For the call money, we can assume that it is NOT RECEIVED. Thank you.

For the call money, we can assume that it is NOT RECEIVED. Thank you.

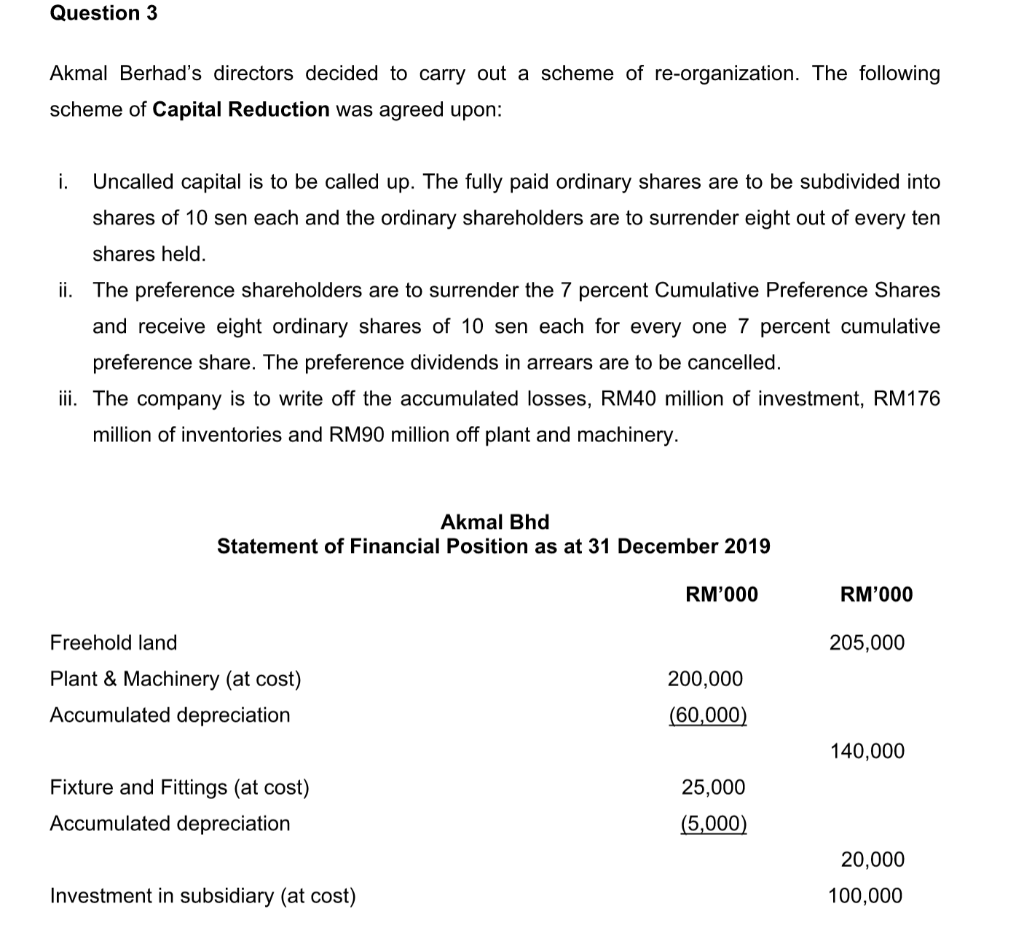

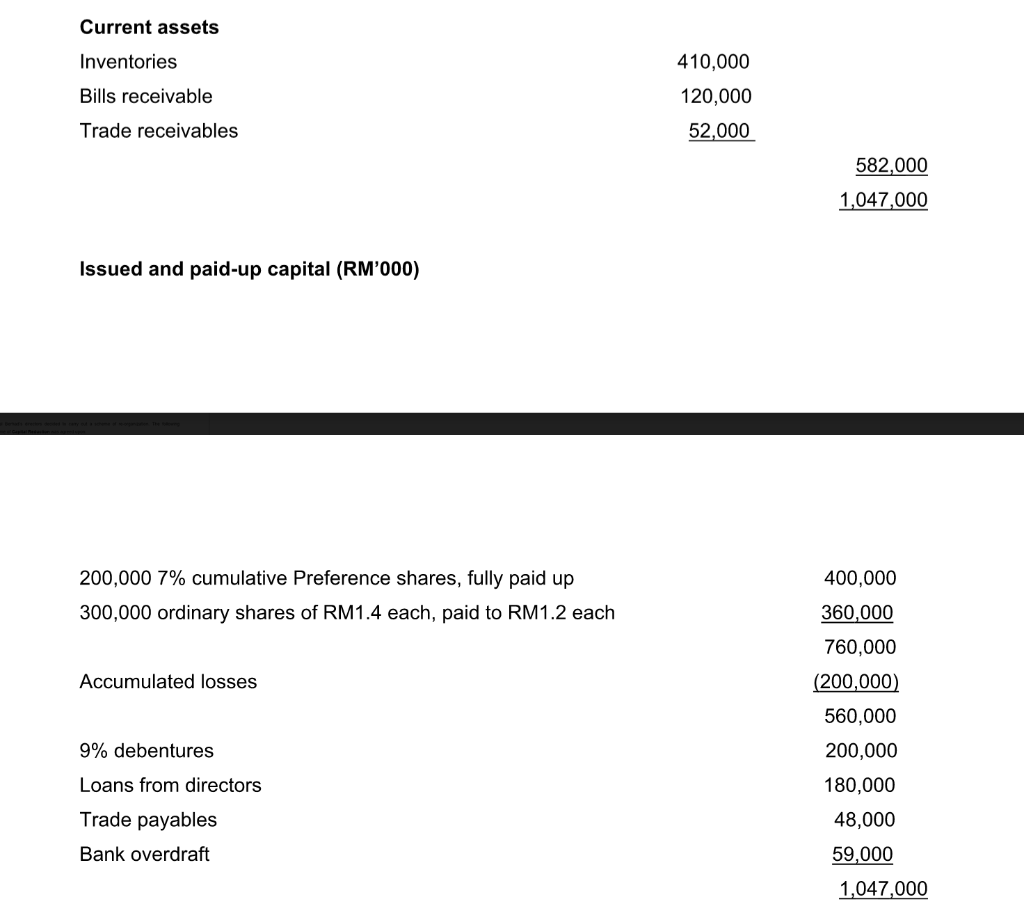

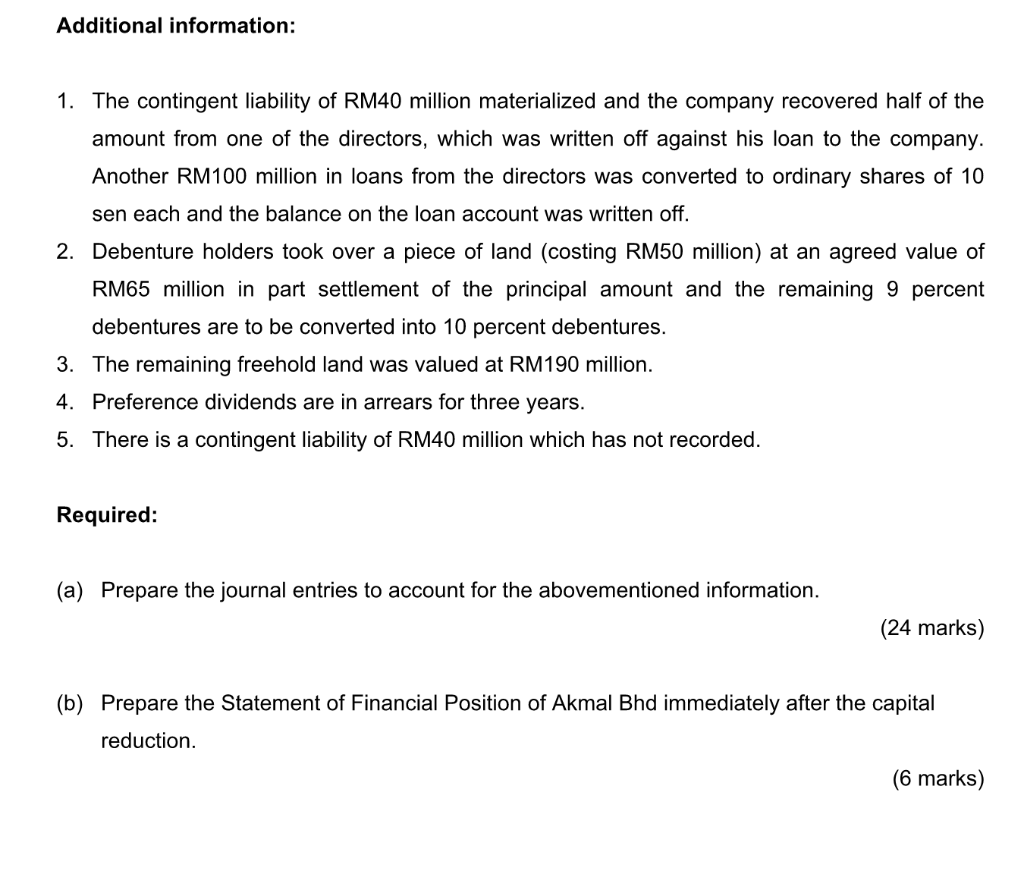

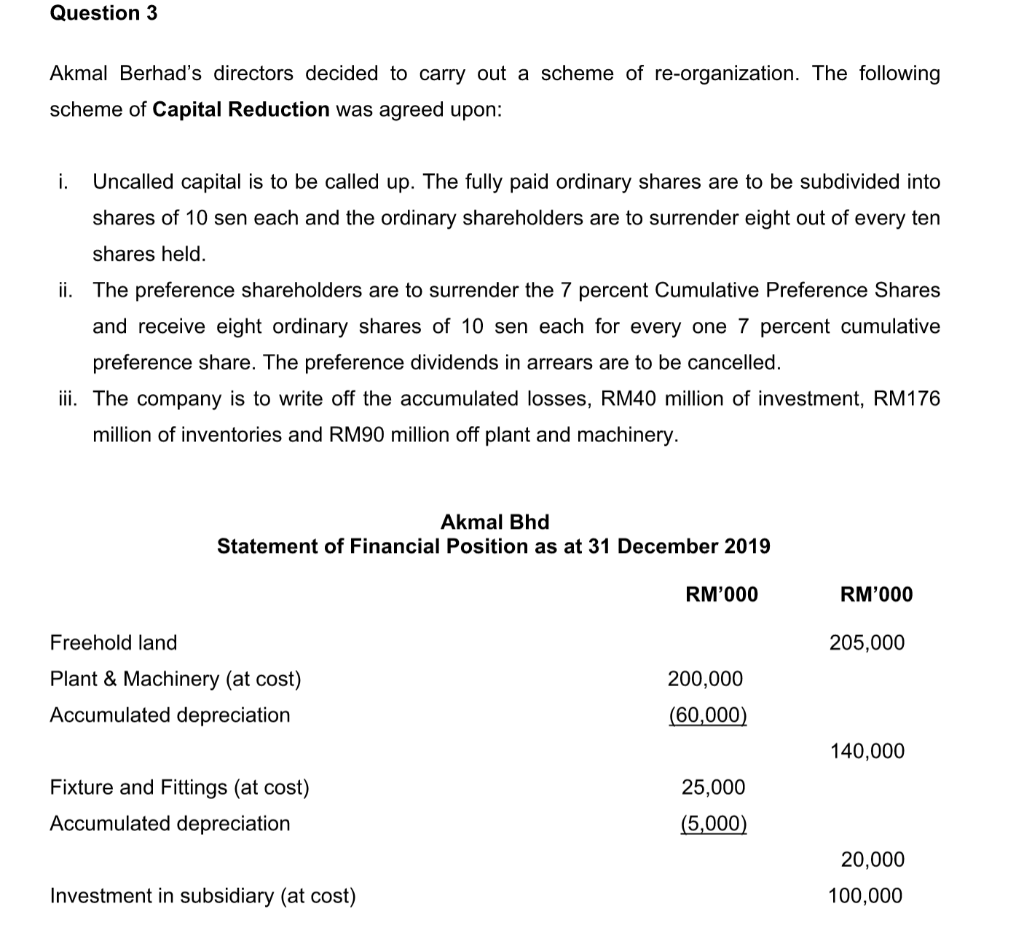

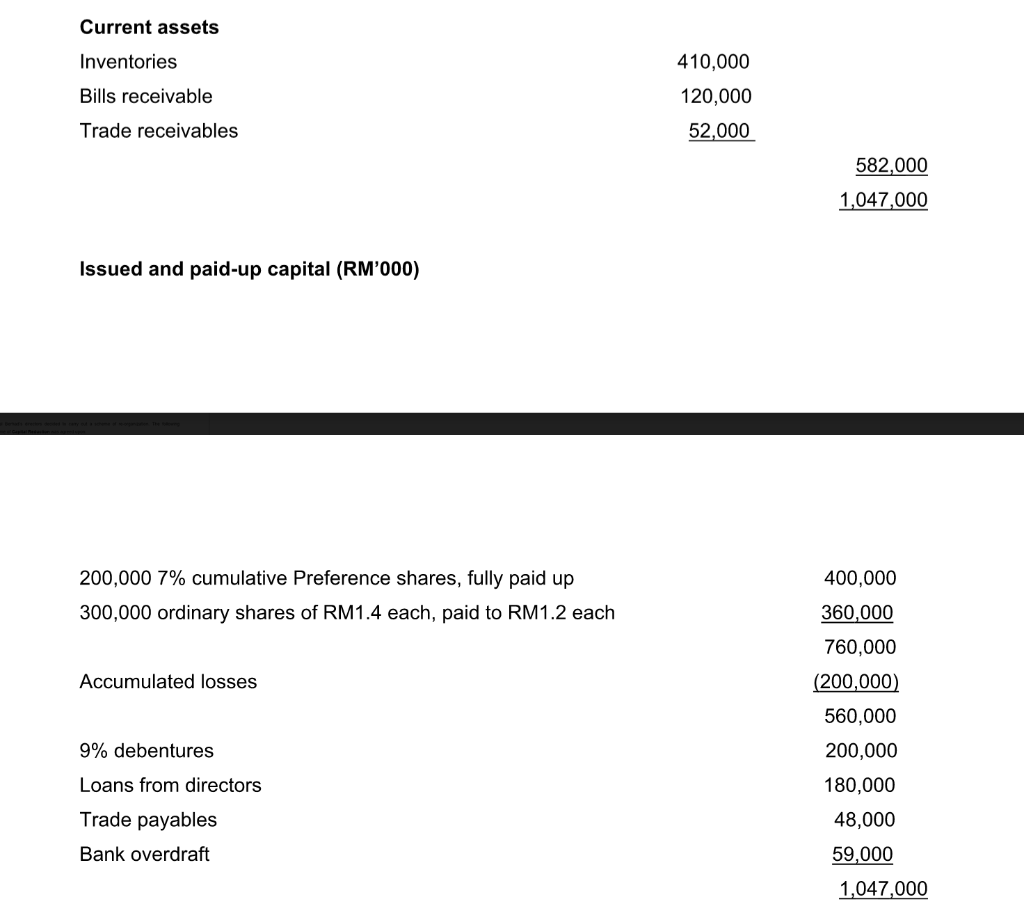

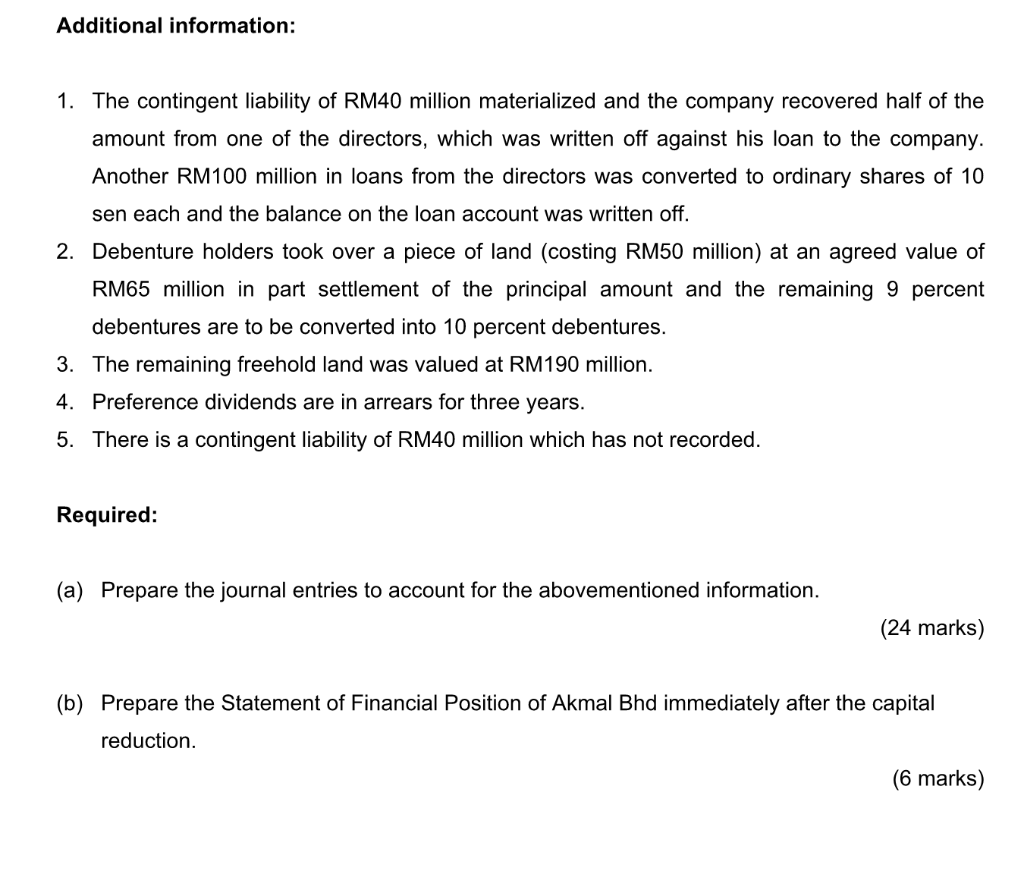

Question 3 Akmal Berhad's directors decided to carry out a scheme of re-organization. The following scheme of Capital Reduction was agreed upon: i. Uncalled capital is to be called up. The fully paid ordinary