For the below, make the following assumptions (except where noted in the questions below): All tables provided.

- D = 0.2 (both for Media General and the media companies in Exhibit 12)

- The market premium is 6%

- The marginal tax rate is 35%

- The deal closes 1/1/2012 (so it is not necessary to consider any partial year discounting of cash flows).

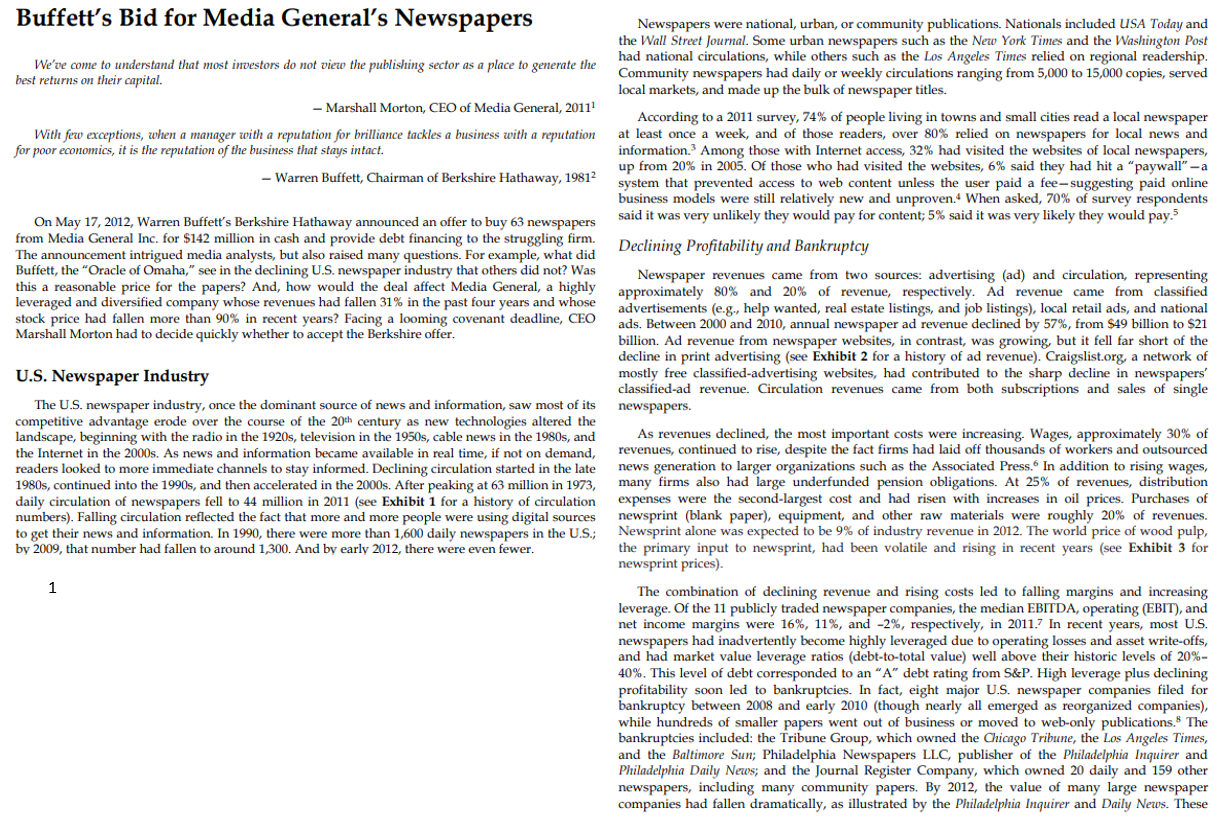

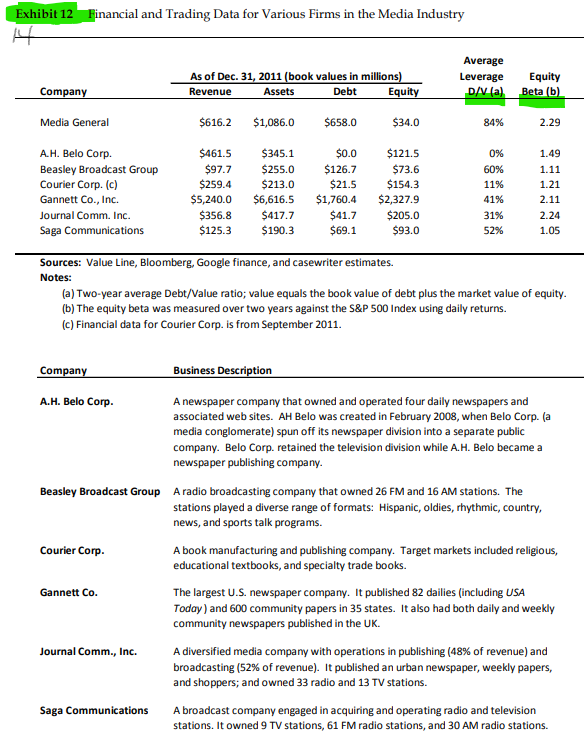

Question 1. Use the information in Exhibit 12 to calculate an appropriate measure of the business risk of the assets Berkshire will acquire in the proposed deal (i.e., OA). Be sure to justify your choices.

Calculate a cost of debt capital, a cost of equity capital, and WACC for the deal(show steps). To begin, you should assume a target leverage ratio of 20% for the Media General assets that are part of the deal. The case tells us that historic leverage ratios among newspapers had been between 20% and 40%. This might suggest that 20% is a conservative assumption. On the other hand, the nature of the business appears to be changing and it could be that the debt capacity of newspapers will be lower in the future. Given this, what WACC would you obtain if instead you used 10% or 40% as target leverage ratios?

| Exhibit 12 Financial and Trading Data for Firms in the Media Industry | | | | |

| | | | | | | Average | | |

| | | | | As of Dec. 31, 2011 (book values in millions) | | Leverage | Equity | |

| | Company | | Revenue | Assets | Debt | Equity | | D/V (a) | Beta (b) | |

| | | | | | | | | | | | |

| | Media General | $616.2 | $1,086.0 | $658.0 | $34.0 | | 84% | 2.29 | |

| | | | | | | | | | | | |

| | A.H. Belo Corp. | $461.5 | $345.1 | $0.0 | $121.5 | | 0% | 1.49 | |

| | Beasley Broadcast Group | $97.7 | $255.0 | $126.7 | $73.6 | | 60% | 1.11 | |

| | Courier Corp. (c) | $259.4 | $213.0 | $21.5 | $154.3 | | 11% | 1.21 | |

| | Gannett Co., Inc. | $5,240.0 | $6,616.5 | $1,760.4 | $2,327.9 | | 41% | 2.11 | |

