Question: For the cross-border valuation analysis, what discount rate would you use to discount the Brazilian real cash flows of the project? Is it possible to

For the cross-border valuation analysis, what discount rate would you use to discount the Brazilian real cash flows of the project? Is it possible to conduct cross-border valuation without calculating foreign currency cost of capital?

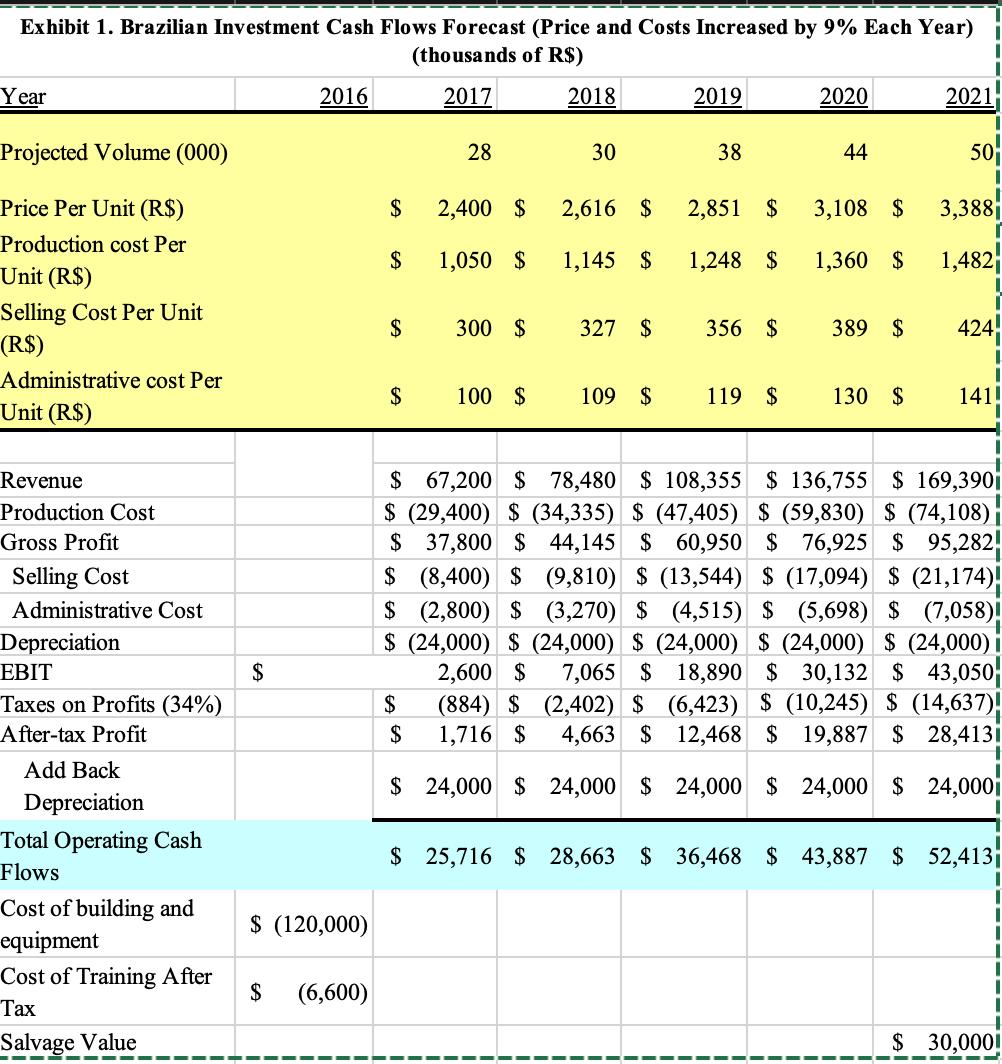

Exhibit 1. Brazilian Investment Cash Flows Forecast (Price and Costs Increased by 9% Each Year) (thousands of R$) 2017 Year Projected Volume (000) Price Per Unit (R$) Production cost Per Unit (R$) Selling Cost Per Unit (R$) Administrative cost Per Unit (R$) Revenue Production Cost Gross Profit Selling Cost Administrative Cost Depreciation EBIT Taxes on Profits (34%) After-tax Profit Add Back Depreciation Total Operating Cash Flows Cost of building and equipment Cost of Training After Tax Salvage Value -- $ 2016 $ (120,000) $ (6,600) $ 2,400 $ $ 1,050 $ $ 28 300 $ $ 100 $ $ 2018 30 2,616 $ 1,145 $ 327 $ 109 $ 2019 38 356 $ 2020 2,851 $ 3,108 $ 1,248 $ 1,360 $ 119 $ 44 389 $ 130 $ 2021 50 I 3,388 1,482 I I 424! I 141! $ $ 67,200 $ 78,480 $ 108,355 $ 136,755 $ 169,390 $ (29,400) $ (34,335) $ (47,405) $ (59,830) $ (74,108) $ 37,800 $ 44,145 $ 60,950 $ 76,925 $ 95,2825 (8,400) $ (9,810) $ (13,544) $ (17,094) $ (21,174) $ (2,800) $ (3,270) $ (4,515) $ (5,698) $ (7,058)! $(24,000) $ (24,000) $ (24,000) $ (24,000) $ (24,000) 2,600 $ 7,065 $18,890 $ 30,132 $ 43,050 (884) $ (2,402) $ (6,423) $ (10,245) $ (14,637)| 1,716 $ 4,663 $12,468 $ 19,887 $ 28,413i $ $ 24,000 $ 24,000 $24,000 $ 24,000 $ 24,000i $ 25,716 $ 28,663 $ 36,468 $ 43,887 $ 52,413| I $ 30,000!

Step by Step Solution

3.65 Rating (171 Votes )

There are 3 Steps involved in it

The discount rate that you would use to discount the Brazilian real cash flows of the project is the ... View full answer

Get step-by-step solutions from verified subject matter experts