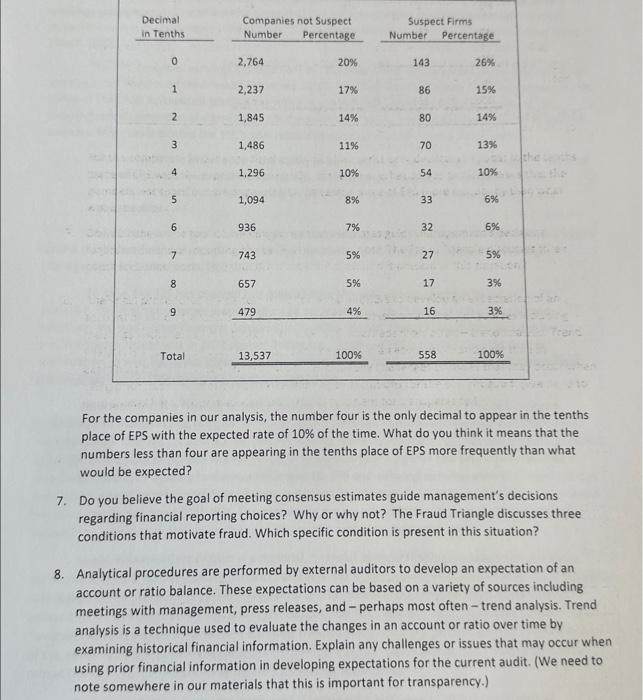

For the companies in our analysis, the number four is the only decimal to appear in the tenths place of EPS with the expected rate of 10% of the time. What do you think it means that the numbers less than four are appearing in the tenths place of EPS more frequently than what would be expected? 7. Do you believe the goal of meeting consensus estimates guide management's decisions regarding financial reporting choices? Why or why not? The Fraud Triangle discusses three conditions that motivate fraud. Which specific condition is present in this situation? 8. Analytical procedures are performed by external auditors to develop an expectation of an account or ratio balance. These expectations can be based on a variety of sources including meetings with management, press releases, and - perhaps most often - trend analysis. Trend analysis is a technique used to evaluate the changes in an account or ratio over time by examining historical financial information. Explain any challenges or issues that may occur when using prior financial information in developing expectations for the current audit. (We need to note somewhere in our materials that this is important for transparency.) The following table summarizes the frequency the numbers zero through nine appear in the tenths place of actual EPS for the 13,537 quarters not identified as suspect firms and the 558 quarters in the suspect sample.? For the companies in our analysis, the number four is the only decimal to appear in the tenths place of EPS with the expected rate of 10% of the time. What do you think it means that the numbers less than four are appearing in the tenths place of EPS more frequently than what would be expected? 7. Do you believe the goal of meeting consensus estimates guide management's decisions regarding financial reporting choices? Why or why not? The Fraud Triangle discusses three conditions that motivate fraud. Which specific condition is present in this situation? 8. Analytical procedures are performed by external auditors to develop an expectation of an account or ratio balance. These expectations can be based on a variety of sources including meetings with management, press releases, and - perhaps most often - trend analysis. Trend analysis is a technique used to evaluate the changes in an account or ratio over time by examining historical financial information. Explain any challenges or issues that may occur when using prior financial information in developing expectations for the current audit. (We need to note somewhere in our materials that this is important for transparency.) The following table summarizes the frequency the numbers zero through nine appear in the tenths place of actual EPS for the 13,537 quarters not identified as suspect firms and the 558 quarters in the suspect sample