Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the Financial Years 2020, 2021 and 2022 obtain the following ratios for AAPLE from finance.yahoo.com 1. Current Ratio 2. Total Assets Turnover (TATO) 3.

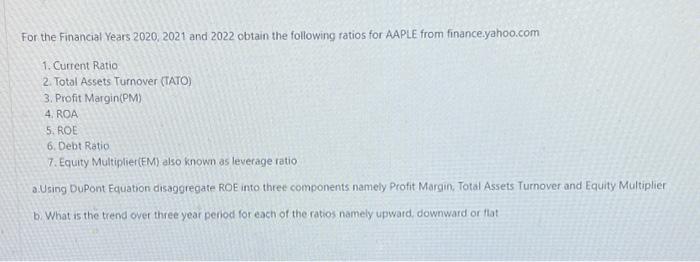

For the Financial Years 2020, 2021 and 2022 obtain the following ratios for AAPLE from finance.yahoo.com 1. Current Ratio 2. Total Assets Turnover (TATO) 3. Profit Margin(PM) 4. ROA 5. ROE 6. Debt Ratio 7. Equity Multiplier(EM) also known as leverage ratio a.Using DuPont Equation disaggregate ROE into three components namely Profit Margin, Total Assets Turnover and Equity Multiplier b. What is the trend over three year period for each of the ratios namely upward, downward or flat

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started