| | Journal Comm. Inc. | $356.8 | $417.7 | $41.7 | $205.0 | | 31% | 2.24 | |

| | Saga Communications | $125.3 | $190.3 | $69.1 | $93.0 | | 52% | 1.05 | |

| | | | | | | | | | | | |

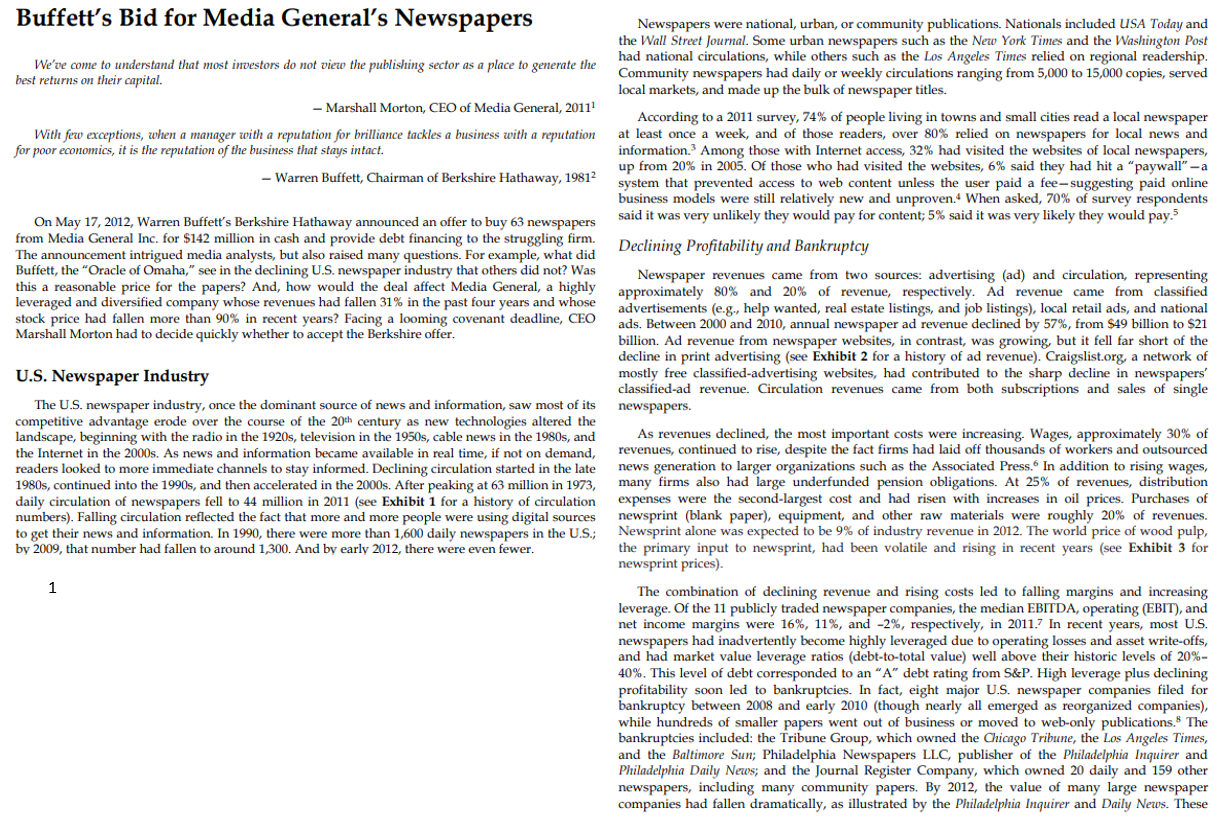

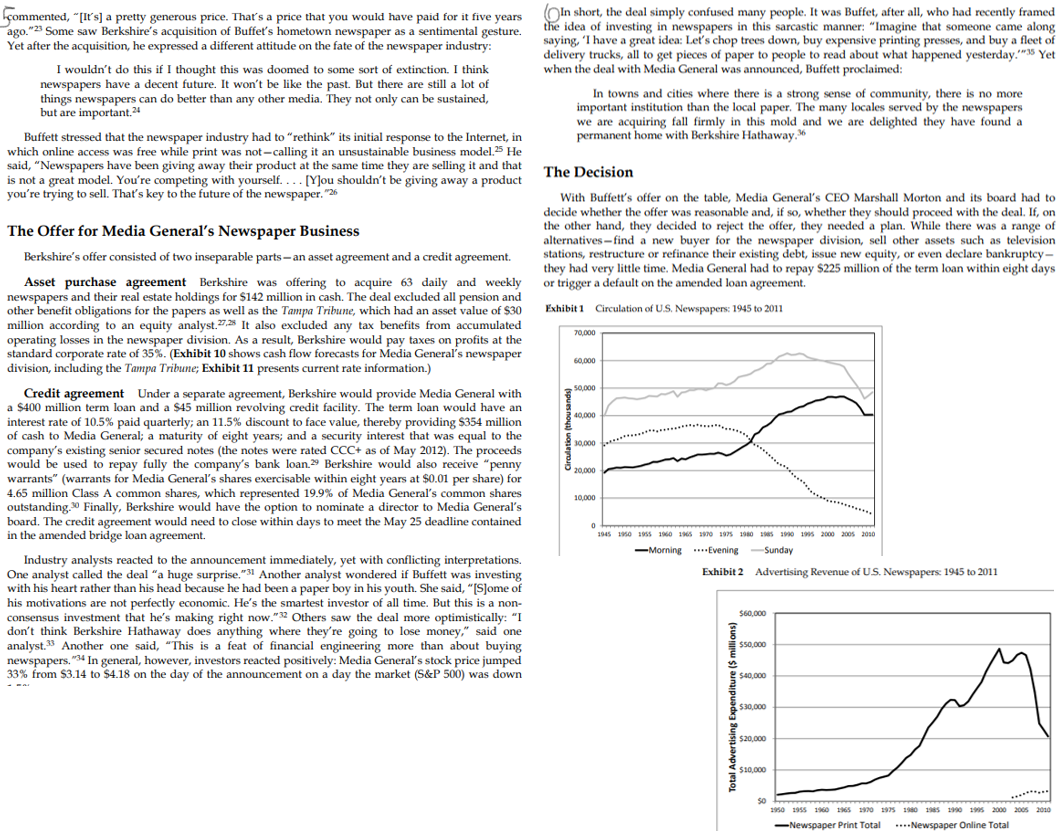

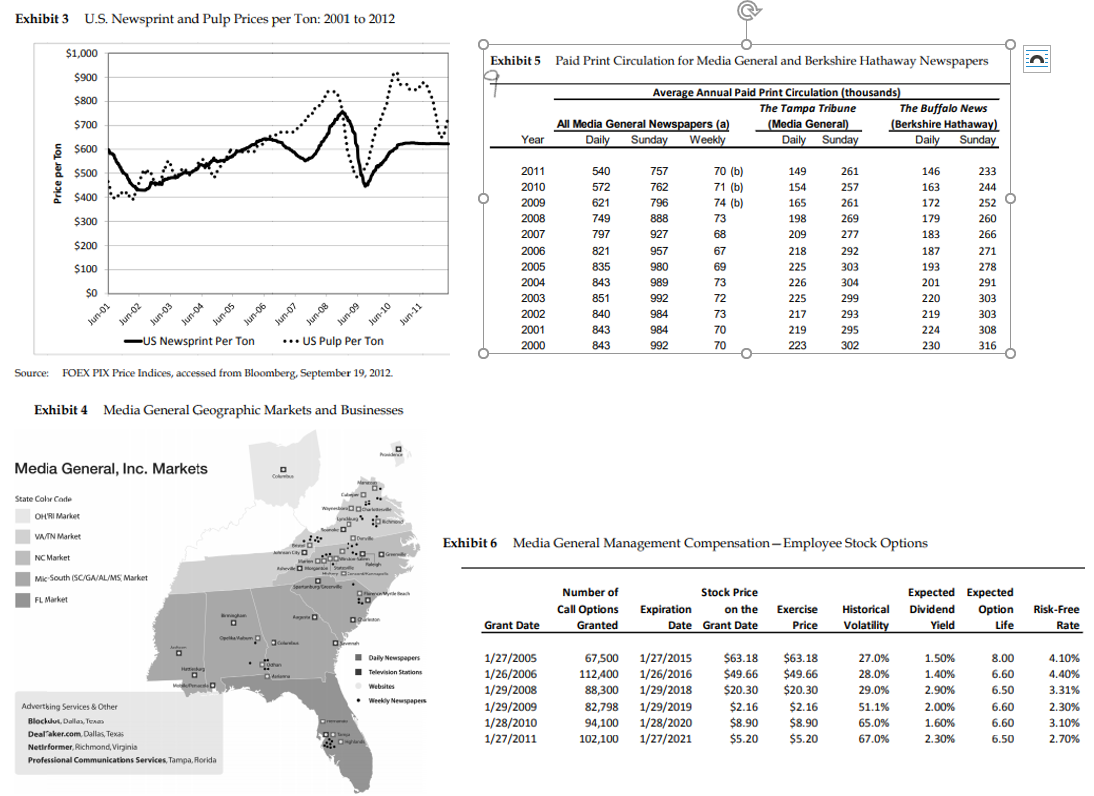

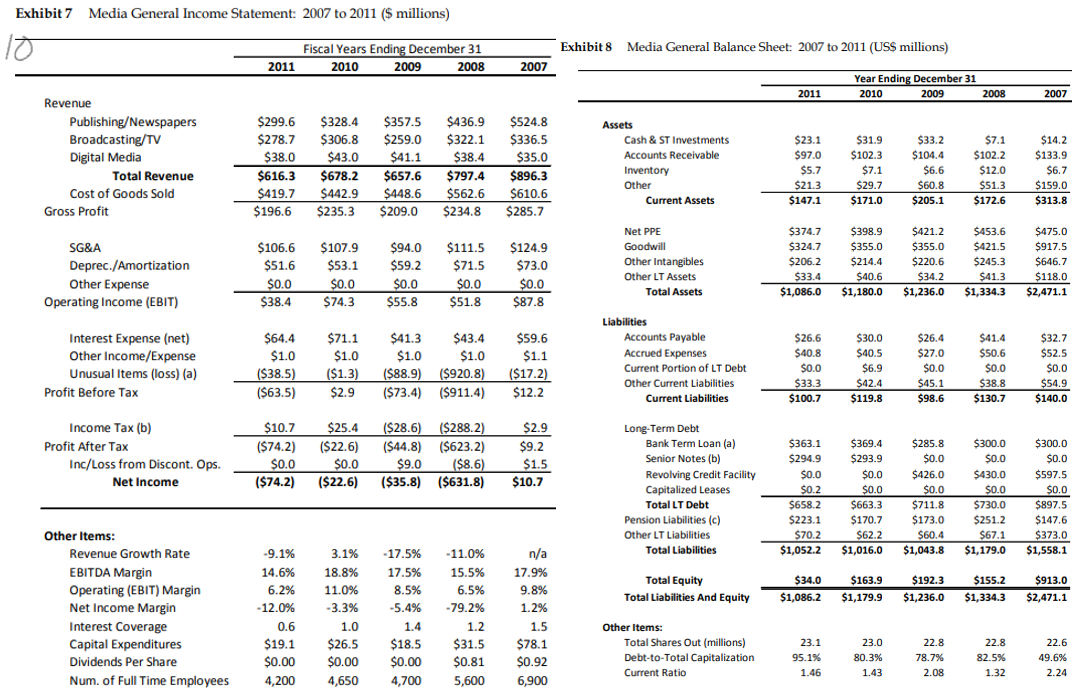

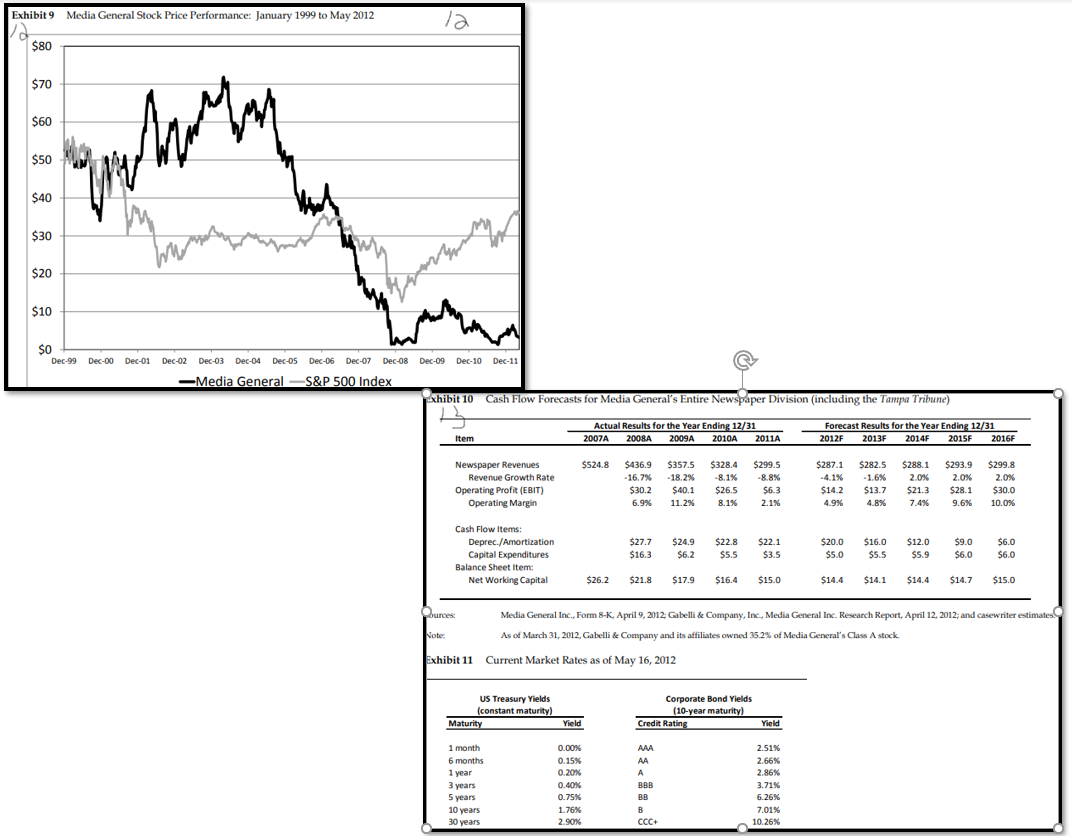

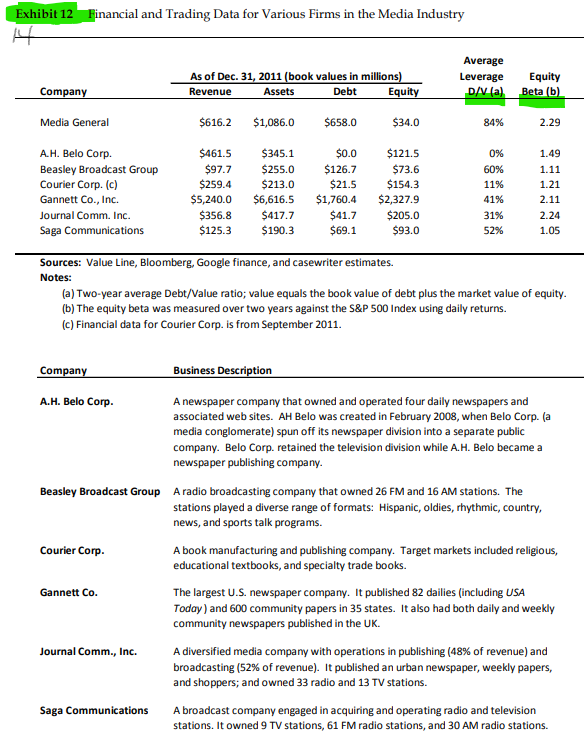

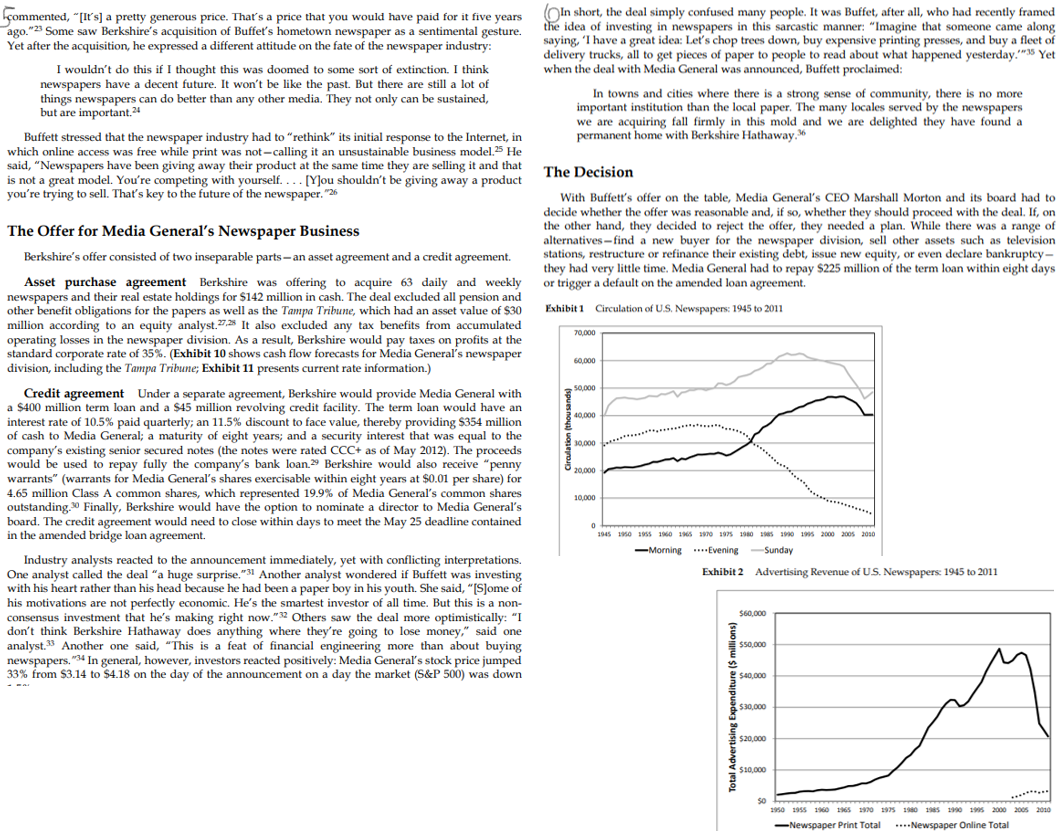

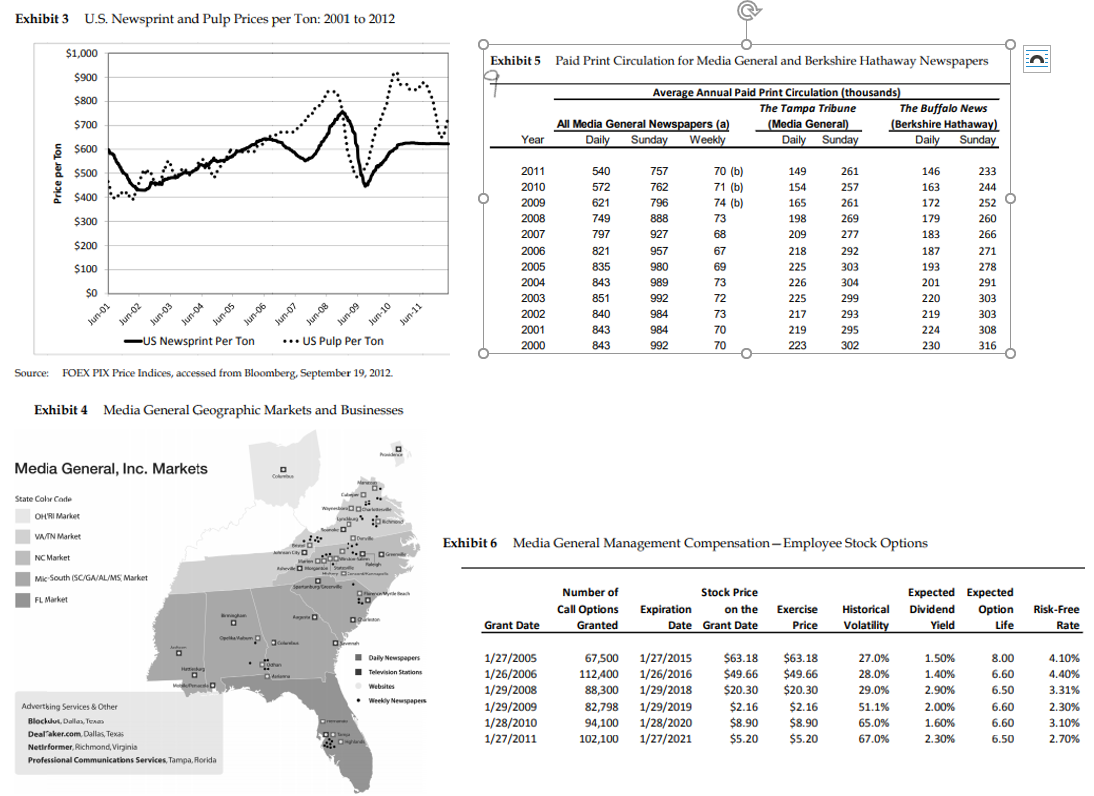

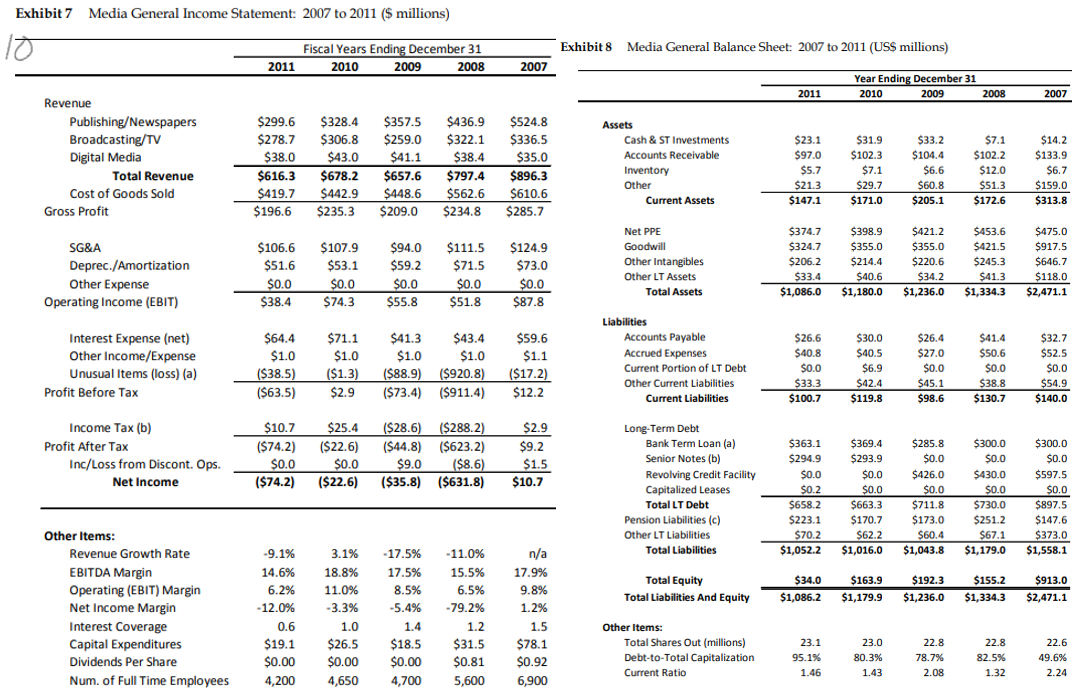

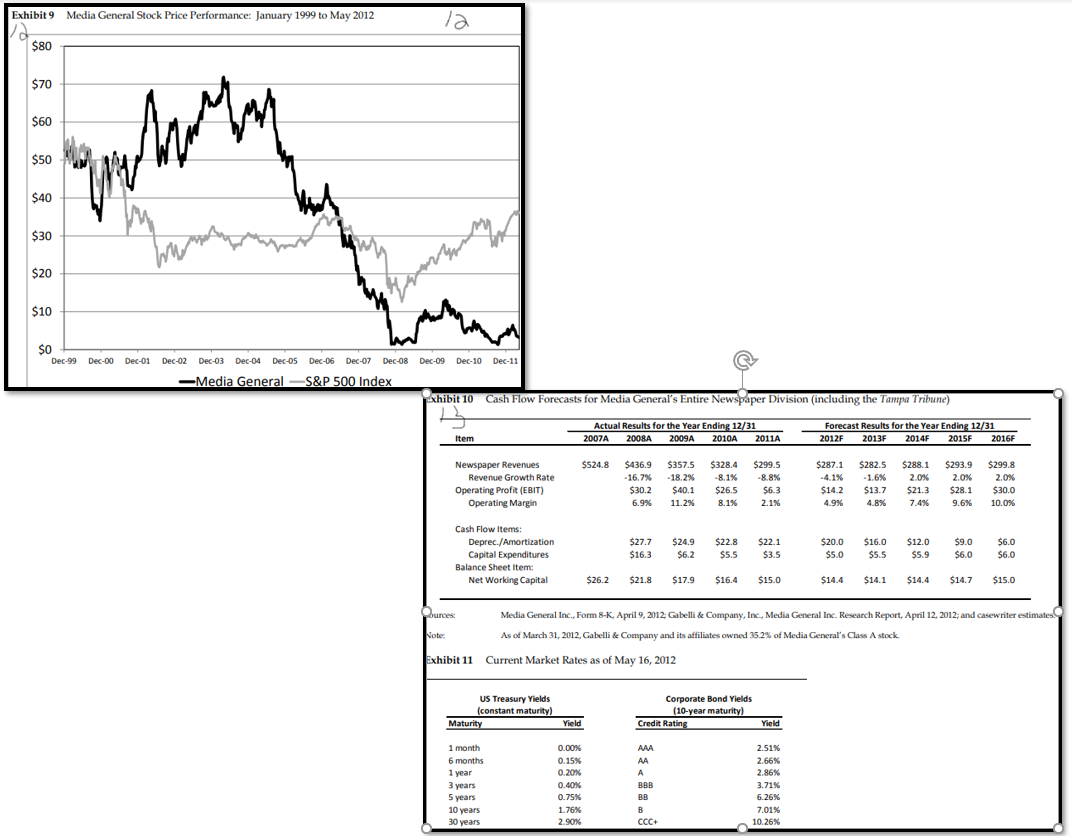

Buffett's Bid for Media General's Newspapers Newspapers were national, urban, or community publications. Nationals included USA Today and the Wall Street Journal. Some urban newspapers such as the New York Times and the Washington Post had national circulations, while others such as the Los Angeles Times relied on regional readership. Community newspapers had daily or weekly circulations ranging from 5,000 to 15,000 copies, served local markets, and made up the bulk of newspaper titles. We've come to understand that most investors do not view the publishing sector as a place to generate the best returns on their capital. - Marshall Morton, CEO of Media General, 2011 With few exceptions, when a manager with a reputation for brilliance tackles a business with a reputation for poor economics, it is the reputation of the business that stays intact. According to a 2011 survey, 74% of people living in towns and small cities read a local newspaper at least once a week, and of those readers, over 80% relied on newspapers for local news and information. Among those with Internet access, 32% had visited the websites of local newspapers, up from 20% in 2005. Of those who had visited the websites, 6% said they had hit a "paywall" -a system that prevented access to web content unless the user paid a fee-suggesting paid online business models were still relatively new and unproven. When asked, 70% of survey respondents said it was very unlikely they would pay for content; 5% said it was very likely they would pay. - Warren Buffett, Chairman of Berkshire Hathaway, 19812 Declining Profitability and Bankruptcy On May 17, 2012, Warren Buffett's Berkshire Hathaway announced an offer to buy 63 newspapers from Media General Inc. for $142 million in cash and provide debt financing to the struggling firm. The announcement intrigued media analysts, but also raised many questions. For example, what did Buffett, the "Oracle of Omaha," see in the declining U.S. newspaper industry that others did not? Was this a reasonable price for the papers? And, how would the deal affect Media General, a highly leveraged and diversified company whose revenues had fallen 31% in the past four years and whose stock price had fallen more than 90% in recent years? Facing a looming covenant deadline, CEO Marshall Morton had to decide quickly whether to accept the Berkshire offer. Newspaper revenues came from two sources: advertising (ad) and circulation, representing approximately 80% and 20% of revenue, respectively. Ad revenue came from classified advertisements (e.g., help wanted, real estate listings, and job listings), local retail ads, and national ads. Between 2000 and 2010, annual newspaper ad revenue declined by 57%, from $49 billion to $21 billion. Ad revenue from newspaper websites, in contrast, was growing, but it fell far short of the decline in print advertising (see Exhibit 2 for a history of ad revenue). Craigslist.org, a network of mostly free classified advertising websites, had contributed to the sharp decline in newspapers' classified ad revenue. Circulation revenues came from both subscriptions and sales of single newspapers. U.S. Newspaper Industry The U.S. newspaper industry, once the dominant source of news and information, saw most of its competitive advantage erode over the course of the 20th century as new technologies altered the landscape, beginning with the radio in the 1920s, television in the 1950s, cable news in the 1980s, and the Internet in the 2000s. As news and information became available in real time, if not on demand, readers looked to more immediate channels to stay informed. Declining circulation started in the late 1980s, continued into the 1990s, and then accelerated in the 2000s. After peaking at 63 million in 1973, daily circulation of newspapers fell to 44 million in 2011 (see Exhibit 1 for a history of circulation numbers). Falling circulation reflected the fact that more and more people were using digital sources to get their news and information. In 1990, there were more than 1,600 daily newspapers in the U.S.; by 2009, that number had fallen to around 1,300. And by early 2012, there were even fewer. As revenues declined, the most important costs were increasing. Wages, approximately 30% of revenues, continued to rise, despite the fact firms had laid off thousands of workers and outsourced news generation to larger organizations such as the Associated Press. In addition to rising wages, many firms also had large underfunded pension obligations. At 25% of revenues, distribution expenses were the second-largest cost and had risen with increases in oil prices. Purchases of newsprint (blank paper), equipment, and other raw materials were roughly 20% of revenues. Newsprint alone was expected to be 9% of industry revenue in 2012. The world price of wood pulp, the primary input to newsprint, had been volatile and rising in recent years (see Exhibit 3 for newsprint prices). The combination of declining revenue and rising costs led to falling margins and increasing leverage. Of the 11 publicly traded newspaper companies, the median EBITDA, operating (EBIT), and net income margins were 16%, 11%, and -2%, respectively, in 2011.7 In recent years, most U.S. newspapers had inadvertently become highly leveraged due to operating losses and asset write-offs, and had market value leverage ratios (debt-to-total value) well above their historic levels of 20%- 40%. This level of debt corresponded to an "A" debt rating from S&P. High leverage plus declining profitability soon led to bankruptcies. In fact, eight major U.S. newspaper companies filed for bankruptcy between 2008 and early 2010 (though nearly all emerged as reorganized companies), while hundreds of smaller papers went out of business or moved to web-only publications. The bankruptcies included: the Tribune Group, which owned the Chicago Tribune, the Los Angeles Times, and the Baltimore Sun; Philadelphia Newspapers LLC, publisher of the Philadelphia Inquirer and Philadelphia Daily News; and the Journal Register Company, which owned 20 daily and 159 other newspapers, including many community papers. By 2012, the value of many large newspaper companies had fallen dramatically, as illustrated by the Philadelphia Inquirer and Daily News. These papers had been sold three times in recent years: they sold for $515 million in 2006, $139 million in 2011 to 5.5X by the end of 2012, the maximum permitted ratio was 7.75X.14 In addition to its financial 2010, and only $55 million in early 2012.9 leverage, the company had pension and postretirement benefit obligations totaling $455 million, of which $132 million was underfunded. In its 2011 annual report, the company warned that "large Media General Inc. declines in the