Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the Bakab Company time series analysis should be applied for most recent years(i.e. as of 31 December 2020 and 31 December 2021) Break your

For the Bakab Company time series analysis should be applied for most recent years(i.e. as of 31 December 2020 and 31 December 2021)

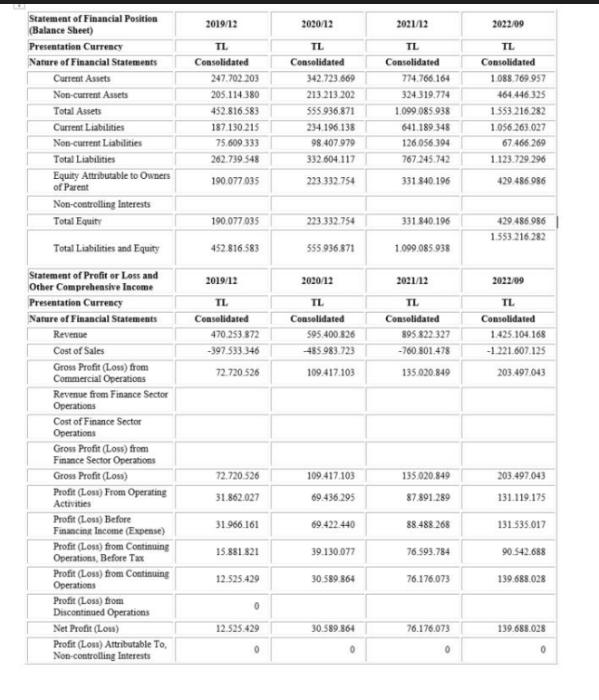

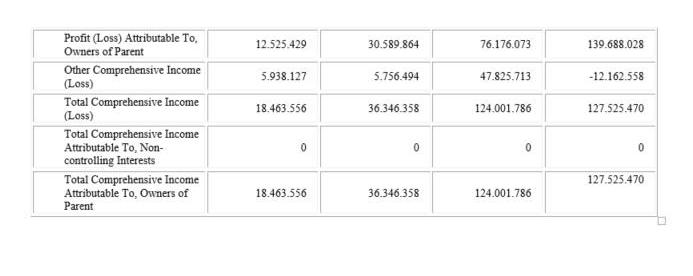

Statement of Financial Position (Balance Sheet) Presentation Currency Nature of Financial Statements Current Assets Non-current Assets Total Assets Current Liabilities Non-current Liabilities Total Liabilities Equity Attributable to Owners of Parent Non-controlling Interests Total Equity Total Liabilities and Equity Statement of Profit or Loss and Other Comprehensive Income Presentation Currency Nature of Financial Statements Revenue Cost of Sales Gross Profit (Loss) from Commercial Operations Revenue from Finance Sector Operations Cost of Finance Sector Operations Gross Profit (Loss) from Finance Sector Operations Gross Profit (Loss) Profit (Loss) From Operating Activities Profit (Loss) Before Financing Income (Expense) Profit (Loss) from Continuing Operations, Before Tax Profit (Loss) from Continuing Operations Profit (Loss) from Discontinued Operations Net Profit (Loss) Profit (Loss) Attributable To, Non-controlling Interests 2019/12 TL Consolidated 247.702 203 205.114.380 452.816.583 187.130.215 75.609.333 262.739.548 190.077.035 190.077.035 452.816.583 2019/12 TL Consolidated 470.253.872 -397.533.346 72.720.526 72.720.526 31.862.027 31.966.161 15.881.821 12.525.429 0 12.525.429 0 2020/12 TL Consolidated 342.723.669 213.213.202 555.936.871 234.196.138 98.407.979 332.604.117 223.332.754 223.332.754 555.936.871 2020/12 TL Consolidated 595.400.826 -485.983.723 109.417.103 109.417.103 69.436.295 69.422.440 39.130.077 30.589.864 30.589.864 0 2021/12 TL Consolidated 774.766.164 324.319.774 1.099.085.938 641.189 348 126.056.394 767 245.742 331 840.196 331.840.196 1.099.085.938 2021/12 TL Consolidated 895.822.327 -760 801.478 135.020.849 135.020.849 87.891.289 88.488.268 76.593.784 76.176.073 76.176.073 0 2022/09 TL Consolidated 1.088.769.957 464.446.325 1.553.216.282 1.056.263.027 67.466.269 1.123.729.296 429.486.986 429.486.986 1.553.216.282 2022/09 TL Consolidated 1.425.104.168 -1.221.607.125 203.497.043 203.497,043 131.119.175 131.535.017 90.542.688 139.688.028 139.688.028 0

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

step 1 st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started