Answered step by step

Verified Expert Solution

Question

1 Approved Answer

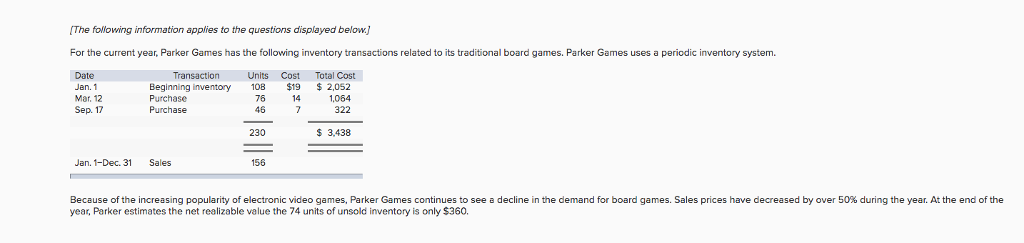

For the current year, Parker Games has the following inventory transactions related to its traditional board games. Parker Games uses a periodic inventory system. 1.

For the current year, Parker Games has the following inventory transactions related to its traditional board games. Parker Games uses a periodic inventory system. 1. Using FIFO, calculate ending inventory and cost of goods sold.

1. Using FIFO, calculate ending inventory and cost of goods sold.

2. Using LIFO, calculate ending inventory and cost of goods sold.

3-a. Determine the amount of ending inventory to report using lower of cost and net realizable value.

3-b. Record the adjustment for inventory under FIFO.

The following information applies to the questions displayed below. For the current year, Parker Games has the following inventory transactions related to its traditional board games. Parker Games uses a periodic inventory system Units Cost Total Cost Beginning inventory 08 $19 $ 2,052 Purchase Purchase Jan. 1 Mar. 12 Sep. 17 1,064 230 3,438 Jan. 1-Dec. 31 Sales Because of the increasing popularity of electronic video games, Parker Games continues to see a decline in the demand for board games. Sales prices have decreased by over 50% during the year. At the end of the year, Parker estimates the net realizable velue the 74 units of unsold inventory is only $360Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started