stock market and lower discount rates would increase the company's expense and necessitate additional cash contribution to the pension plans."15 Media General entered the newspaper business in 1850 as the Richmond (Virginia) Dispatch. Over time, it acquired a portfolio of other newspapers and diversified into television (TV) broadcasting In February 2012, management announced it had completed the first step in a refinancing process. and digital businesses (ie, interactive coupon websites) primarily serving the southeastern U.S. (see For a fee of $10 million, the company's lenders agreed to a short-term bridge amendment that waived Exhibit 4 for its geographic markets). As of 2012, it operated 18 TV stations and published 64 certain covenants and extended the maturity date of the bank loan by two years to March 2015, newspapers. Based on circulation, the largest newspapers were the Tampa Tribune, Riclumond Times provided Media General met certain conditions.16 The key condition was the need to raise $225 million prior to May 25, 2012, to prepay a portion of the outstanding bank loan and to establish daily and weekly) such as the Goochland Gazette, Culpepper Star Exponent, Hickory SuperBuzz, and other certain liquidity reserves. The amendment permitted Media General to raise new debt to satisfy this niche publications such as Gotcha!, which covered crime news and contained mug shots of criminals. obligation. Later in February, Media General announced that its newspaper business was up for (Exhibit 5 shows circulation data for Media General and its largest newspaper, the Tampa Tribune.) sale as a way to meet this condition and that it had received inquiries from several parties. For much of the company's history, the Bryan family ran the business and held a majority stake. J. Stewart Bryan, the fourth-generation owner, became CEO in 1990 and chairman in 2000. As of 2012, Berkshire Hathaway Bryan still held a controlling interest in the paper through the company's Class B shares. The company's 22.55 million Class A shares were listed on the New York Stock Exchange (NYSE). Its 0.55 Based in Omaha, Nebraska, Berkshire Hathaway Inc. (Berkshire) was a decentralized holding million Class B shares were not publicly traded. Although the Class B shares had greater voting company with a buy-and-hold investment strategy. Its top holdings included stakes in American rights, they had similar cash flow and dividend rights as the Class A shares. Bryan, and the entire Express, Coca-Cola, and Goldman Sachs. In recent years, Berkshire had bought Lubrizol Corporation, senior management team, received compensation consisting of a base salary, annual incentives, and a specialty chemical company, for $9.7 billion in 2011, and Burlington Northern Santa Fe Corporation, long-term incentives, including stock options. (Exhibit 6 shows stock options granted to seniora U.S. railway transportation company, for $16 billion in 2010. Over 90% of Berkshire's holdings were executives in recent years.) In 2011, the company's top seven executives earned $6.1 million in in U.S. and Canadian companies, with large cap stocks representing over 96% of the firm's portfolio. compensation, while officers and directors held 2.42 million A shares and 0.47 million B shares." Buffett became Berkshire's chairman in 1970, eight years after he began buying shares of the then- struggling textile company. Although Buffett called Berkshire "the dumbest stock" he ever bought, 19 Media General's performance started to deteriorate in 2007 as the industry began to change. After peaking at $983 million in 2006, total revenues fell to $616 million in 2011. But the decline varied by he transformed the company into an investment vehicle that was famous for generating high returns line of business. Whereas broadcasting was down 17% from 2007 to 2011, the newspaper division was for investors. down 43%. After a modest profit in 2007, the company lost money in each of the next four years - Buffett's relationship with newspapers dated back to the 1940s when he was a paper boy in culminating in a loss of $74 million in 2011 - and experienced a particularly large write-off in 2008 Washington, D.C. His business relationship with newspapers began years later when Berkshire due to asset impairment and other charges. (Exhibits 7 and 8 present the company's income bought the Washington Post in 1973. Four years later, Berkshire acquired the Buffalo News for $32.5 statements and balance sheets. Given these operating losses and asset write-offs, Media General's CFO said the firm did not expect to pay cash taxes for the "foreseeable future."12 million.20 After 10 years of losing money, the newspaper finally became profitable (see Exhibit 5 for circulation data). Although Buffet retained his love of newspapers over the years, his view of them as Management responded by cutting costs and other financial commitments. Between 2007 and investment opportunities wavered over time. In his 2007 letter to Berkshire shareholders, he wrote: 2011, the company shed almost 40% of its workforce (2,700 people). Over the same period, it cut capital expenditures from $78 million to $19 million. To further save cash, the company eliminated its Aspiring press lords should be careful, however: There's no rule that says a newspaper's revenues can't fall below its expenses and that losses can't mushroom. dividend in 2009. This combination of events caused the stock price to fall from a high of almost $72 in 2004 to a low of $1.20 in October 2011 (see Exhibit 9 for stock performance), and left the firm Fixed costs are high in the newspaper business, and that's bad news when unit volume highly leveraged. heads south. As the importance of newspapers diminishes, moreover, the "psychic" value of possessing one will wane. In December 2011, the company had total debt of $658 million. Approximately half the debt was in the form of a variable-rate syndicated bank loan for $363 million that was due in March 2013. The As recently as May 2009, Buffett had said: remaining $295 million was in the form of senior secured notes that were issued in 2010, were rated CCC+, and paid quarterly interest at the rate of 11.75%. These notes had a face amount of $300 [W]e would not buy (newspapers) at any price. Twenty to 40 years ago, they were million and were due in 2017. The company's CFO admitted, "[W]e have become uncomfortable with essential to customers and advertisers. They had pricing power, but they've lost their our ability to remain in compliance with our [loan] covenants in the current operating environment essential nature-essentiality has eroded. Erosion (has) accelerated dramatically, and it absent modifications."13 According to the loan agreement, Media General needed to reduce its won't end based on anything on the horizon. We do not see anything to reverse it.22 maximum leverage ratio (total debt plus leases and guarantees to EBITDA) from 7.43X at the end of But in November 2011, Buffett did something that puzzled people: Berkshire acquired the Omaha World-Herald newspaper and several newspapers in Iowa and Nebraska for $200 million. One analyst commented, [It's a pretty generous price. That's a price that you would have paid for it five years ago."2 Some saw Berkshire's acquisition of Buffet's hometown newspaper as a sentimental gesture. Yet after the