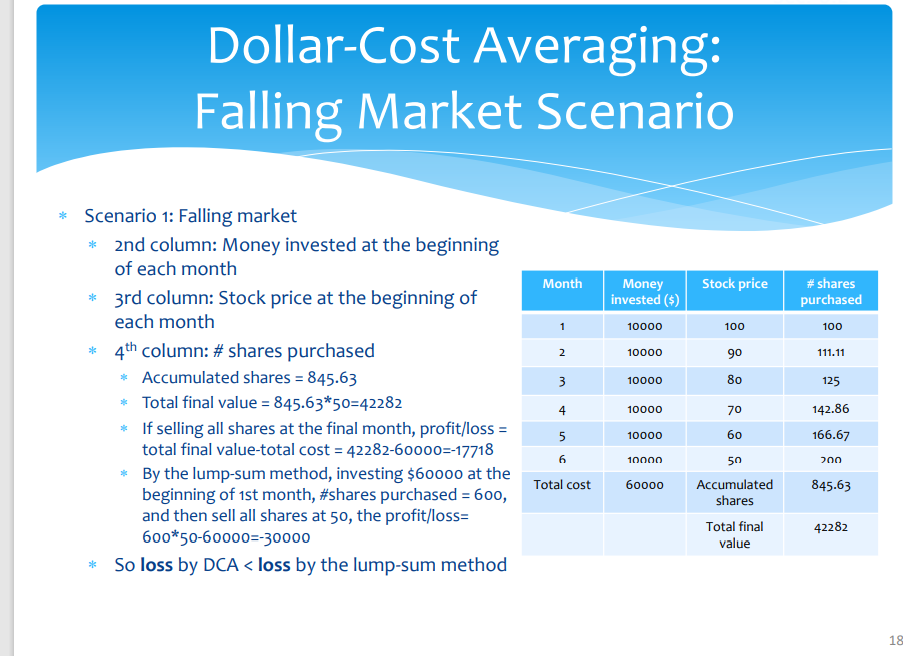

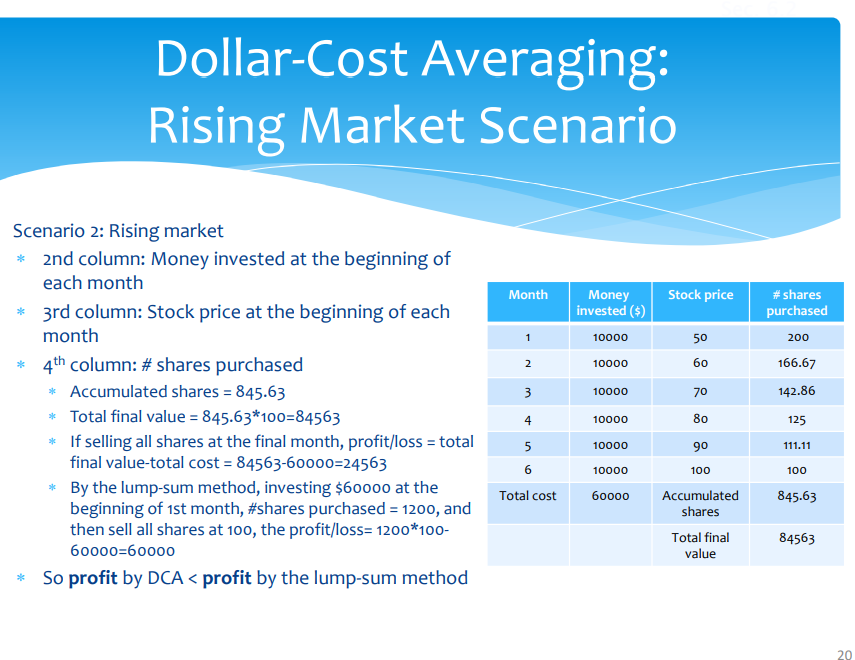

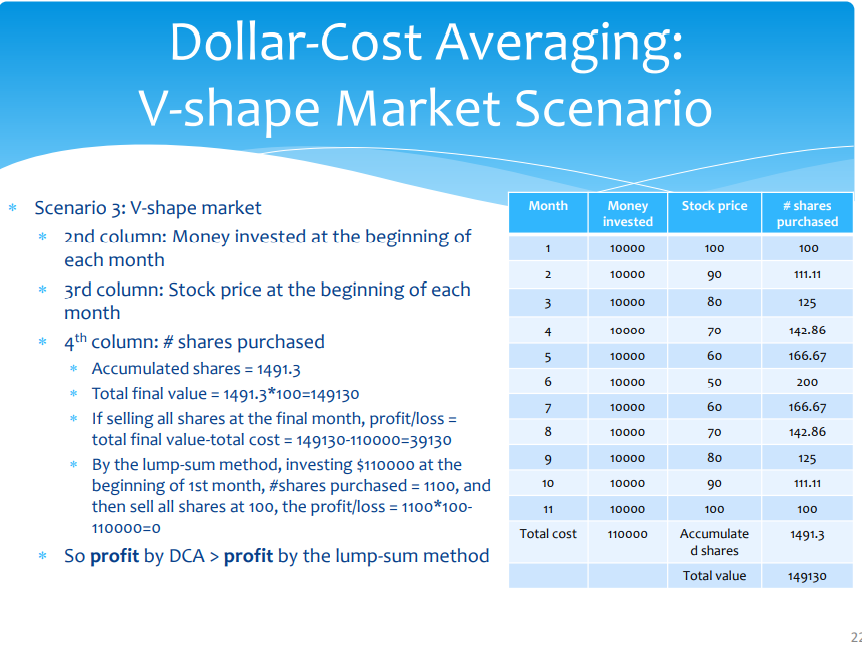

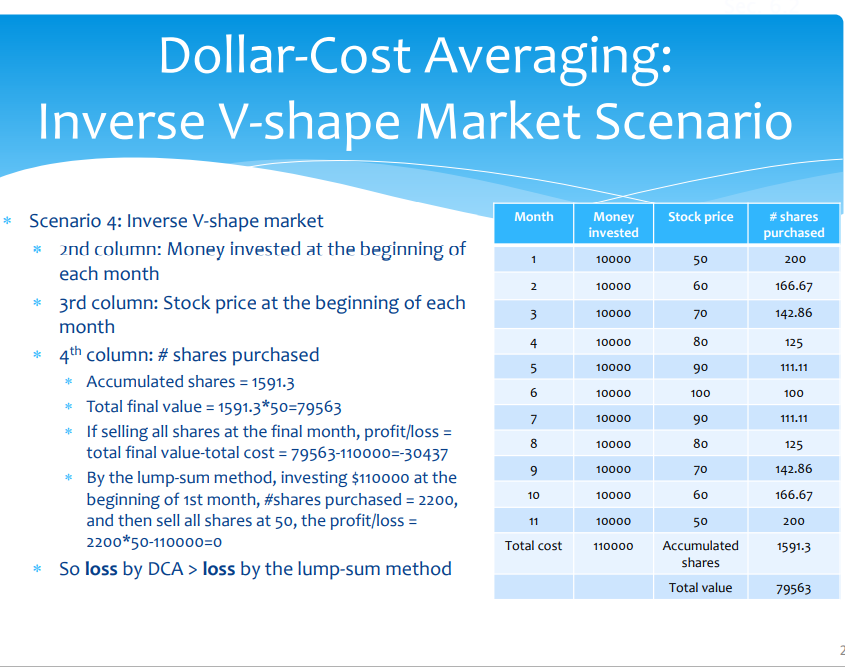

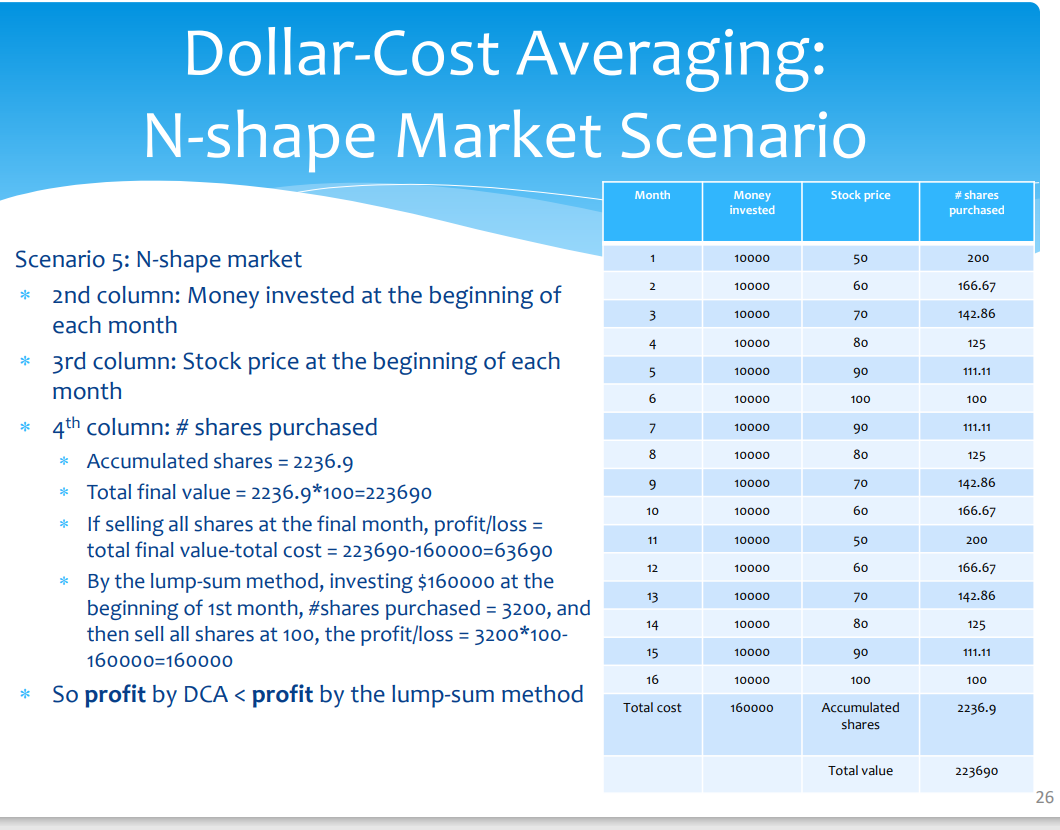

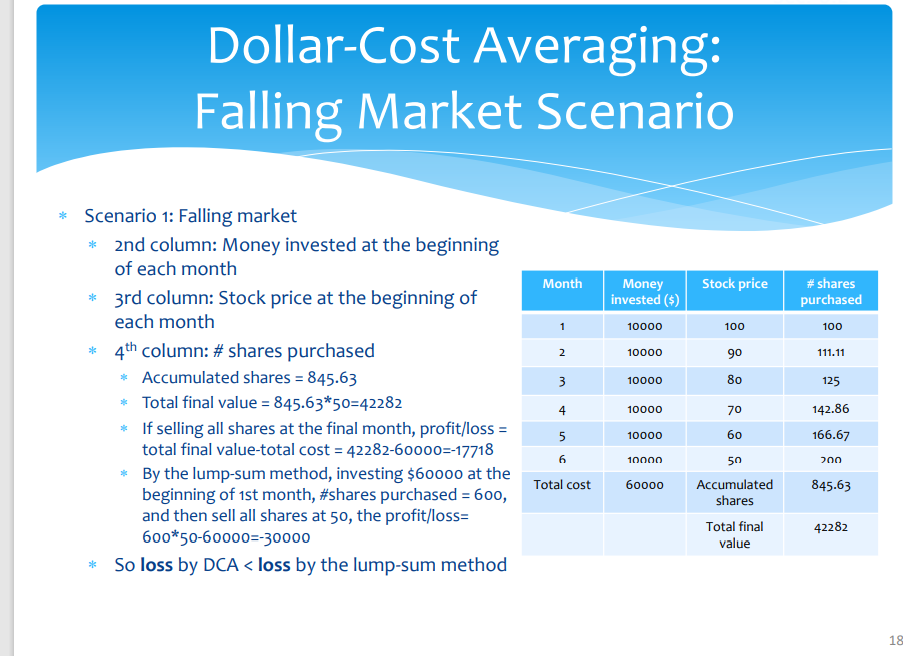

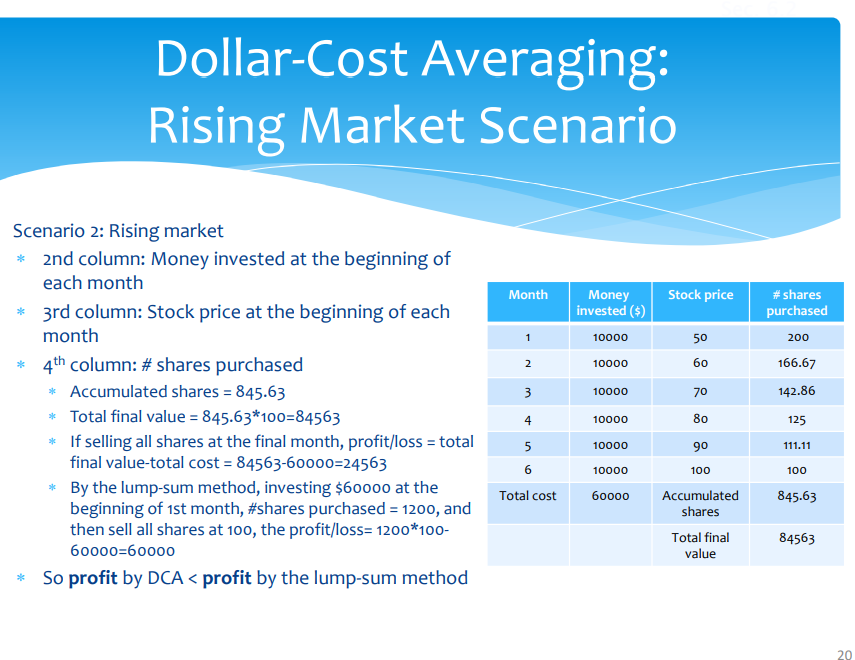

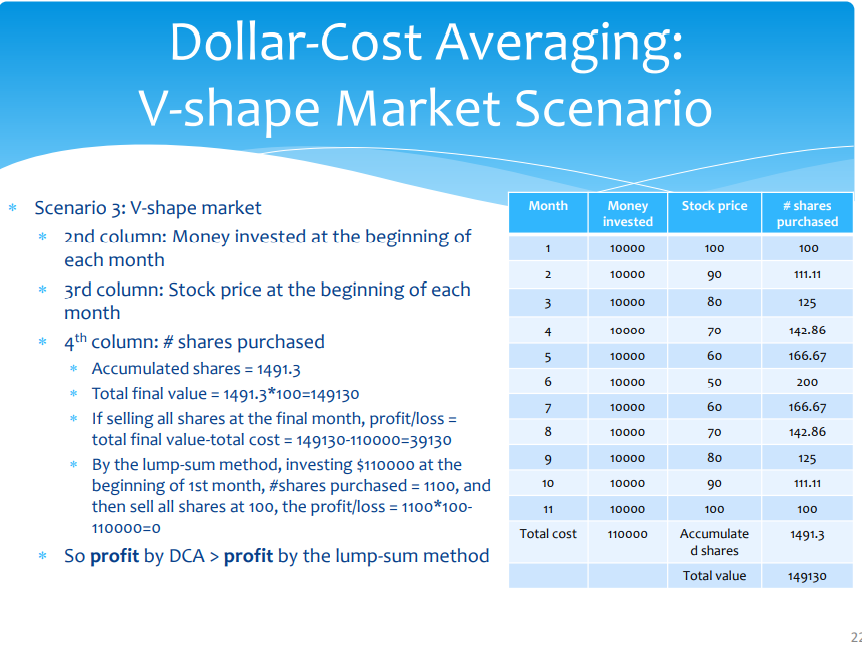

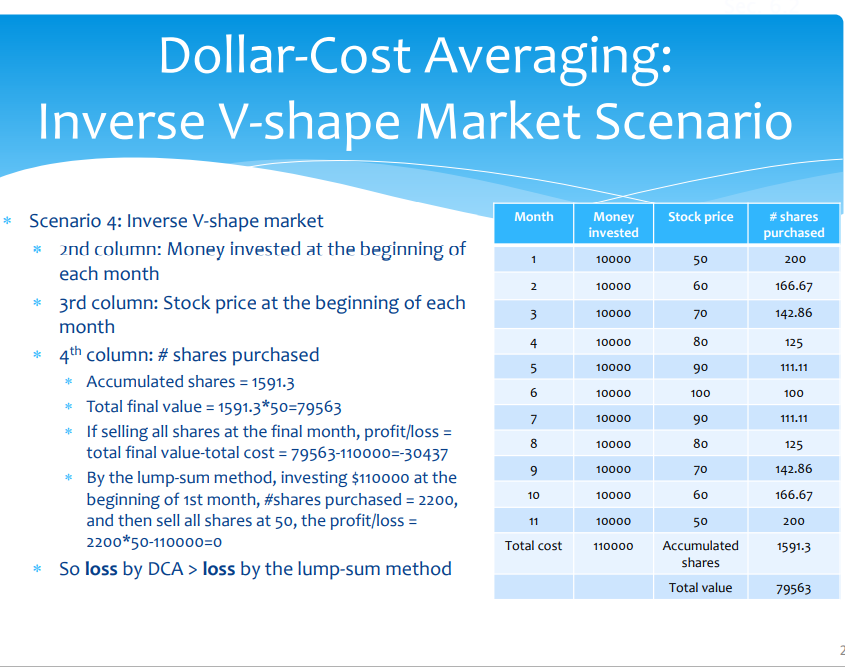

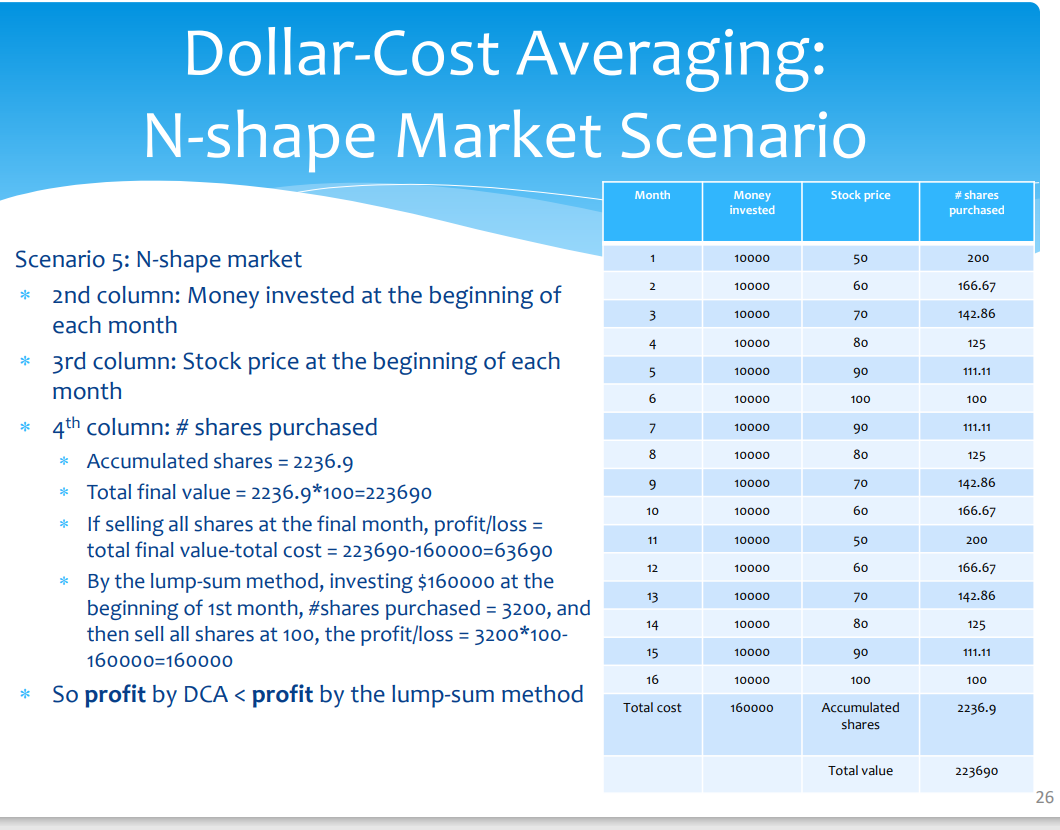

* W-shape and inverse W-shape market: Stock price moves in a fairly stable range without any distinct trends over certain period of time * Scenario 1: Falling market * 2nd column: Money invested at the beginning of each month * 3rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =845.63 * Total final value =845.6350=42282 * If selling all shares at the final month, profit/loss = total final value-total cost =4228260000=17718 * By the lump-sum method, investing $60000 at the beginning of 1st