Question

For the company Acushnet , use concepts learned about present value to estimate a value of the company's stock. Note that you will need

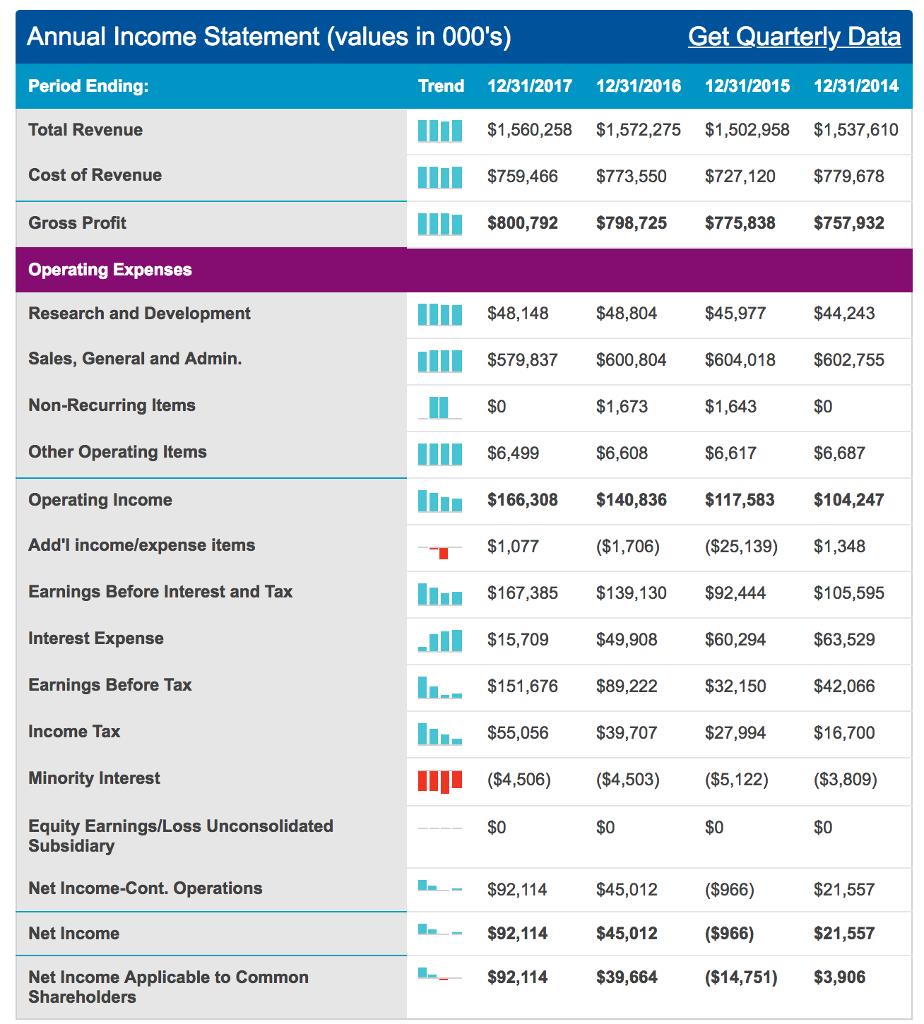

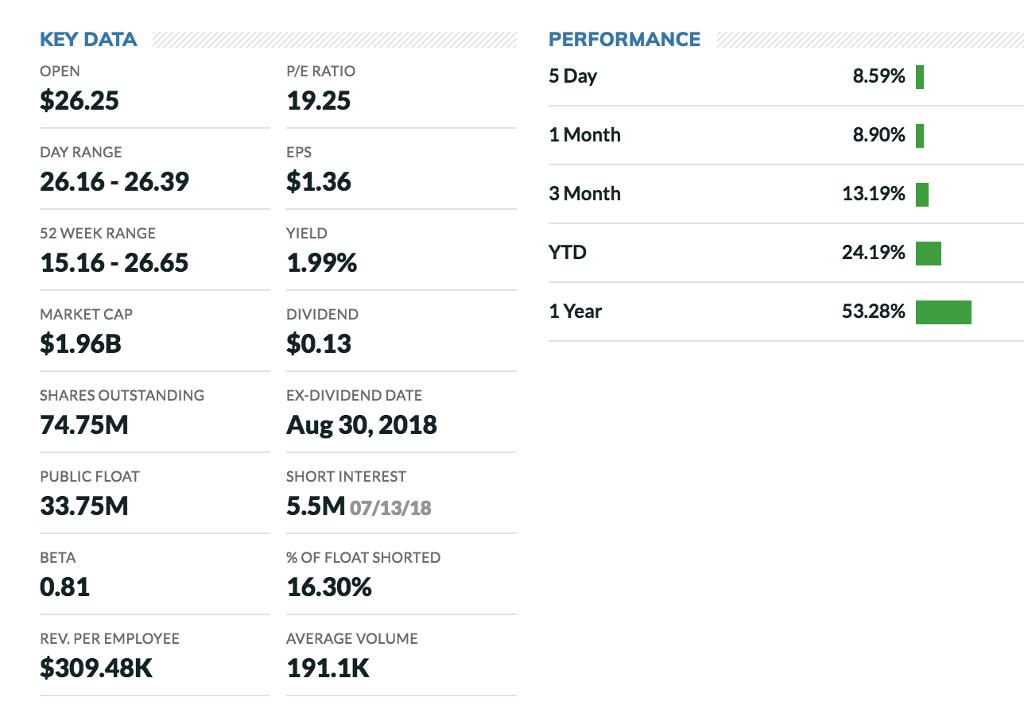

For the company "Acushnet", use concepts learned about present value to estimate a value of the company's stock. Note that you will need to estimate the appropriate cost of capital or discount rate for your analysis based on the firm’s risk, based on its industry and individual characteristics. You will also need to estimate a growth rate for the firm's Dividend, as well as finding what Dividend they have been paying (perhaps past Dividend history can help in estimating a growth rate). Provide explanations of how you determined each variable. Once you estimate the Stock price, compare it to the actual stock price from current markets. Comment on the comparison (is it lower or higher and why).

I am not sure if these are the data points needed? The question is meant to be answered from the financial statements from the actual company 'Acushnet Holdings Corp.'

The site I was given to use is https://www.acushnetholdingscorp.com/investors/financials/default.aspx

The picture should be clear? I provided a link to the financial statements that need to be used anyway?