acquisition, he expressed a different attitude on the fate of the newspaper industry: In short, the deal simply confused many people. It was Buffet, after all, who had recently framed the idea of investing in newspapers in this sarcastic manner: "Imagine that someone came along saying, 'I have a great idea: Let's chop trees down, buy expensive printing presses, and buy a fleet of delivery trucks, all to get pieces of paper to people to read about what happened yesterday. Yet when the deal with Media General was announced, Buffett proclaimed: I wouldn't do this if I thought this was doomed to some sort of extinction. I think newspapers have a decent future. It won't be like the past. But there are still a lot of things newspapers can do better than any other media. They not only can be sustained, but are important.24 In towns and cities where there is a strong sense of community, there is no more important institution than the local paper. The many locales served by the newspapers we are acquiring fall firmly in this mold and we are delighted they have found a permanent home with Berkshire Hathaway. 36 Buffett stressed that the newspaper industry had to "rethink" its initial response to the Internet, in which online access was free while print was not-calling it an unsustainable business model. He said, "Newspapers have been giving away their product at the same time they are selling it and that is not a great model. You're competing with yourself. ... [You shouldn't be giving away a product you're trying to sell. That's key to the future of the newspaper."26 The Offer for Media General's Newspaper Business Berkshire's offer consisted of two inseparable parts-an asset agreement and a credit agreement. The Decision With Buffett's offer on the table, Media General's CEO Marshall Morton and its board had to reasonable and, if so, whether they should proceed with the deal. If, on the other hand, they decided to reject the offer, they needed a plan. While there was a range of alternatives-find a new buyer for the newspaper division, sell other assets such as television stations, restructure or refinance their existing debt, issue new equity, or even declare bankruptcy- they had very little time. Media General had to repay $225 million of the term loan within eight days or trigger a default on the amended loan agreement. Exhibit 1 Circulation of US Newspapers: 1945 to 2011 Asset purchase agreement Berkshire was offering to acquire 63 daily and weekly newspapers and their real estate holdings for $142 million in cash. The deal excluded all pension and other benefit obligations for the papers as well as the Tampa Tribune, which had an asset value of $30 million according to an equity analyst.27.25 It also excluded any tax benefits from accumulated operating losses in the newspaper division. As a result, Berkshire would pay taxes on profits at the standard corporate rate of 35%. (Exhibit 10 shows cash flow forecasts for Media General's newspaper division, including the Tampa Tribune; Exhibit 11 presents current rate information.) 60,000 250.000 (thousands) 340.000 9 30.000 Credit agreement Under a separate agreement, Berkshire would provide Media General with a $400 million term loan and a $45 million revolving credit facility. The term loan would have an interest rate of 10.5% paid quarterly; an 11.5% discount to face value, thereby providing $354 million of cash to Media General; a maturity of eight years, and a security interest that was equal to the company's existing senior secured notes (the notes were rated CCC+ as of May 2012). The proceeds would be used to repay fully the company's bank loan.29 Berkshire would also receive "penny warrants" (warrants for Media General's shares exercisable within eight years at $0.01 per share) for 4.65 million Class A common shares, which represented 19.9% of Media General's common shares outstanding. Finally, Berkshire would have the option to nominate a director to Media General's board. The credit agreement would need to close within days to meet the May 25 deadline contained in the amended bridge loan agreement. 20,000 10.000 1945 1950 1959 1960 1969 1970 1975 180 185 190 195 2000 2001 2000 -Morning Evening Sunday Exhibit 2 Advertising Revenue of U.S. Newspapers: 1945 to 2011 Industry analysts reacted to the announcement immediately, yet with conflicting interpretations. One analyst called the deal "a huge surprise."31 Another analyst wondered if Buffett was investing with his heart rather than his head because he had been a paper boy in his youth. She said, "Some of his motivations are not perfectly economic. He's the smartest investor of all time. But this is a non- consensus investment that he's making right now."32 Others saw the deal more optimistically: "I don't think Berkshire Hathaway does anything where they're going to lose money," said one analyst. Another one said, "This is a feat of financial engineering more than about buying newspapers.34 In general, however, investors reacted positively: Media General's stock price jumped 33% from $3.14 to $4.18 on the day of the announcement on a day the market (S&P 500) was down $60,000 550,000 Total Advertising Expenditure ($ millions) 30,000 3950 1959 1960 1965 1970 1979 1980 1989 1990 195 2000 2005 2010 -Newspaper Print Total ...Newspaper Online Total Exhibit 3 U.S. Newsprint and Pulp Prices per Ton: 2001 to 2012 Exhibit 5 Paid Print Circulation for Media General and Berkshire Hathaway Newspapers $1,000 $900 $800 Average Annual Paid Print Circulation (thousands) The Tampa Tribune The Buffalo News All Media General Newspapers (a) (Media General) (Berkshire Hathaway) Daily Sunday Weekly Daily Sunday Daily Sunday Year Price per Ton 2011 70 (b) 149 261 146 540 572 71 (b) 757 762 796 888 74 (b) 257 261 163 172 179 183 927 292 187 957 980 989 303 843 992 2004 2003 2002 2001 2000 984 193 201 220 219 224 230 851 840 843 843 217 299 293 295 302 984 219 303 308 316 - US Newsprint Per Ton US Pulp Per Ton 992 223 Source: FOEX PIX Price Indices, accessed from Bloomberg, September 19, 2012. Exhibit 4 Media General Geographic Markets and Businesses Media General, Inc. Markets State Cobe Code OHRI Market VATN Market Exhibit 6 Media General Management Compensation - Employee Stock Options NC Market Mic South SC/GA ALIMS Market FL Market Number of Call Options Granted Stock Price Expiration on the Date Grant Date Exercise Price Historical Volatility Expected Expected Dividend Option Yield Life Risk-Free Rate Grant Date Daily News 1/27/2005 1/26/2006 1/29/2008 1/29/2009 1/28/2010 1/27/2011 67,500 112,400 88,300 82,798 94,100 102,100 1/27/2015 1/26/2016 1/29/2018 1/29/2019 1/28/2020 1/27/2021 $63.18 $49.66 $20.30 $2.16 $8.90 $5.20 $63.18 $49.66 $20.30 $2.16 $8.90 $5.20 27.0% 28.0% 29.0% 51.1% 65.0% 67.0% 1.50% 1.40% 2.90% 2.00% 1.60% 2.30% 8.00 6.60 6.50 6.60 6.60 6.50 4.10% 4.40% 3.31% 2.30% 3.10% 2.70% Advertising Services & Other Blockbut. Dalam Dealer.com, Dallas, Texas Netirformer, Richmond, Virginia Professional Communications Services Tampa, Horida Exhibit 7 Media General Income Statement: 2007 to 2011 ($ millions) Exhibit 8 Media General Balance Sheet: 2007 to 2011 (US$ millions) Fiscal Years Ending December 31 2010 2009 2008 2011 2007 2011 Year Ending December 31 2010 2009 2008 2007 Revenue Publishing/Newspapers Broadcasting/TV Digital Media Total Revenue Cost of Goods Sold Gross Profit $299.6 $278.7 $38.0 $616.3 $419.7 $196.6 $328.4 $306.8 $43.0 $678.2 $442.9 $235.3 $357.5 $259.0 $41.1 $657.6 $448.6 $209.0 $436.9 $322.1 $38.4 $797.4 $562.6 $234.8 $524.8 $336.5 $35.0 $896.3 $610.6 $285.7 Assets Cash & ST Investments Accounts Receivable Inventory Other Current Assets $23.1 $97.0 $5.7 $21.3 $147.1 $31.9 $102.3 $7.1 $29.7 $171.0 $33.2 $104.4 $6.6 $60.8 $205.1 $7.1 $102.2 $12.0 $51.3 $172.6 $14.2 $133.9 $6.7 $159.0 $313.8 $374.7 $324.7 $124.9 $73.0 SG&A Deprec./Amortization Other Expense Operating Income (EBIT) $106.6 $51.6 $0.0 $38.4 $107.9 $53.1 $0.0 $74.3 $94.0 $59.2 $0.0 $55.8 $111.5 $71.5 $0.0 $51.8 Net PPE Goodwill Other Intangibles Other LT Assets Total Assets $206.2 $33.4 $1,086.0 $398.9 $355.0 $214.4 $40.6 $1,180.0 $421.2 $355.0 $220.6 $34.2 $1,236.0 $453.6 $421.5 $245.3 $41.3 $1,334.3 $475.0 $917.5 $646.7 $1180 $2,471.1 $87.8 Interest Expense (net) Other Income/Expense Unusual Items (loss) (a) Profit Before Tax $64.4 $1.0 ($38.5) ($63.5) $71.1 $1. 