Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the case study above the phase 2 needs to be founded. Jack Smith is 52 years old and is married to his wife, Kara,

For the case study above the phase 2 needs to be founded.

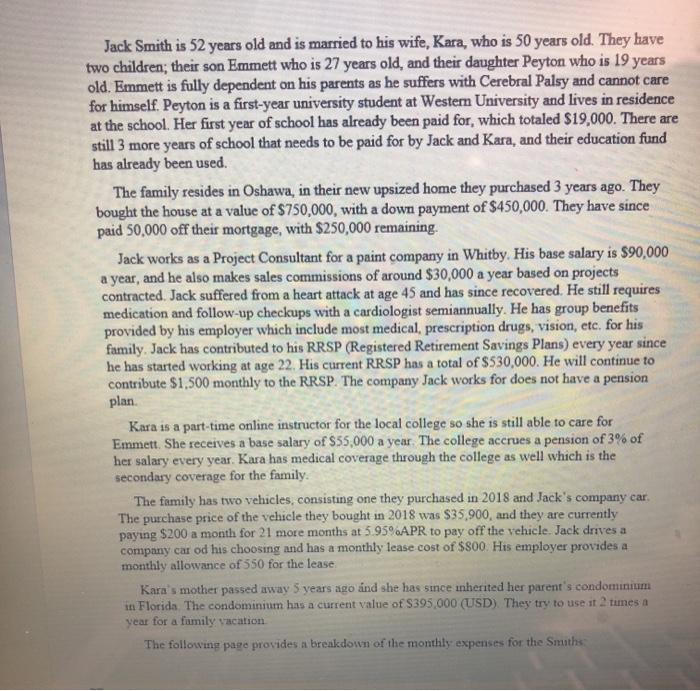

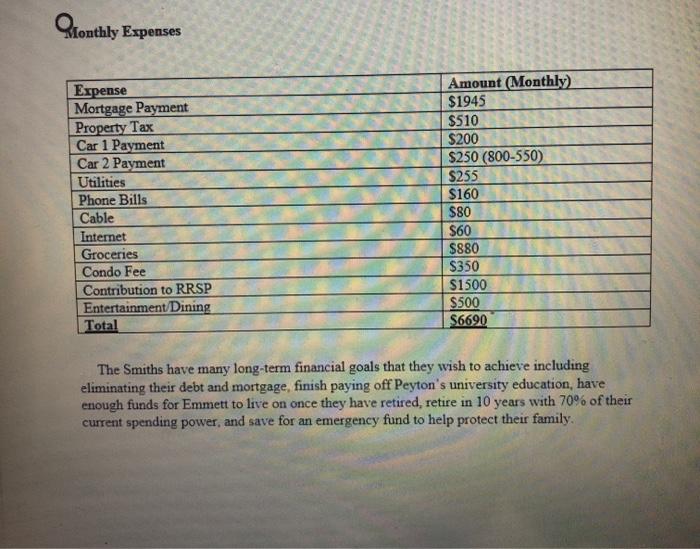

Jack Smith is 52 years old and is married to his wife, Kara, who is 50 years old. They have two children; their son Emmett who is 27 years old, and their daughter Peyton who is 19 years old. Emmett is fully dependent on his parents as he suffers with Cerebral Palsy and cannot care for himself. Peyton is a first-year university student at Western University and lives in residence at the school. Her first year of school has already been paid for, which totaled $19,000. There are still 3 more years of school that needs to be paid for by Jack and Kara, and their education fund has already been used The family resides in Oshawa, in their new upsized home they purchased 3 years ago. They bought the house at a value of $750,000, with a down payment of $450,000. They have since paid 50,000 off their mortgage, with $250,000 remaining. Jack works as a Project Consultant for a paint company in Whitby. His base salary is $90,000 a year, and he also makes sales commissions of around $30,000 a year based on projects contracted. Jack suffered from a heart attack at age 45 and has since recovered. He still requires medication and follow-up checkups with a cardiologist semiannually. He has group benefits provided by his employer which include most medical, prescription drugs, vision, etc. for his family. Jack has contributed to his RRSP (Registered Retirement Savings Plans) every year since he has started working at age 22. His current RRSP has a total of $530,000. He will continue to contribute $1,500 monthly to the RRSP. The company Jack works for does not have a pension plan. Kara is a part-time online instructor for the local college so she is still able to care for Emmett. She receives a base salary of $55,000 a year. The college accrues a pension of 3% of her salary every year. Kara has medical coverage through the college as well which is the secondary coverage for the family. The family has two vehicles, consisting one they purchased in 2018 and Jack's company car The purchase price of the vehicle they bought in 2018 was $35.900, and they are currently paying $200 a month for 21 more months at 5.95%APR to pay off the vehicle. Jack drives a company car od his choosing and has a monthly lease cost of $800. His employer provides a monthly allowance of 550 for the lease Kara's mother passed away 5 years ago and she has since inherited her parent's condominium in Florida. The condominium has a current value of S395,000 (USD) They try to use it 2 times a year for a family vacation The following page provides a breakdown of the monthly expenses for the Smiths Monthly Expenses Stonthly Expense Mortgage Payment Property Tax Car 1 Payment Car 2 Payment Utilities Phone Bills Cable Internet Groceries Condo Fee Contribution to RRSP Entertainment/Dining Total Amount (Monthly) $1945 $510 $200 $250 (800-550) $255 $160 $80 $60 $880 $350 $1500 $500 S6690 The Smiths have many long-term financial goals that they wish to achieve including eliminating their debt and mortgage, finish paying off Peyton's university education, have enough funds for Emmett to live on once they have retired, retire in 10 years with 70% of their current spending power, and save for an emergency fund to help protect their family submission.) Phase 2: Develop a plan - prioritize the client's needs basing the priority on risk to financial security and the family's goals. In your plan, get 2 or 3 quotes