Answered step by step

Verified Expert Solution

Question

1 Approved Answer

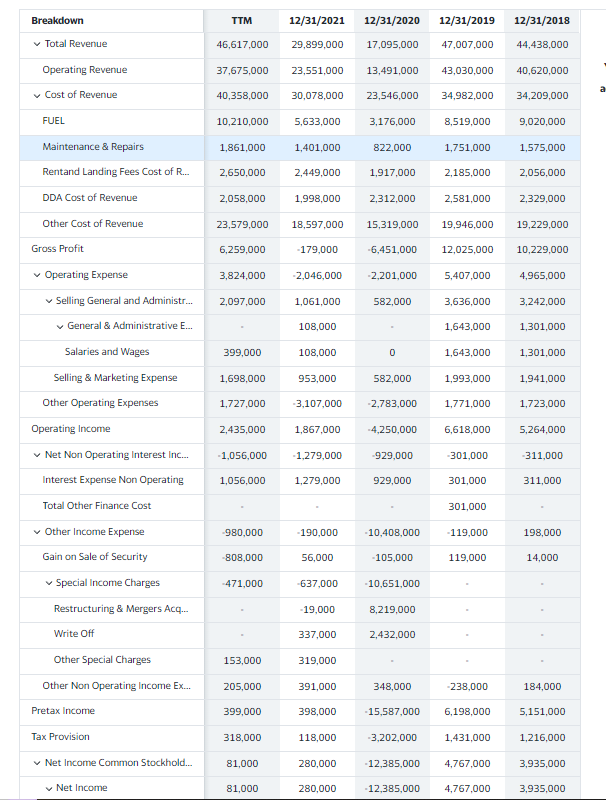

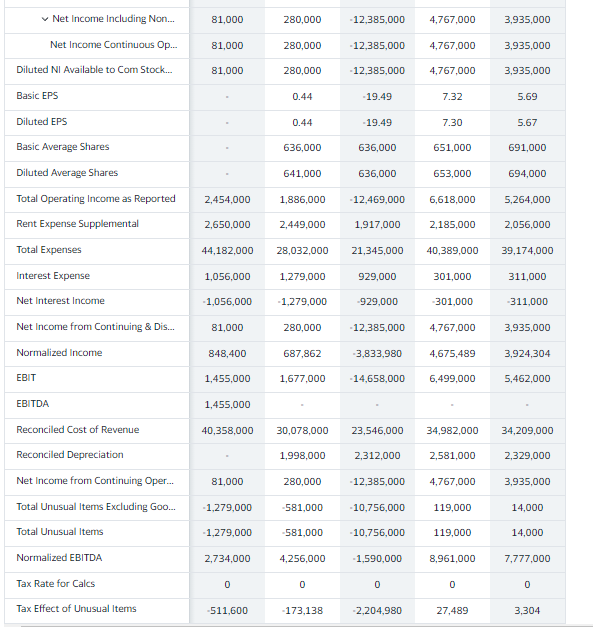

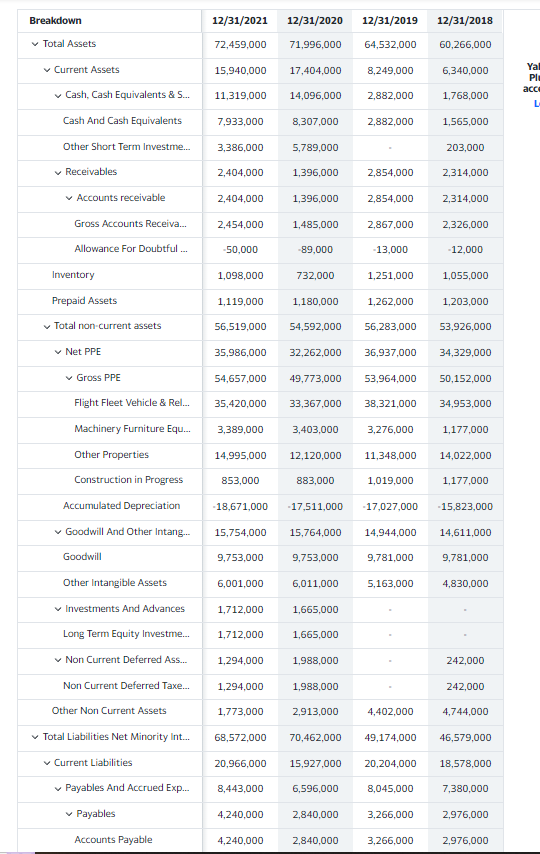

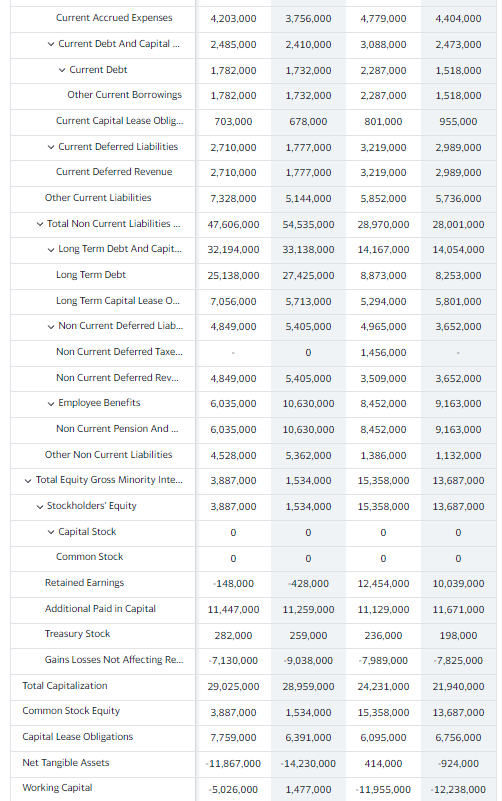

For the company below for 2021 find: Current ratio Acid-test ratio Working capital Inventory turnover Accounts receivable turnover Debt ratio Times-interest-earned ratio Return on net

For the company below for 2021 find:

Current ratio

Acid-test ratio

Working capital

Inventory turnover

Accounts receivable turnover

Debt ratio

Times-interest-earned ratio

Return on net sales

Return on total assets

Return on common stockholders equity

Earnings per share

Price/earnings ratio

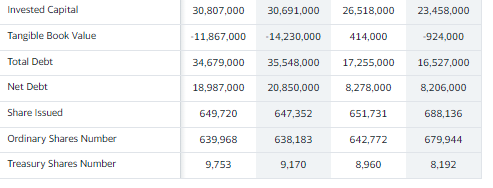

\begin{tabular}{|l|c|ccc|} \hline Invested Capital & 30,807,000 & 30,691,000 & 26,518,000 & 23,458,000 \\ \hline Tangible Book Value & 11,867,000 & 14,230,000 & 414,000 & 924,000 \\ \hline Total Debt & 34,679,000 & 35,548,000 & 17,255,000 & 16,527,000 \\ \hline Net Debt & 18,987,000 & 20,850,000 & 8,278,000 & 8,206,000 \\ \hline Share Issued & 649,720 & 647,352 & 651,731 & 688,136 \\ \hline Ordinary Shares Number & 639,968 & 638,183 & 642,772 & 679,944 \\ \hline Treasury Shares Number & 9,753 & 9,170 & 8,960 & 8,192 \\ \hline \end{tabular} \begin{tabular}{|l|c|ccc|} \hline Invested Capital & 30,807,000 & 30,691,000 & 26,518,000 & 23,458,000 \\ \hline Tangible Book Value & 11,867,000 & 14,230,000 & 414,000 & 924,000 \\ \hline Total Debt & 34,679,000 & 35,548,000 & 17,255,000 & 16,527,000 \\ \hline Net Debt & 18,987,000 & 20,850,000 & 8,278,000 & 8,206,000 \\ \hline Share Issued & 649,720 & 647,352 & 651,731 & 688,136 \\ \hline Ordinary Shares Number & 639,968 & 638,183 & 642,772 & 679,944 \\ \hline Treasury Shares Number & 9,753 & 9,170 & 8,960 & 8,192 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started