0 ($1.3) $2.9 $41.3 9 1.0 ($88.9) $73.4) $43.4 $1.0 ($920.8) ($911.4) $59.6 91.1 ($17.2) $12.2 Liabilities Accounts Payable Accrued Expenses Current Portion of LT Debt Other Current Liabilities Current Liabilities $26.6 $40.8 $0.0 $33.3 $100.7 $30.0 $40.5 $6.9 $42.4 $119.8 $26.4 $27.0 $0.0 $45.1 $98.6 $41.4 $50.6 $0.0 $38.8 $130.7 $32.7 $52.5 $0.0 $54.9 $140.0 Income Tax (b) Profit After Tax Inc/Loss from Discont. Ops. Net Income $10.7 ($74.2) $0.0 ($74.2) $25.4 ($22.6) $0.0 ($22.6) ($28.6) ($44.8) $9.0 ($35.8) ($288.2) ($623.2) ($8.6) ($631.8) $363.1 $294.9 $0.0 $10.7 Long-Term Debt Bank Term Loan (a) Senior Notes (b) Revolving Credit Facility Capitalized Leases Total LT Debt Pension Liabilities (c) Other LT Liabilities Total Liabilities $285.8 $0.0 $426.0 $0.0 $711.8 $173.0 $0.2 $369.4 $293.9 $0.0 $0.0 $663.3 $170.7 $62.2 $1,016.0 $300.0 $0.0 $430.0 $0.0 $730.0 $251.2 $67.1 $1,179.0 $300.0 $0.0 $597.5 $0.0 $897.5 $147.6 $373.0 $1,558.1 $658.2 $223.1 $70.2 $1,052.2 n/a $1,043.8 Total Equity Total Liabilities And Equity $34.0 $1,086.2 $163.9 $1,179.9 $192.3 $1,236.0 $155.2 $1,334.3 $913.0 $2,471.1 Other Items: Revenue Growth Rate EBITDA Margin Operating (EBIT) Margin Net Income Margin Interest Coverage Capital Expenditures Dividends Per Share Num. of Full Time Employees -9.1% 14.6% 6.2% -12.0% 0.6 $19.1 $0.00 4,200 3.1% 18.8% 11.0% -3.3% 1.0 $26.5 $0.00 4,650 -17.5% 17.5% 8.5% -5.4% 1.4 $18.5 $0.00 4,700 -11.0% 15.5% 6.5% -79.2% 1.2 $31.5 $0.81 5,600 17.9% 9.8% 1.2% 1.5 $78.1 $0.92 6,900 Other Items: Total Shares Out (millions) Debt-to-Total Capitalization Current Ratio 23.1 95.1% 1.46 23.0 80.3% 1.43 22.8 78.7% .08 22.8 82.5% 1.32 22.6 49.6% 2.24 2 Exhibit 9 Media General Stock Price Performance: January 1999 to May 2012 Dec-99 Dec-00 Dec-01 Dec-09 Dec-10 Dec-11 Dec 02 Dec 03 Dec 04 Dec 05 Dec 06 Dec 07 Dec 08 -Media General --S&P 500 Index xhibit 10 Cash Flow Forecasts for Media General's Entire Newspaper Division (including the Tampa Tribune) Actual Results for the Year Ending 12/31 2007A 2008 2009 2010 2011A Forecast Results for the Year Ending 12/31 2012F2013F 2014 2015 2016F Item $524.8 Newspaper Revenues Revenue Growth Rate Operating Profit (EBIT) Operating Margin $436.9 .16.7% $30.2 6.9% $357.5 18.2% $40.1 11.2% $328.4 8.1% $26.5 8.1% $299.5 8.8% $6.3 2.1% $287.1 -4.1% $14.2 4.9% $282.5 -1.6% $13.7 4.8% $288.1 2.0% $21.3 7,4% $293.9 2.0% $28.1 9.6% $299.8 2.0% $30.0 10.0% Cash Flow Items: Deprec./Amortization Capital Expenditures Balance Sheet Item: Net Working Capital $27.7 $16.3 $24.9 $6.2 $22.8 $5.5 $22.1 $3.5 $20.0 $5.0 $16.0 $5.5 $12.0 $5.9 $9.0 $6.0 $6.0 $6.0 $26.2 $21.8 $17.9 $16.4 $15.0 $14.4 $14.1 $14.4 $14.7 $15.0 burces: Media General Inc., Form 8-K, April 9, 2012, Gabelli & Company, Inc., Media General Inc. Research Report, April 12, 2012, and casewriter estimates Note: As of March 31, 2012, Gabelli & Company and its affiliates owned 35.2% of Media General's Class A stock Exhibit 11 Current Market Rates as of May 16, 2012 US Treasury Yields (constant maturity) Maturity Corporate Bond Yields (10-year maturity) Credit Rating Yield Yield 1 month 6 months 1 year 3 years 5 years 10 years 30 years 0.00% 0.15% 0.20% 0.40% 0.75% A BBB 2.515 2.66% 2.86% 3.71% 6.26% 7.01% 10.26% 1.76% 2.90% CCC+ Exhibit 12 Financial and Trading Data for Various Firms in the Media Industry As of Dec. 31, 2011 (book values in millions) Revenue Assets Debt Equity Average Leverage D/V (a) Equity Beta (b) Company Media General $616.2 $1,086.0 $658.0 $34.0 84% 2.29 0% 60% 11% A.H. Belo Corp. Beasley Broadcast Group Courier Corp. (c) Gannett Co., Inc. Journal Comm. Inc. Saga Communications $461.5 $97.7 $259.4 $5,240.0 $356.8 $125.3 $345.1 $255.0 $213.0 $6,616.5 $417.7 $190.3 $0.0 $126.7 $21.5 $1,760.4 $41.7 $69.1 $121.5 $73.6 $154.3 $2,327.9 $205.0 $93.0 1.49 1.11 1.21 2.11 2.24 41% 31% 52% 1.05 Sources: Value Line, Bloomberg, Google finance, and casewriter estimates. Notes: (a) Two-year average Debt/Value ratio; value equals the book value of debt plus the market value of equity. (b) The equity beta was measured over two years against the S&P 500 Index using daily returns. (c) Financial data for Courier Corp. is from September 2011. Company Business Description A.H. Belo Corp. A newspaper company that owned and operated four daily newspapers and associated web sites. AH Belo was created in February 2008, when Belo Corp. (a media conglomerate) spun off its newspaper division into a separate public company. Belo Corp. retained the television division while A.H. Belo became a newspaper publishing company. Beasley Broadcast Group A radio broadcasting company that owned 26 FM and 16 AM stations. The stations played a diverse range of formats: Hispanic, oldies, rhythmic, country, news, and sports talk programs. Courier Corp. A book manufacturing and publishing company. Target markets included religious, educational textbooks, and specialty trade books. Gannett Co. The largest U.S. newspaper company. It published 82 dailies (including USA Today) and 600 community papers in 35 states. It also had both daily and weekly community newspapers published in the UK. Journal Comm., Inc. A diversified media company with operations in publishing (48% of revenue) and broadcasting (52% of revenue). It published an urban newspaper, weekly papers, and shoppers; and owned 33 radio and 13 TV stations. Saga Communications A broadcast company engaged in acquiring and operating radio and television stations. It owned 9 TV stations, 61 FM radio stations, and 30 AM radio stations Buffett's Bid for Media General's Newspapers Newspapers were national, urban, or community publications. Nationals included USA Today and the Wall Street Journal. Some urban newspapers such as the New York Times and the Washington Post had national circulations, while others such as the Los Angeles Times relied on regional readership. Community newspapers had daily or weekly circulations ranging from 5,000 to 15,000 copies, served local markets, and made up the bulk of newspaper titles. We've come to understand that most investors do not view the publishing sector as a place to generate the best returns on their capital. - Marshall Morton, CEO of Media General, 2011 With few exceptions, when a manager with a reputation for brilliance tackles a business with a reputation for poor economics, it is the reputation of