month, #shares purchased =600, and then sell all shares at 50 , the profit/loss= 6005060000=30000 * So loss by DCA 4th column: # shares purchased * Accumulated shares =845.63 * Total final value =845.63100=84563 * If selling all shares at the final month, profit/loss = total final value-total cost =8456360000=24563 * By the lump-sum method, investing $60000 at the beginning of 1st month, #shares purchased =1200, and then sell all shares at 100 , the profit/loss =1200100 60000=60000 * So profit by DCA 4th column: # shares purchased * Accumulated shares =1491.3 * Total final value =14913100=149130 * If selling all shares at the final month, profit/loss = total final value-total cost =149130110000=39130 * By the lump-sum method, investing $110000 at the beginning of 1st month, #shares purchased =1100, and then sell all shares at 100 , the profit/loss =1100100 - 110000=0 * So profit by DCA > profit by the lump-sum method llar-Cost Averaging: Inverse V-shape Market Scenario Scenario 4: Inverse V-shape market * 2nd column: Money invested at the beginning of each month * 3rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =1591.3 * Total final value =1591350=79563 * If selling all shares at the final month, profit/loss = total final value-total cost =79563110000=30437 * By the lump-sum method, investing $110000 at the beginning of 1st month, #shares purchased =2200, and then sell all shares at 50 , the profit/loss = 220050110000=0 * So loss by DCA > loss by the lump-sum method Dollar-Cost Averaging: N-shape Market Scenario Scenario 5: N-shape market * 2nd column: Money invested at the beginning of each month * 3 rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =2236.9 * Total final value =2236.9100=223690 * If selling all shares at the final month, profit/loss = total final value-total cost =223690160000=63690 * By the