Annual Income Statement (values in 000's) Period Ending: Total Revenue Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Other Operating Items Operating Income Add'l income/expense items Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Earnings/Loss Unconsolidated Subsidiary Net Income-Cont. Operations Net Income Net Income Applicable to Common Shareholders Trend 12/31/2017 12/31/2016 12/31/2015 12/31/2014 $1,560,258 $1,572,275. $1,502,958 $1,537,610 -- $759,466 $800,792 I- $48,148 $579,837 $0 $6,499 $166,308 $1,077 $0 $773,550 $92,114 $798,725 $92,114 $92,114 $48,804 $600,804 - $15,709 $49,908 $151,676 $89,222 $55,056 ($4,506) $1,673 $6,608 $140,836 Get Quarterly Data $117,583 ($1,706) ($25,139) $167,385 $139,130 $92,444 $727,120 $0 $775,838 $45,977 $604,018 $1,643 $6,617 $60,294 $32,150 $39,707 $27,994 ($4,503) ($5,122) $0 $45,012 ($966) $45,012 ($966) $39,664 ($14,751) $779,678 $757,932 $44,243 $602,755 $0 $6,687 $104,247 $1,348 $105,595 $63,529 $42,066 $16,700 ($3,809) $0 $21,557 $21,557 $3,906

Step by Step Solution

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A 1 2 Annual Quarterly 3 Income statement 4 All numbers in thousands 5 Revenue 6 Total revenue 7 8 G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3e89de3b5_183104.pdf

180 KBs PDF File

635e3e89de3b5_183104.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started