the business that stays intact. According to a 2011 survey, 74% of people living in towns and small cities read a local newspaper at least once a week, and of those readers, over 80% relied on newspapers for local news and information. Among those with Internet access, 32% had visited the websites of local newspapers, up from 20% in 2005. Of those who had visited the websites, 6% said they had hit a "paywall" -a system that prevented access to web content unless the user paid a fee-suggesting paid online business models were still relatively new and unproven. When asked, 70% of survey respondents said it was very unlikely they would pay for content; 5% said it was very likely they would pay. - Warren Buffett, Chairman of Berkshire Hathaway, 19812 Declining Profitability and Bankruptcy On May 17, 2012, Warren Buffett's Berkshire Hathaway announced an offer to buy 63 newspapers from Media General Inc. for $142 million in cash and provide debt financing to the struggling firm. The announcement intrigued media analysts, but also raised many questions. For example, what did Buffett, the "Oracle of Omaha," see in the declining U.S. newspaper industry that others did not? Was this a reasonable price for the papers? And, how would the deal affect Media General, a highly leveraged and diversified company whose revenues had fallen 31% in the past four years and whose stock price had fallen more than 90% in recent years? Facing a looming covenant deadline, CEO Marshall Morton had to decide quickly whether to accept the Berkshire offer. Newspaper revenues came from two sources: advertising (ad) and circulation, representing approximately 80% and 20% of revenue, respectively. Ad revenue came from classified advertisements (e.g., help wanted, real estate listings, and job listings), local retail ads, and national ads. Between 2000 and 2010, annual newspaper ad revenue declined by 57%, from $49 billion to $21 billion. Ad revenue from newspaper websites, in contrast, was growing, but it fell far short of the decline in print advertising (see Exhibit 2 for a history of ad revenue). Craigslist.org, a network of mostly free classified advertising websites, had contributed to the sharp decline in newspapers' classified ad revenue. Circulation revenues came from both subscriptions and sales of single newspapers. U.S. Newspaper Industry The U.S. newspaper industry, once the dominant source of news and information, saw most of its competitive advantage erode over the course of the 20th century as new technologies altered the landscape, beginning with the radio in the 1920s, television in the 1950s, cable news in the 1980s, and the Internet in the 2000s. As news and information became available in real time, if not on demand, readers looked to more immediate channels to stay informed. Declining circulation started in the late 1980s, continued into the 1990s, and then accelerated in the 2000s. After peaking at 63 million in 1973, daily circulation of newspapers fell to 44 million in 2011 (see Exhibit 1 for a history of circulation numbers). Falling circulation reflected the fact that more and more people were using digital sources to get their news and information. In 1990, there were more than 1,600 daily newspapers in the U.S.; by 2009, that number had fallen to around 1,300. And by early 2012, there were even fewer. As revenues declined, the most important costs were increasing. Wages, approximately 30% of revenues, continued to rise, despite the fact firms had laid off thousands of workers and outsourced news generation to larger organizations such as the Associated Press. In addition to rising wages, many firms also had large underfunded pension obligations. At 25% of revenues, distribution expenses were the second-largest cost and had risen with increases in oil prices. Purchases of newsprint (blank paper), equipment, and other raw materials were roughly 20% of revenues. Newsprint alone was expected to be 9% of industry revenue in 2012. The world price of wood pulp, the primary input to newsprint, had been volatile and rising in recent years (see Exhibit 3 for newsprint prices). The combination of declining revenue and rising costs led to falling margins and increasing leverage. Of the 11 publicly traded newspaper companies, the median EBITDA, operating (EBIT), and net income margins were 16%, 11%, and -2%, respectively, in 2011.7 In recent years, most U.S. newspapers had inadvertently become highly leveraged due to operating losses and asset write-offs, and had market value leverage ratios (debt-to-total value) well above their historic levels of 20%- 40%. This level of debt corresponded to an "A" debt rating from S&P. High leverage plus declining profitability soon led to bankruptcies. In fact, eight major U.S. newspaper companies filed for bankruptcy between 2008 and early 2010 (though nearly all emerged as reorganized companies), while hundreds of smaller papers went out of business or moved to web-only publications. The bankruptcies included: the Tribune Group, which owned the Chicago Tribune, the Los Angeles Times, and the Baltimore Sun; Philadelphia Newspapers LLC, publisher of the Philadelphia Inquirer and Philadelphia Daily News; and the Journal Register Company, which owned 20 daily and 159 other newspapers, including many community papers. By 2012, the value of many large newspaper companies had fallen dramatically, as illustrated by the Philadelphia Inquirer and Daily News. These papers had been sold three times in recent years: they sold for $515 million in 2006, $139 million in 2011 to 5.5X by the end of 2012, the maximum permitted ratio was 7.75X.14 In addition to its financial 2010, and only $55 million in early 2012.9 leverage, the company had pension and postretirement benefit obligations totaling $455 million, of which $132 million was underfunded. In its 2011 annual report, the company warned that "large Media General Inc. declines in the stock market and lower discount rates would increase the company's expense and necessitate additional cash contribution to the pension plans."15 Media General entered the newspaper business in 1850 as the Richmond (Virginia) Dispatch. Over time, it acquired a portfolio of other newspapers and diversified into television (TV) broadcasting In February 2012, management announced it had completed the first step in a refinancing process. and digital businesses (ie, interactive coupon websites) primarily serving the southeastern U.S. (see For a fee of $10 million, the company's lenders agreed to a short-term bridge amendment that waived Exhibit 4 for its geographic markets). As of 2012, it operated 18 TV stations and published 64 certain covenants and extended the maturity date of the bank loan by two years to March 2015, newspapers. Based on circulation, the largest newspapers were the Tampa Tribune, Riclumond Times provided Media General met certain conditions.16 The key condition was the need to raise $225 million prior to May 25, 2012, to prepay a portion of the outstanding bank loan and to establish daily and weekly) such as the Goochland Gazette, Culpepper Star Exponent, Hickory SuperBuzz, and other certain liquidity reserves. The amendment permitted Media General to raise new debt to satisfy this niche publications such as Gotcha!, which covered crime news and contained mug shots of criminals. obligation. Later