for the coverages you are recommending so you can accurately demonstrate cost and benefit to the family's financial position. Jack Smith is 52 years old and is married to his wife, Kara, who is 50 years old. They have two children; their son Emmett who is 27 years old, and their daughter Peyton who is 19 years old. Emmett is fully dependent on his parents as he suffers with Cerebral Palsy and cannot care for himself. Peyton is a first-year university student at Western University and lives in residence at the school. Her first year of school has already been paid for, which totaled $19,000. There are still 3 more years of school that needs to be paid for by Jack and Kara, and their education fund has already been used The family resides in Oshawa, in their new upsized home they purchased 3 years ago. They bought the house at a value of $750,000, with a down payment of $450,000. They have since paid 50,000 off their mortgage, with $250,000 remaining. Jack works as a Project Consultant for a paint company in Whitby. His base salary is $90,000 a year, and he also makes sales commissions of around $30,000 a year based on projects contracted. Jack suffered from a heart attack at age 45 and has since recovered. He still requires medication and follow-up checkups with a cardiologist semiannually. He has group benefits provided by his employer which include most medical, prescription drugs, vision, etc. for his family. Jack has contributed to his RRSP (Registered Retirement Savings Plans) every year since he has started working at age 22. His current RRSP has a total of $530,000. He will continue to contribute $1,500 monthly to the RRSP. The company Jack works for does not have a pension plan. Kara is a part-time online instructor for the local college so she is still able to care for Emmett. She receives a base salary of $55,000 a year. The college accrues a pension of 3% of her salary every year. Kara has medical coverage through the college as well which is the secondary coverage for the family. The family has two vehicles, consisting one they purchased in 2018 and Jack's company car The purchase price of the vehicle they bought in 2018 was $35.900, and they are currently paying $200 a month for 21 more months at 5.95%APR to pay off the vehicle. Jack drives a company car od his choosing and has a monthly lease cost of $800. His employer provides a monthly allowance of 550 for the lease Kara's mother passed away 5 years ago and she has since inherited her parent's condominium in Florida. The condominium has a current value of S395,000 (USD) They try to use it 2 times a year for a family vacation The following page provides a breakdown of the monthly expenses for the Smiths Monthly Expenses Stonthly Expense Mortgage Payment Property Tax Car 1 Payment Car 2 Payment Utilities Phone Bills Cable Internet Groceries Condo Fee Contribution to RRSP Entertainment/Dining Total Amount (Monthly) $1945 $510 $200 $250 (800-550) $255 $160 $80 $60 $880 $350 $1500 $500 S6690 The Smiths have many long-term financial goals that they wish to achieve including eliminating their debt and mortgage, finish paying off Peyton's university education, have enough funds for Emmett to live on once they have retired, retire in 10 years with 70% of their current spending power, and save for an emergency fund to help protect their family submission.) Phase 2: Develop a plan - prioritize the client's needs basing the priority on risk to financial security and the family's goals. In your plan, get 2 or 3 quotes for the coverages you are recommending so you can accurately demonstrate cost and benefit to the family's financial position Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started