Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**For the calculations, give your answer correct to 2 decimal places. Question 1 (Total 35 marks) A) The Institute of Financial Planners of Hong Kong

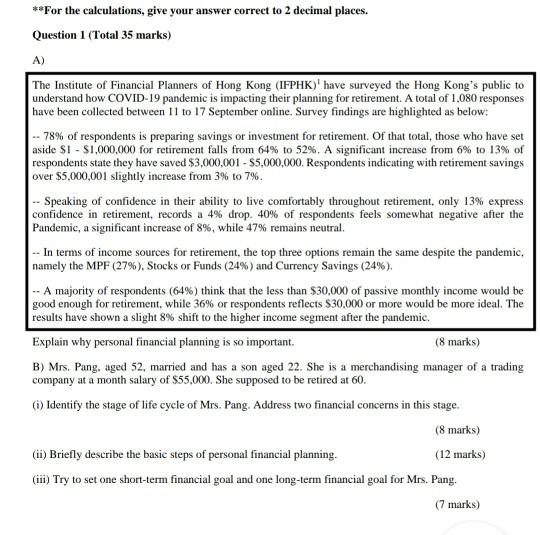

**For the calculations, give your answer correct to 2 decimal places. Question 1 (Total 35 marks) A) The Institute of Financial Planners of Hong Kong (IFPHK) have surveyed the Hong Kong's public to understand how COVID-19 pandemic is impacting their planning for retirement. A total of 1,080 responses have been collected between 11 to 17 September online. Survey findings are highlighted as below: -- 78% of respondents is preparing savings or investment for retirement of that total, those who have set aside $1 - $1,000,000 for retirement falls from 64% to 52%. A significant increase from 6% to 13% of respondents state they have saved $3,000,001 - 55,000,000. Respondents indicating with retirement savings over $5.000,001 slightly increase from 3% to 7%. - Speaking of confidence in their ability to live comfortably throughout retirement, only 13% express confidence in retirement, records a 4% drop. 40% of respondents feels somewhat negative after the Pandemic, a significant increase of 8%, while 47% remains neutral. -- In terms of income sources for retirement, the top three options remain the same despite the pandemic, namely the MPF (27%), Stocks or Funds (24%) and Currency Savings (24%). -- A majority of respondents (64%) think that the less than $30,000 of passive monthly income would be good enough for retirement, while 36% or respondents reflects $30,000 or more would be more ideal. The results have shown a slight 8% shift to the higher income segment after the pandemic. Explain why personal financial planning is so important. (8 marks) B) Mrs. Pang, aged 52, married and has a son aged 22. She is a merchandising manager of a trading company at a month salary of $55,000. She supposed to be retired at 60. () Identify the stage of life cycle of Mrs. Pang. Address two financial concerns in this stage. (8 marks) (ii) Briefly describe the basic steps of personal financial planning. (12 marks) (iii) Try to set one short-term financial goal and one long-term financial goal for Mrs. Pang. (7 marks) **For the calculations, give your answer correct to 2 decimal places. Question 1 (Total 35 marks) A) The Institute of Financial Planners of Hong Kong (IFPHK) have surveyed the Hong Kong's public to understand how COVID-19 pandemic is impacting their planning for retirement. A total of 1,080 responses have been collected between 11 to 17 September online. Survey findings are highlighted as below: -- 78% of respondents is preparing savings or investment for retirement of that total, those who have set aside $1 - $1,000,000 for retirement falls from 64% to 52%. A significant increase from 6% to 13% of respondents state they have saved $3,000,001 - 55,000,000. Respondents indicating with retirement savings over $5.000,001 slightly increase from 3% to 7%. - Speaking of confidence in their ability to live comfortably throughout retirement, only 13% express confidence in retirement, records a 4% drop. 40% of respondents feels somewhat negative after the Pandemic, a significant increase of 8%, while 47% remains neutral. -- In terms of income sources for retirement, the top three options remain the same despite the pandemic, namely the MPF (27%), Stocks or Funds (24%) and Currency Savings (24%). -- A majority of respondents (64%) think that the less than $30,000 of passive monthly income would be good enough for retirement, while 36% or respondents reflects $30,000 or more would be more ideal. The results have shown a slight 8% shift to the higher income segment after the pandemic. Explain why personal financial planning is so important. (8 marks) B) Mrs. Pang, aged 52, married and has a son aged 22. She is a merchandising manager of a trading company at a month salary of $55,000. She supposed to be retired at 60. () Identify the stage of life cycle of Mrs. Pang. Address two financial concerns in this stage. (8 marks) (ii) Briefly describe the basic steps of personal financial planning. (12 marks) (iii) Try to set one short-term financial goal and one long-term financial goal for Mrs. Pang. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started