in February, Media General announced that its newspaper business was up for (Exhibit 5 shows circulation data for Media General and its largest newspaper, the Tampa Tribune.) sale as a way to meet this condition and that it had received inquiries from several parties. For much of the company's history, the Bryan family ran the business and held a majority stake. J. Stewart Bryan, the fourth-generation owner, became CEO in 1990 and chairman in 2000. As of 2012, Berkshire Hathaway Bryan still held a controlling interest in the paper through the company's Class B shares. The company's 22.55 million Class A shares were listed on the New York Stock Exchange (NYSE). Its 0.55 Based in Omaha, Nebraska, Berkshire Hathaway Inc. (Berkshire) was a decentralized holding million Class B shares were not publicly traded. Although the Class B shares had greater voting company with a buy-and-hold investment strategy. Its top holdings included stakes in American rights, they had similar cash flow and dividend rights as the Class A shares. Bryan, and the entire Express, Coca-Cola, and Goldman Sachs. In recent years, Berkshire had bought Lubrizol Corporation, senior management team, received compensation consisting of a base salary, annual incentives, and a specialty chemical company, for $9.7 billion in 2011, and Burlington Northern Santa Fe Corporation, long-term incentives, including stock options. (Exhibit 6 shows stock options granted to seniora U.S. railway transportation company, for $16 billion in 2010. Over 90% of Berkshire's holdings were executives in recent years.) In 2011, the company's top seven executives earned $6.1 million in in U.S. and Canadian companies, with large cap stocks representing over 96% of the firm's portfolio. compensation, while officers and directors held 2.42 million A shares and 0.47 million B shares." Buffett became Berkshire's chairman in 1970, eight years after he began buying shares of the then- struggling textile company. Although Buffett called Berkshire "the dumbest stock" he ever bought, 19 Media General's performance started to deteriorate in 2007 as the industry began to change. After peaking at $983 million in 2006, total revenues fell to $616 million in 2011. But the decline varied by he transformed the company into an investment vehicle that was famous for generating high returns line of business. Whereas broadcasting was down 17% from 2007 to 2011, the newspaper division was for investors. down 43%. After a modest profit in 2007, the company lost money in each of the next four years - Buffett's relationship with newspapers dated back to the 1940s when he was a paper boy in culminating in a loss of $74 million in 2011 - and experienced a particularly large write-off in 2008 Washington, D.C. His business relationship with newspapers began years later when Berkshire due to asset impairment and other charges. (Exhibits 7 and 8 present the company's income bought the Washington Post in 1973. Four years later, Berkshire acquired the Buffalo News for $32.5 statements and balance sheets. Given these operating losses and asset write-offs, Media General's CFO said the firm did not expect to pay cash taxes for the "foreseeable future."12 million.20 After 10 years of losing money, the newspaper finally became profitable (see Exhibit 5 for circulation data). Although Buffet retained his love of newspapers over the years, his view of them as Management responded by cutting costs and other financial commitments. Between 2007 and investment opportunities wavered over time. In his 2007 letter to Berkshire shareholders, he wrote: 2011, the company shed almost 40% of its workforce (2,700 people). Over the same period, it cut capital expenditures from $78 million to $19 million. To further save cash, the company eliminated its Aspiring press lords should be careful, however: There's no rule that says a newspaper's revenues can't fall below its expenses and that losses can't mushroom. dividend in 2009. This combination of events caused the stock price to fall from a high of almost $72 in 2004 to a low of $1.20 in October 2011 (see Exhibit 9 for stock performance), and left the firm Fixed costs are high in the newspaper business, and that's bad news when unit volume highly leveraged. heads south. As the importance of newspapers diminishes, moreover, the "psychic" value of possessing one will wane. In December 2011, the company had total debt of $658 million. Approximately half the debt was in the form of a variable-rate syndicated bank loan for $363 million that was due in March 2013. The As recently as May 2009, Buffett had said: remaining $295 million was in the form of senior secured notes that were issued in 2010, were rated CCC+, and paid quarterly interest at the rate of 11.75%. These notes had a face amount of $300 [W]e would not buy (newspapers) at any price. Twenty to 40 years ago, they were million and were due in 2017. The company's CFO admitted, "[W]e have become uncomfortable with essential to customers and advertisers. They had pricing power, but they've lost their our ability to remain in compliance with our [loan] covenants in the current operating environment essential nature-essentiality has eroded. Erosion (has) accelerated dramatically, and it absent modifications."13 According to the loan agreement, Media General needed to reduce its won't end based on anything on the horizon. We do not see anything to reverse it.22 maximum leverage ratio (total debt plus leases and guarantees to EBITDA) from 7.43X at the end of But in November 2011, Buffett did something that puzzled people: Berkshire acquired the Omaha World-Herald newspaper and several newspapers in Iowa and Nebraska for $200 million. One analyst commented, [It's a pretty generous price. That's a price that you would have paid for it five years ago."2 Some saw Berkshire's acquisition of Buffet's hometown newspaper as a sentimental gesture. Yet after the acquisition, he expressed a different attitude on the fate of the newspaper industry: In short, the deal simply confused many people. It was Buffet, after all, who had recently framed the idea of investing in newspapers in this sarcastic manner: "Imagine that someone came along saying, 'I have a great idea: Let's chop trees down, buy expensive printing presses, and buy a fleet of delivery trucks, all to get pieces of paper to people to read about what happened yesterday. Yet when the deal with Media General was announced, Buffett proclaimed: I wouldn't do this if I thought this was doomed to some sort of extinction. I think newspapers have a decent future. It won't be like the past. But there are still a lot of things newspapers can do better than any other media. They not only can be sustained, but are important.24 In towns and cities where there is a strong sense of community, there is no more important institution than the local paper. The many locales served by the newspapers we are acquiring fall firmly in this mold and we are delighted they have found a permanent home with Berkshire Hathaway. 