Question

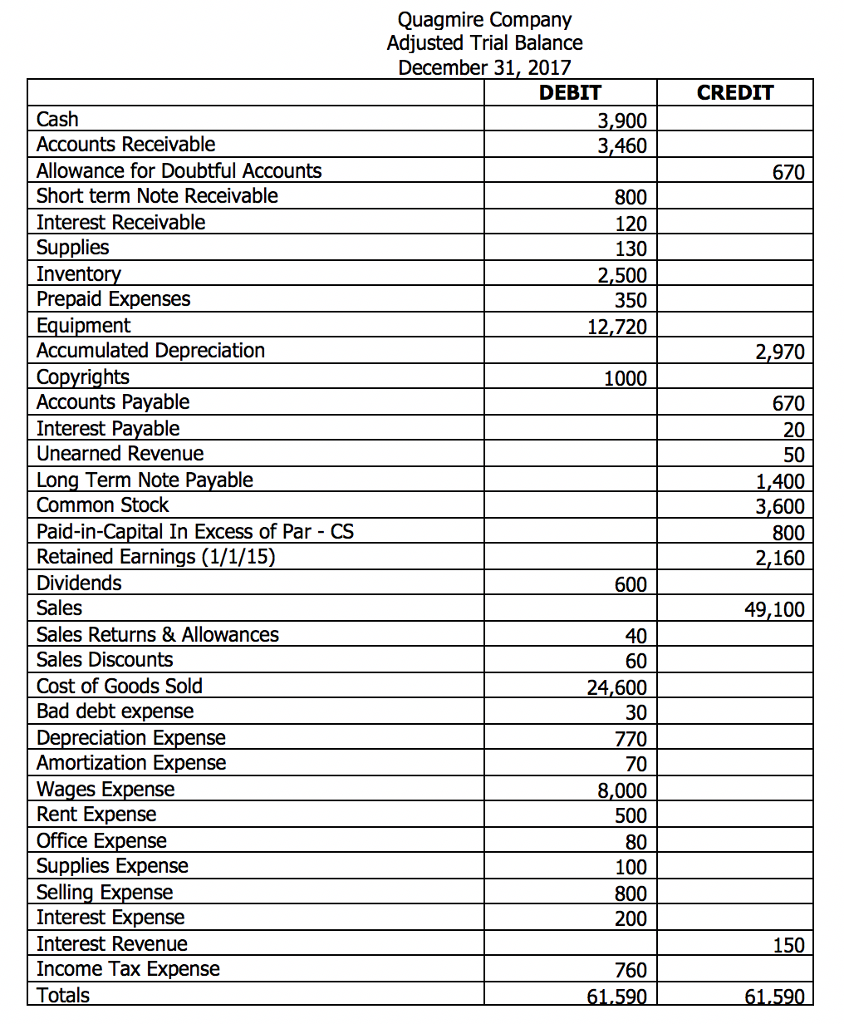

Part 2: NOTE: This is a DIFFERENT COMPANY . Using the trial balance below, complete the Multi-Step Income Statement and prepare the Statement of Retained

Part 2:NOTE: This is a DIFFERENT COMPANY. Using the trial balance below, complete the Multi-Step Income Statementand prepare the Statement of Retained Earningsand Classified Balance Sheeton the pages which follow. To get full credit you must include all critical subtotals.

Part 2: Insert Second Trial Balance HERE.

Multi Step Income Statement

For the year ended December 31, 2017

(Be sure to include all the necessary headings, totals and subtotals as outlined in Chapter 5. You may not need to use all the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Income Statement, use the right column for subtotals and totals.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Retained Earnings

For the year ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Classified Balance Sheet

December 31, 2017

(Be sure to include all the necessary subtotals and totals as outlined in Chapter 2. You may not need to use all of the lines provided. Note: The two columns below do not represent debit and credit balances like they do on a trial balance. On the Balance Sheet, use the right column for subtotals and totals.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started