lump-sum method, investing $160000 at the beginning of 1 st month, #shares purchased =3200, and then sell all shares at 100 , the profit/loss =3200100 - 160000=160000 * So profit by DCA * W-shape and inverse W-shape market: Stock price moves in a fairly stable range without any distinct trends over certain period of time * Scenario 1: Falling market * 2nd column: Money invested at the beginning of each month * 3rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =845.63 * Total final value =845.6350=42282 * If selling all shares at the final month, profit/loss = total final value-total cost =4228260000=17718 * By the lump-sum method, investing $60000 at the beginning of 1st month, #shares purchased =600, and then sell all shares at 50 , the profit/loss= 6005060000=30000 * So loss by DCA 4th column: # shares purchased * Accumulated shares =845.63 * Total final value =845.63100=84563 * If selling all shares at the final month, profit/loss = total final value-total cost =8456360000=24563 * By the lump-sum method, investing $60000 at the beginning of 1st month, #shares purchased =1200, and then sell all shares at 100 , the profit/loss =1200100 60000=60000 * So profit by DCA 4th column: # shares purchased * Accumulated shares =1491.3 * Total final value =14913100=149130 * If selling all shares at the final month, profit/loss = total final value-total cost =149130110000=39130 * By the lump-sum method, investing $110000 at the beginning of 1st month, #shares purchased =1100, and then sell all shares at 100 , the profit/loss =1100100 - 110000=0 * So profit by DCA > profit by the lump-sum method llar-Cost Averaging: Inverse V-shape Market Scenario Scenario 4: Inverse V-shape market * 2nd column: Money invested at the beginning of each month * 3rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =1591.3 * Total final value =1591350=79563 * If selling all shares at the final month, profit/loss = total final value-total cost =79563110000=30437 * By the lump-sum method, investing $110000 at the beginning of 1st month, #shares purchased =2200, and then sell all shares at 50 , the profit/loss = 220050110000=0 * So loss by DCA > loss by the lump-sum method Dollar-Cost Averaging: N-shape Market Scenario Scenario 5: N-shape market * 2nd column: Money invested at the beginning of each month * 3 rd column: Stock price at the beginning of each month * 4th column: # shares purchased * Accumulated shares =2236.9 * Total final value =2236.9100=223690 * If selling all shares at the final month, profit/loss = total final value-total cost =223690160000=63690 * By the lump-sum method, investing $160000 at the beginning of 1 st month, #shares purchased =3200, and then sell all shares at 100 , the profit/loss =3200100 - 160000=160000 * So profit by DCA