36 Buffett stressed that the newspaper industry had to "rethink" its initial response to the Internet, in which online access was free while print was not-calling it an unsustainable business model. He said, "Newspapers have been giving away their product at the same time they are selling it and that is not a great model. You're competing with yourself. ... [You shouldn't be giving away a product you're trying to sell. That's key to the future of the newspaper."26 The Offer for Media General's Newspaper Business Berkshire's offer consisted of two inseparable parts-an asset agreement and a credit agreement. The Decision With Buffett's offer on the table, Media General's CEO Marshall Morton and its board had to reasonable and, if so, whether they should proceed with the deal. If, on the other hand, they decided to reject the offer, they needed a plan. While there was a range of alternatives-find a new buyer for the newspaper division, sell other assets such as television stations, restructure or refinance their existing debt, issue new equity, or even declare bankruptcy- they had very little time. Media General had to repay $225 million of the term loan within eight days or trigger a default on the amended loan agreement. Exhibit 1 Circulation of US Newspapers: 1945 to 2011 Asset purchase agreement Berkshire was offering to acquire 63 daily and weekly newspapers and their real estate holdings for $142 million in cash. The deal excluded all pension and other benefit obligations for the papers as well as the Tampa Tribune, which had an asset value of $30 million according to an equity analyst.27.25 It also excluded any tax benefits from accumulated operating losses in the newspaper division. As a result, Berkshire would pay taxes on profits at the standard corporate rate of 35%. (Exhibit 10 shows cash flow forecasts for Media General's newspaper division, including the Tampa Tribune; Exhibit 11 presents current rate information.) 60,000 250.000 (thousands) 340.000 9 30.000 Credit agreement Under a separate agreement, Berkshire would provide Media General with a $400 million term loan and a $45 million revolving credit facility. The term loan would have an interest rate of 10.5% paid quarterly; an 11.5% discount to face value, thereby providing $354 million of cash to Media General; a maturity of eight years, and a security interest that was equal to the company's existing senior secured notes (the notes were rated CCC+ as of May 2012). The proceeds would be used to repay fully the company's bank loan.29 Berkshire would also receive "penny warrants" (warrants for Media General's shares exercisable within eight years at $0.01 per share) for 4.65 million Class A common shares, which represented 19.9% of Media General's common shares outstanding. Finally, Berkshire would have the option to nominate a director to Media General's board. The credit agreement would need to close within days to meet the May 25 deadline contained in the amended bridge loan agreement. 20,000 10.000 1945 1950 1959 1960 1969 1970 1975 180 185 190 195 2000 2001 2000 -Morning Evening Sunday Exhibit 2 Advertising Revenue of U.S. Newspapers: 1945 to 2011 Industry analysts reacted to the announcement immediately, yet with conflicting interpretations. One analyst called the deal "a huge surprise."31 Another analyst wondered if Buffett was investing with his heart rather than his head because he had been a paper boy in his youth. She said, "Some of his motivations are not perfectly economic. He's the smartest investor of all time. But this is a non- consensus investment that he's making right now."32 Others saw the deal more optimistically: "I don't think Berkshire Hathaway does anything where they're going to lose money," said one analyst. Another one said, "This is a feat of financial engineering more than about buying newspapers.34 In general, however, investors reacted positively: Media General's stock price jumped 33% from $3.14 to $4.18 on the day of the announcement on a day the market (S&P 500) was down $60,000 550,000 Total Advertising Expenditure ($ millions) 30,000 3950 1959 1960 1965 1970 1979 1980 1989 1990 195 2000 2005 2010 -Newspaper Print Total ...Newspaper Online Total Exhibit 3 U.S. Newsprint and Pulp Prices per Ton: 2001 to 2012 Exhibit 5 Paid Print Circulation for Media General and Berkshire Hathaway Newspapers $1,000 $900 $800 Average Annual Paid Print Circulation (thousands) The Tampa Tribune The Buffalo News All Media General Newspapers (a) (Media General) (Berkshire Hathaway) Daily Sunday Weekly Daily Sunday Daily Sunday Year Price per Ton 2011 70 (b) 149 261 146 540 572 71 (b) 757 762 796 888 74 (b) 257 261 163 172 179 183 927 292 187 957 980 989 303 843 992 2004 2003 2002 2001 2000 984 193 201 220 219 224 230 851 840 843 843 217 299 293 295 302 984 219 303 308 316 - US Newsprint Per Ton US Pulp Per Ton 992 223 Source: FOEX PIX Price Indices, accessed from Bloomberg, September 19, 2012. Exhibit 4 Media General Geographic Markets and Businesses Media General, Inc. Markets State Cobe Code OHRI Market VATN Market Exhibit 6 Media General Management Compensation - Employee Stock Options NC Market Mic South SC/GA ALIMS Market FL Market Number of Call Options Granted Stock Price Expiration on the Date Grant Date Exercise Price Historical Volatility Expected Expected Dividend Option Yield Life Risk-Free Rate Grant Date Daily News 1/27/2005 1/26/2006 1/29/2008 1/29/2009 1/28/2010 1/27/2011 67,500 112,400 88,300 82,798 94,100 102,100 1/27/2015 1/26/2016 1/29/2018 1/29/2019 1/28/2020 1/27/2021 $63.18 $49.66 $20.30 $2.16 $8.90 $5.20 $63.18 $49.66 $20.30 $2.16 $8.90 $5.20 27.0% 28.0% 29.0% 51.1% 65.0% 67.0% 1.50% 1.40% 2.90% 2.00% 1.60% 2.30% 8.00 6.60 6.50 6.60 6.60 6.50 4.10% 4.40% 3.31% 2.30% 3.10% 2.70% Advertising Services & Other Blockbut. Dalam Dealer.com, Dallas, Texas Netirformer, Richmond, Virginia Professional Communications Services Tampa, Horida Exhibit 7 Media General Income Statement: 2007 to 2011 ($ millions) Exhibit 8 Media General Balance Sheet: 2007 to 2011 (US$ millions) Fiscal Years Ending December 31 2010 2009 2008 2011 2007 2011 Year Ending December 31 2010 2009 2008 2007 Revenue Publishing/Newspapers Broadcasting/TV Digital Media Total Revenue Cost of Goods Sold Gross Profit $299.6 $278.7 $38.0 $616.3 $419.7 $196.6 $328.4 $306.8 $43.0 $678.2 $442.9 $235.3 $357.5 $259.0 $41.1 $657.6 $448.6 $209.0 $436.9 $322.1 $38.4 $797.4 $562.6 $234.8 $524.8 $336.5 $35.0 $896.3 $610.6 $285.7 Assets Cash & ST Investments Accounts Receivable Inventory Other Current Assets $23.1 $97.0 $5.7 $21.3 $147.1 $31.9 $102.3 $7.1 $29.7 $171.0 $33.2 $104.4 $6.6 $60.8 $205.1 $7.1 $102.2 $12.0 $51.3 $172.6 $14.2 $133.9 $6.7 $159.0 $313.8 $374.7 $324.7 $124.9 $73.0 SG&A Deprec./Amortization Other Expense Operating Income (EBIT) $106.6 $51.6 $0.0 $38.4 $107.9 $53.1 $0.0 $74.3 $94.0 $59.2 $0.0 $55.8 $111.5 $71.5 $0.0 $51.8 Net PPE Goodwill Other Intangibles Other LT Assets Total Assets $206.2 $33.4 $1,086.0 $398.9 $355.0 $214.4 $40.6 $1,180.0 $421.2 $355.0 $220.6 $34.2 $1,236.0 $453.6 $421.5 $245.3 $41.3 $1,334.3 $475.0 $917.5 $646.7 $1180 $2,471.1 $87.8 Interest Expense (net) Other Income/Expense Unusual Items (loss) (a) Profit Before Tax $64.4 $1.0 ($38.5) ($63.5) $71.1 $1. 0 ($1.3) $2.9 $41.3 9 1.0 ($88.9) $73.4) $43.4 $1.0 ($920.8) ($911.4) $59.6 91.1 ($17.2) $12.2 Liabilities Accounts Payable Accrued Expenses Current Portion of LT Debt Other Current Liabilities Current Liabilities $26.6 $40.8 $0.0 $33.3 $100.7 $30.0 $40.5 $6.9 $42.4 $119.8 $26.4 $27.0 $0.0 $45.1 $98.6 $41.4 $50.6 $0.0 $38.8 $130.7 $32.7 $52.5 $0.0 $54.9 $140.0 Income Tax (b) Profit After Tax Inc/Loss from Discont.