shares are to be subdivided into shares of 10 sen each and the ordinary shareholders are to surrender eight out of every ten shares held. ii. The preference shareholders are to surrender the 7 percent Cumulative Preference Shares and receive eight ordinary shares of 10 sen each for every one 7 percent cumulative preference share. The preference dividends in arrears are to be cancelled. iii. The company is to write off the accumulated losses, RM40 million of investment, RM176 million of inventories and RM90 million off plant and machinery. Akmal Bhd Statement of Financial Position as at 31 December 2019 RM'000 RM'000 Freehold land 205,000 Plant & Machinery (at cost) Accumulated depreciation 200,000 (60,000) 140,000 Fixture and Fittings (at cost) Accumulated depreciation 25,000 (5,000) 20,000 100,000 Investment in subsidiary (at cost) Current assets Inventories 410.000 Bills receivable 120,000 52,000 Trade receivables 582,000 1,047,000 Issued and paid-up capital (RM'000) 200,000 7% cumulative Preference shares, fully paid up 300,000 ordinary shares of RM1.4 each, paid to RM1.2 each Accumulated losses 400,000 360,000 760,000 (200,000) 560,000 200,000 180,000 48,000 59,000 1,047,000 9% debentures Loans from directors Trade payables Bank overdraft Additional information: 1. The contingent liability of RM40 million materialized and the company recovered half of the amount from one of the directors, which was written off against his loan to the company. Another RM100 million in loans from the directors was converted to ordinary shares of 10 sen each and the balance on the loan account was written off. 2. Debenture holders took over a piece of land (costing RM50 million) at an agreed value of RM65 million in part settlement of the principal amount and the remaining 9 percent debentures are to be converted into 10 percent debentures. 3. The remaining freehold land was valued at RM190 million. 4. Preference dividends are in arrears for three years. 5. There is a contingent liability of RM40 million which has not recorded. Required: (a) Prepare the journal entries to account for the abovementioned information. (24 marks) (b) Prepare the Statement of Financial Position of Akmal Bhd immediately after the capital reduction. (6 marks)

For the call money, we can assume that it is NOT RECEIVED. Thank you.

For the call money, we can assume that it is NOT RECEIVED. Thank you.